Types Of Permanent Life Insurance

Whole life insurance offers coverage for the full lifetime of the insured and its savings can grow at a.

Types of permanent life insurance - If you pick this type of life insurance policy you are agreeing to pay a certain amount in premiums on a regular basis for a specific death benefit. This a very common type of permanent life insurance although it s not our first choice more on that later. Whole or ordinary life.

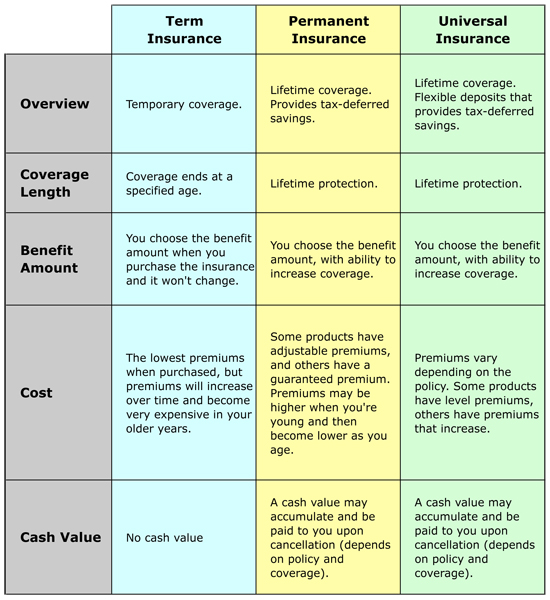

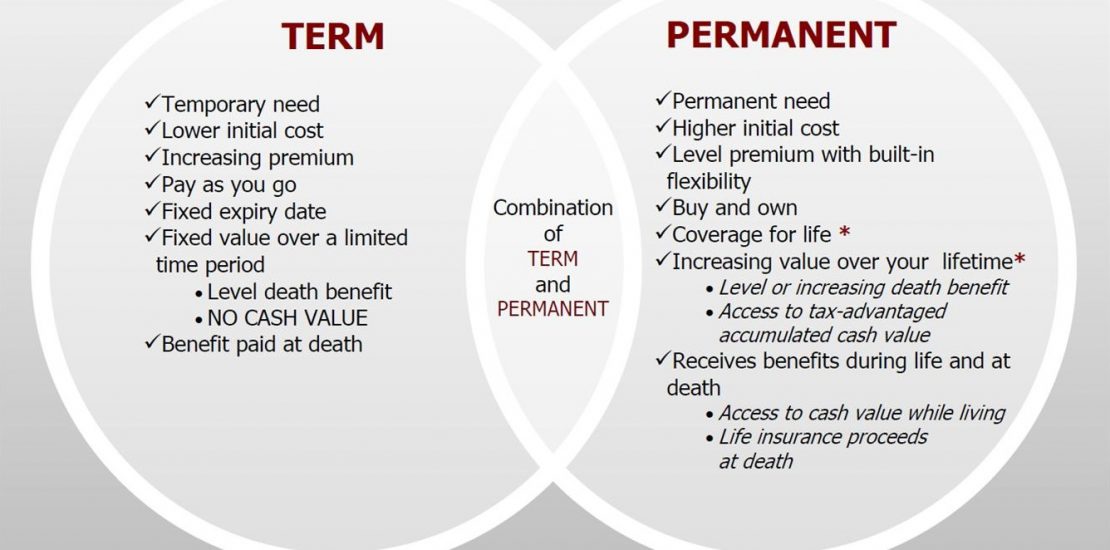

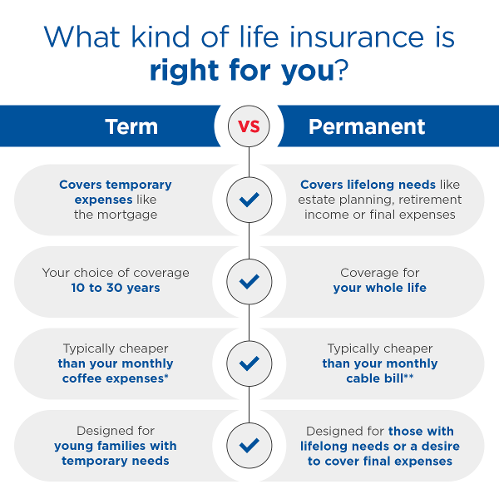

As its name implies permanent life insurance lasts for the duration of your life. Permanent life insurance is a category of life insurance policies that never expire. Permanent policies build a cash value you can borrow against to help pay for emergencies or retirement related expenses.

