Variable Life Insurance Definition

An insurance policy whose annuity payments or payment to the beneficiary are not fixed.

Variable life insurance definition - This type of life insurance provides some guarantees but also comes with certain risks that you should be aware of before investing in the policy. Meaning pronunciation translations and examples. Variable life insurance is a type of life insurance policy where the policyholder chooses the investments which will be used to earn the return on the policy such as stocks bonds or money market accounts.

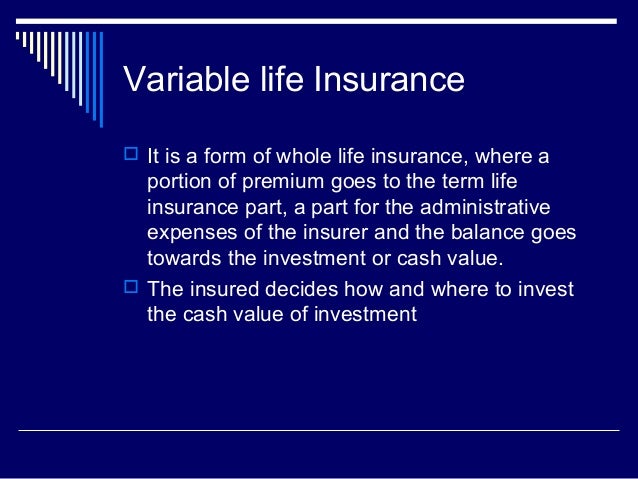

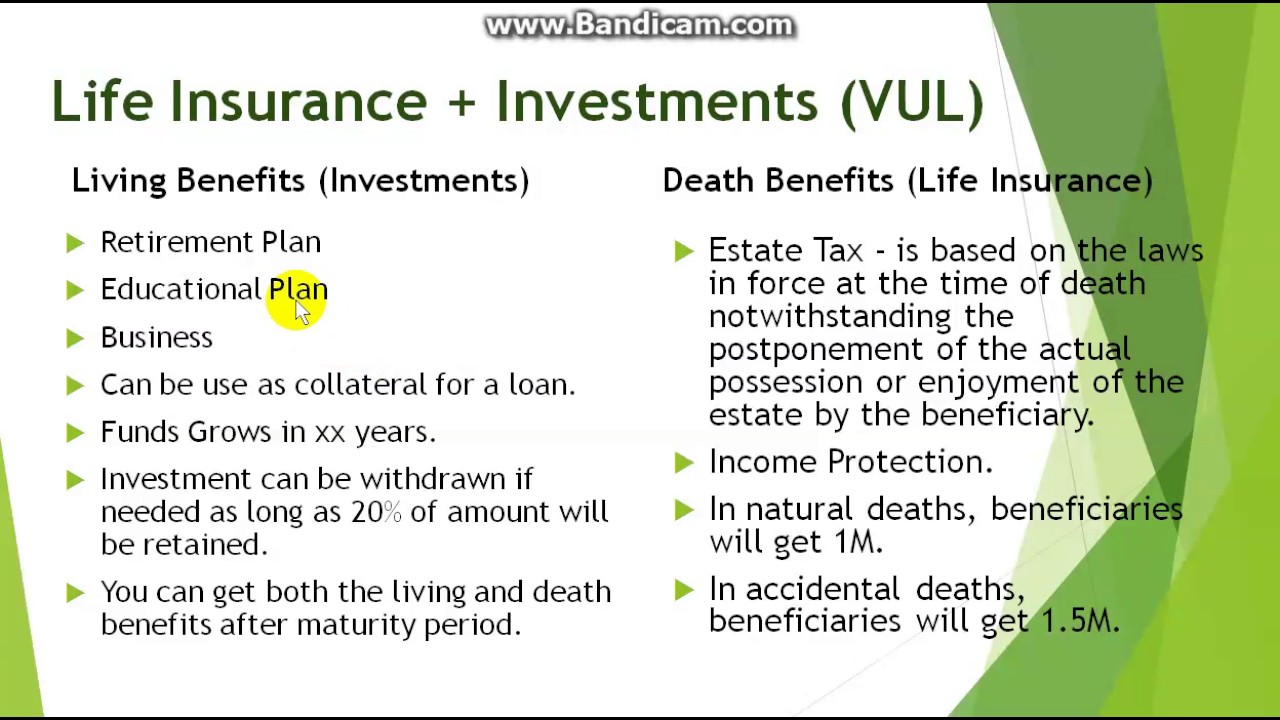

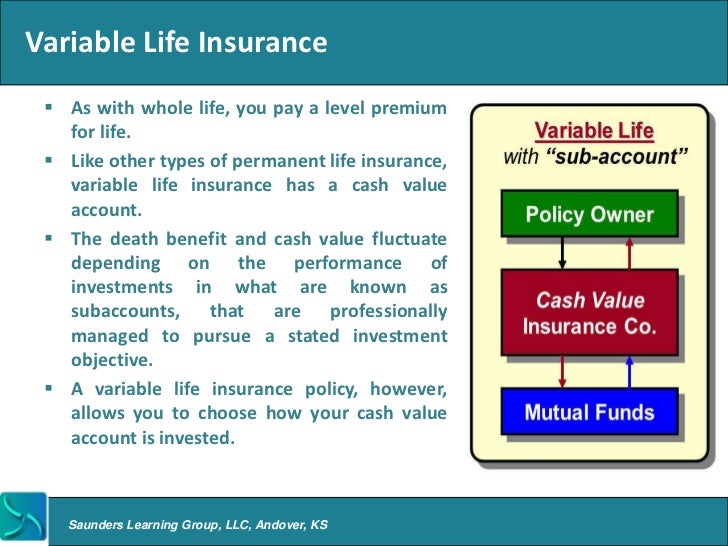

In a vul the cash value can be invested in a wide variety of separate accounts similar to mutual funds and the choice of which of the available separate accounts to use is entirely up to the contract owner the variable component in the name refers to this ability to invest in. Upon the death of the policyholder the beneficiaries will receive not only death benefits but also the investment returns. Variable life insurance is a permanent life insurance product with separate investment accounts and often offers flexibility regarding premium remittance and cash value accumulation.

Noun an example of vari. Fixed premium insurance policy that in addition to a guaranteed minimum death benefit provides a return based on the income performance of an investment portfolio. Variable universal life insurance often shortened to vul is a type of life insurance that builds a cash value.

