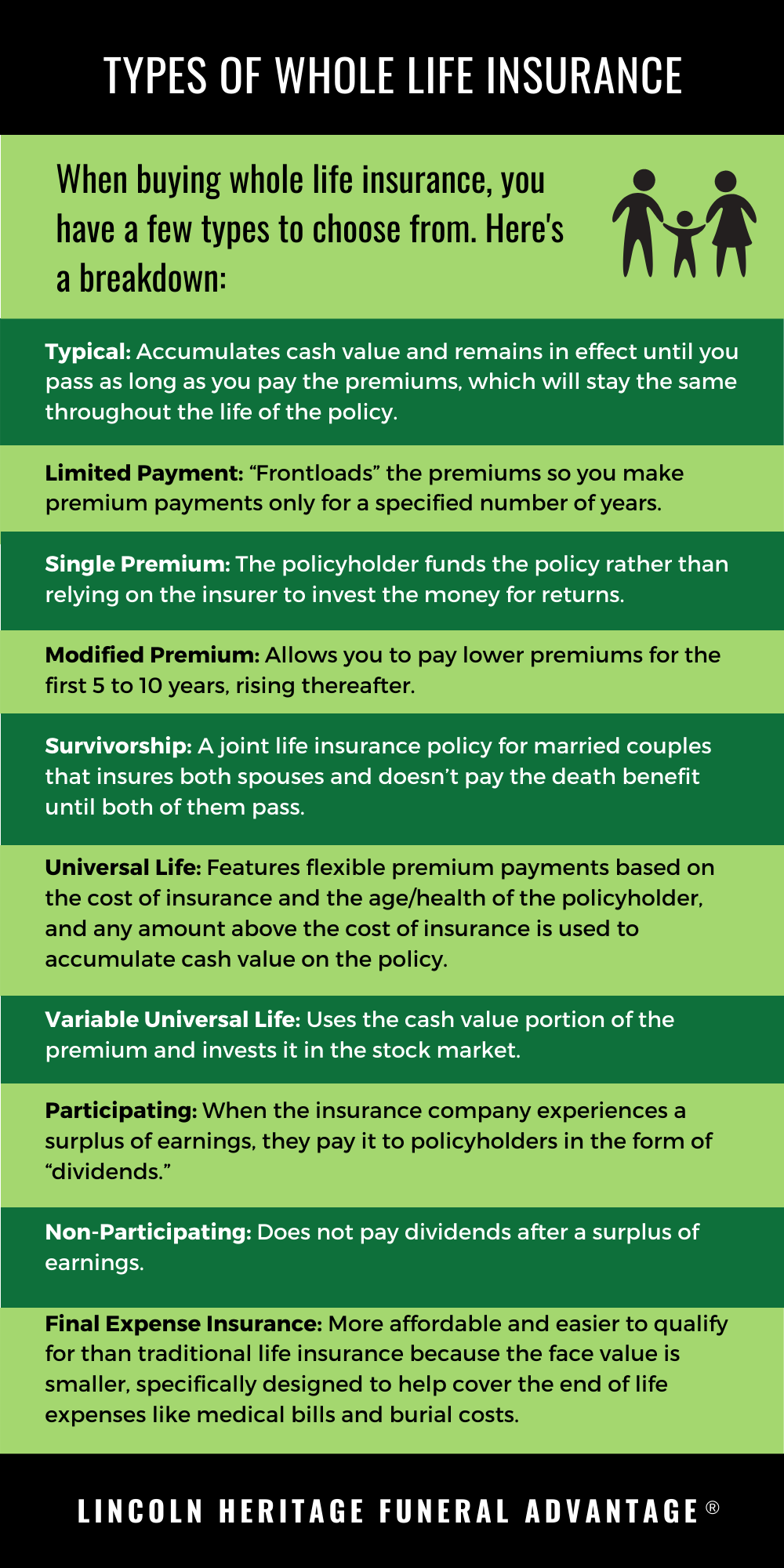

Types Of Whole Life Insurance

Some types of life insurance come with a cash value amount that works like savings or an investment account.