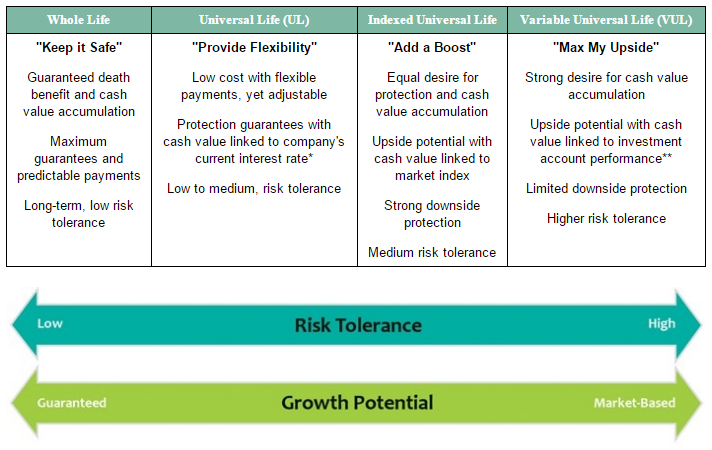

Universal life insurance universal life insurance was created in response to the high interest rates in the early 1980 s. You can take a loan against the. The two primary types of permanent life insurance are whole life and universal life.

Unlike term life insurance that you buy in increments of time normally 10 20 or 30 year blocks with permanent. These policies are have small face values often between 2 000 and 15 000. Final expense life insurance is a type of permanent life insurance that you can t be turned down for.

This is the most common type of permanent insurance policy. Whole life insurance policies have fixed premiums and a cash value component that slowly accumulates. Whole and universal are the two primary types.

The policy expires at the end of the term which can last up to 30 years. These policies feature fixed premiums they will never increase and a cash value component. Term life insurance policies are more affordable than other types of life insurance policies usually costing 30 40 a month for a 30 year 500 000 policy for healthy people in their 20s and 30s.

Types of permanent life insurance. There are no medical questionnaires or exams. These types of policies have fixed premiums most of the time a death benefit and a cash value component.

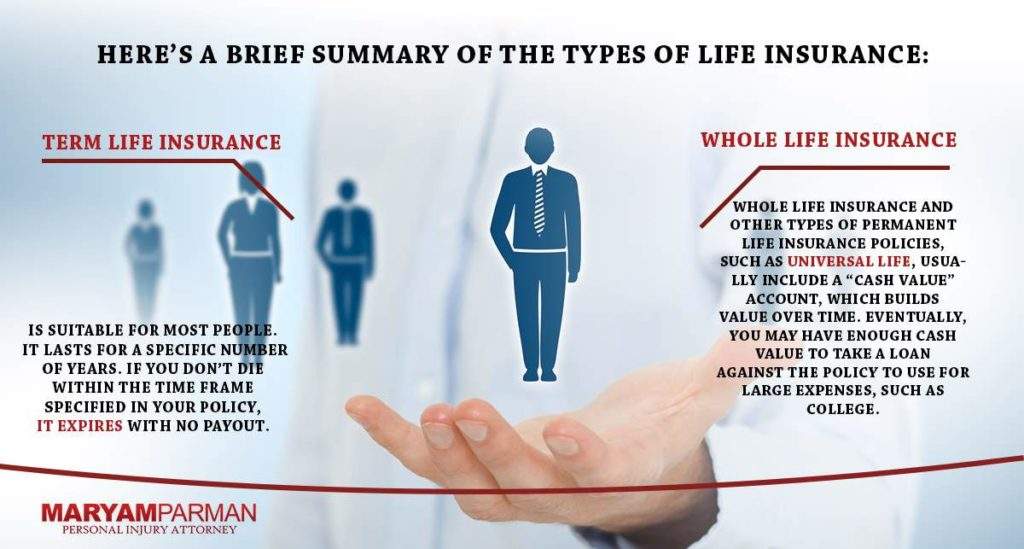

It offers a death benefit along with a savings account. Whole life insurance and other types of permanent life insurance policies such as universal life usually include a cash value account which builds value over time.

.jpg)