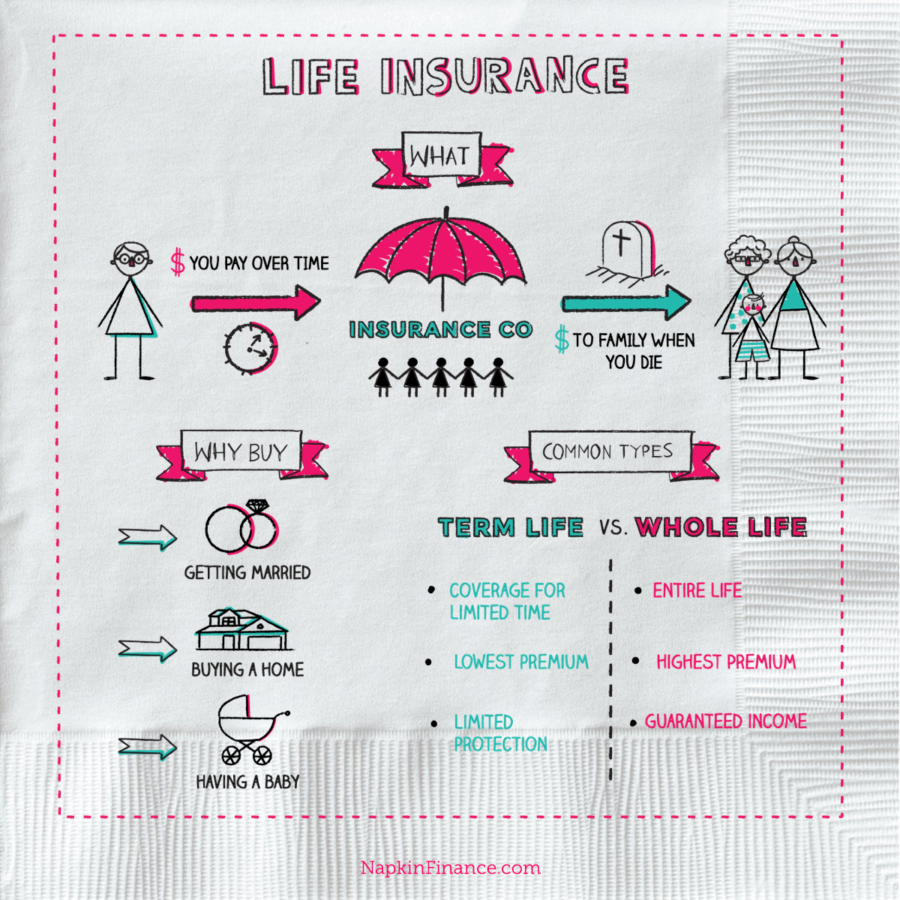

Variable life insurance is a permanent life insurance policy with an investment component. Whole life insurance policies don t offer the flexible premiums of variable universal life insurance policies. The policy has a cash value account which is invested in a number of sub accounts available in the policy.

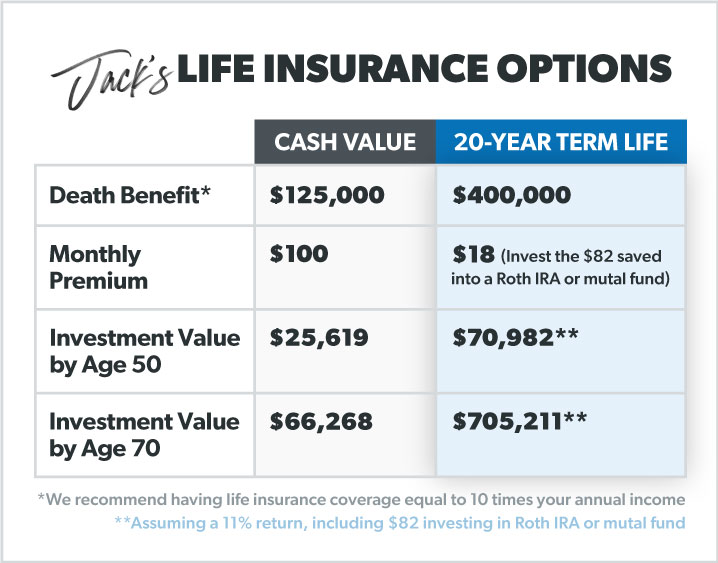

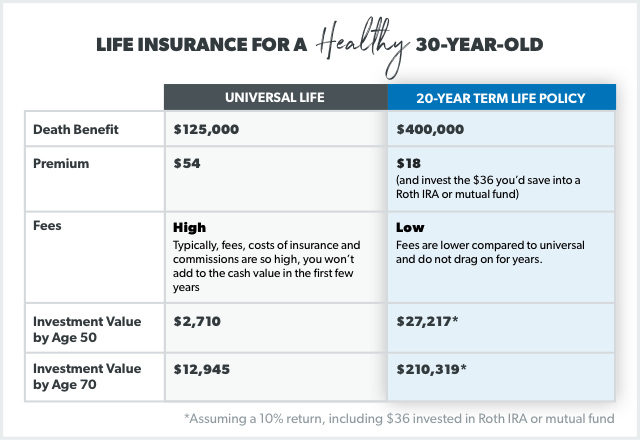

Variable appreciable life insurance is a form of whole life insurance that offers you the ability to invest a portion of your premium dollars in mutual fund investments. Variable life insurance is a type of permanent life insurance meaning it stays in force your whole life if you keep paying your monthly or annual premiums variable life insurance is similar to whole life insurance a simpler form of permanent life insurance in that it pays a tax free lump sum to your beneficiaries if you die and in that it contains a long term savings component called the. Variable life insurance vs mutual funds and term life insurance.

The cash value of variable life insurance policies can grow at a much faster rate and in certain cases can be used to pay premiums.

:max_bytes(150000):strip_icc()/life_insurance_87614098-5bfc370fc9e77c005879d678.jpg)

.jpg)