Types of whole life insurance - These policies won t offer more than 25 000 in death benefit and are much easier to get approved for if you can t get a traditional life insurance policy. Types of whole life insurance policies. The sum assured or the coverage is decided at the time of policy purchase and is paid to the nominee at the time of death claim of the life assured along with bonuses if any.

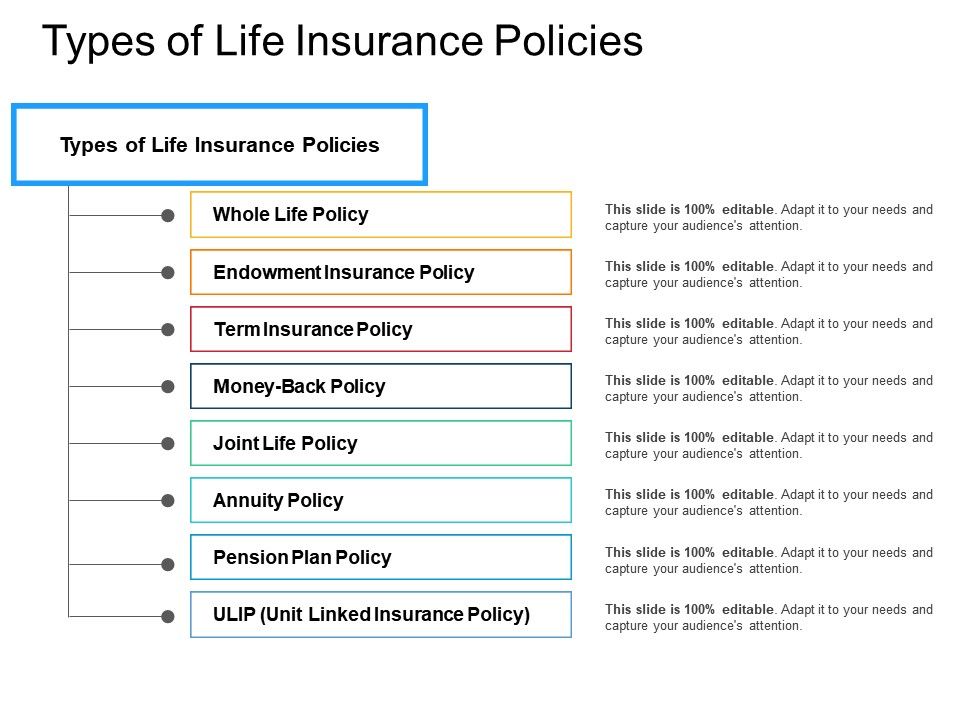

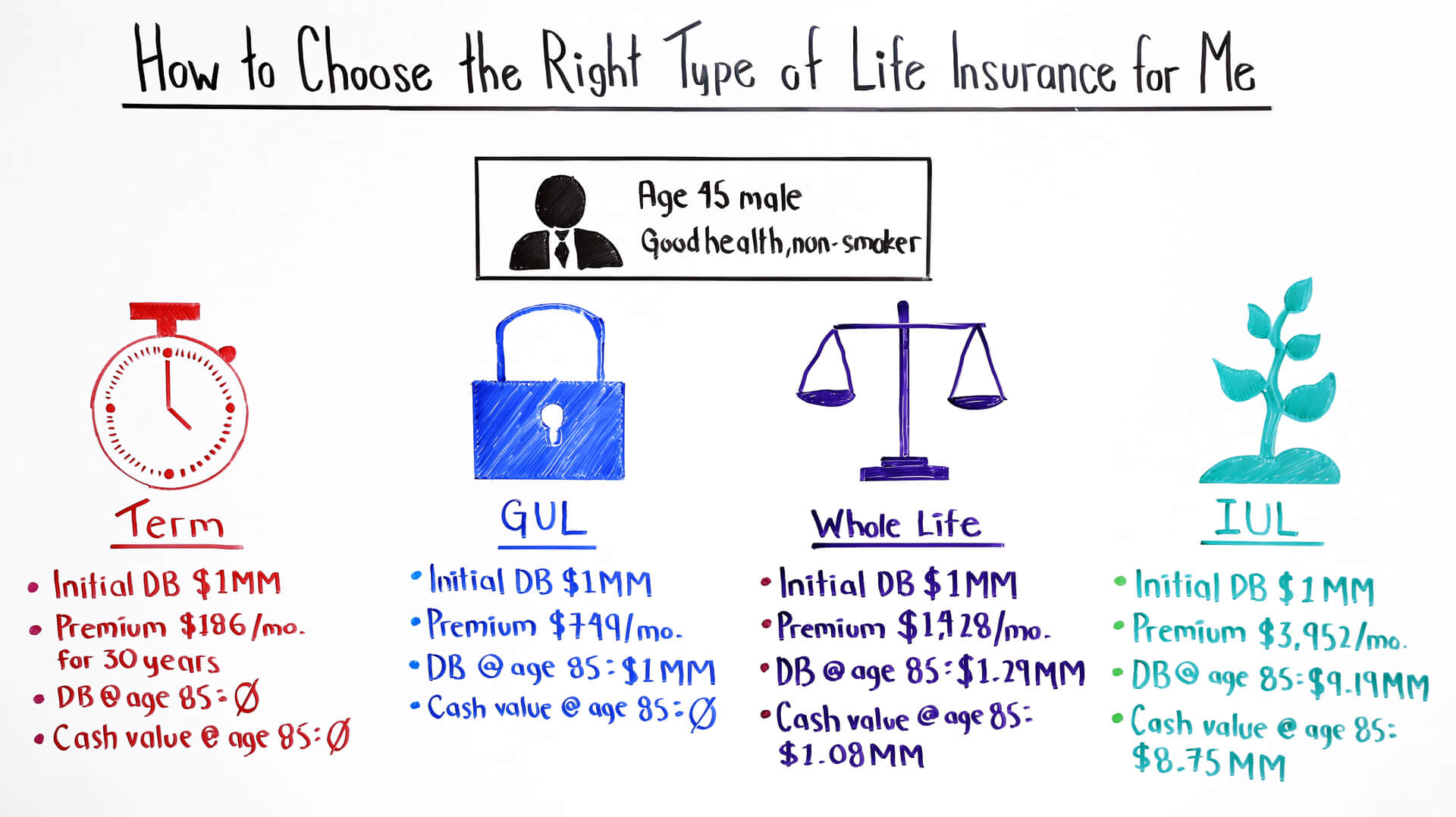

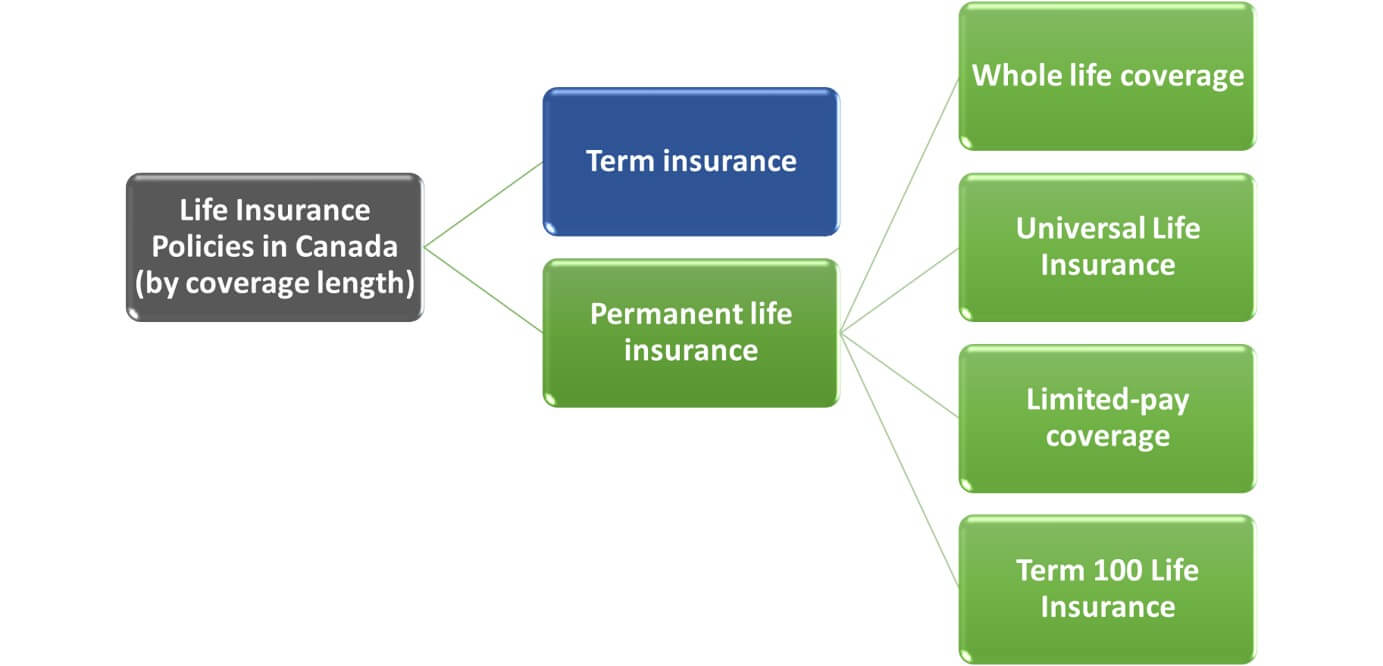

Eventually you may. Unlike term plans which are for a specified term. There are three main types of life insurance.

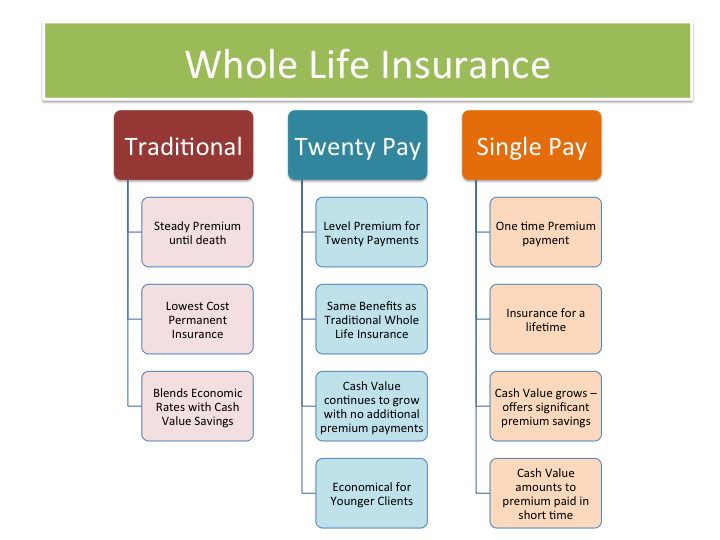

Term life whole life and universal life. If you re shopping for life insurance one of the first steps is choosing the right type of life insurance. We ll explain several types of whole life insurance in this article including participating and non participating whole life insurance limited payment whole life insurance single premium whole life insurance and high early cash value whole life insurance.

Term life insurance is one of the most affordable types of life insurance. It can further be classified into level term insurance decreasing term life insurance and increasing term life insurance. Below is a deeper dive into the different types of whole life policies.

A great appeal for many people looking for life insurance is that some types of policies also offers a cash value to its customers which in some circumstances can be used to borrow. The two main types of life insurance are term and whole life insurance. All whole life insurance policies are not created equally.

Other policies allow you to skip the medical exam or pay for specific end of life expenses. Guaranteed whole life insurance also referred to as life assurance permanent whole life insurance or full life insurance is a type of cover that financially protects your loved ones in the event of your death. Whole life insurance is a safer permanent life insurance choice than some others it can provide guaranteed interest premium and death benefit so you know what to expect.

Whole life insurance policies are designed to provide life insurance coverage for the entire life of the insured. There is a wide variety of options to suit your individual needs. A whole life insurance policy covers the life assured for whole life or in some cases up to the age of 100 years.

Whole life insurance and other types of permanent life insurance policies such as universal life usually include a cash value account which builds value over time. Let s look at the pros and cons of each so you can make the right decision based on your goals. Let s look at the types of whole life insurance policies available in the marketplace.

Final expense and burial insurance are both types of whole life insurance policies that focus on people between the ages of 50 to 85.