Vul Insurance Quotes

The following is a list of the popular pros and cons of the variable universal life insurance policy.

Vul insurance quotes - Another factor that you may want to consider is funeral. This way you will be able to compare different insurers policies and benefits objectively in order to determine which fits best with your specific needs. As life insurance is meant in part to provide for your beneficiaries after your death you will need to consider what their financial needs will be when deciding how much coverage to get with variable universal life insurance.

We here at i e hope that this list will help provide just a little insight into this unique insurance and investment product. Like universal the policy is flexible allowing you to change the premium face value. The basic features of a vul policy are.

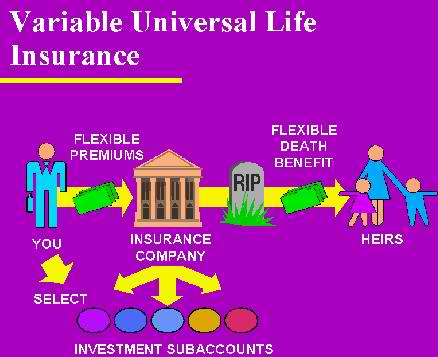

This type of life insurance coverage provides not only a death benefit but an element of investment as well. This type of policy is more likely suited for people who take the driver s seat while riding a car. Variable universal life vul insurance policies combine the fluctuating premiums of universal life insurance with the various asset choices of variable life insurance.

Pro 1 death benefit. Variable universal life insurance. Variable universal life insurance vul is a hybrid policy that combines elements of a variable life and universal life policy.

A variable universal life insurance is an interesting product. When shopping for variable life insurance quotes it is best to work with a company or an agency that has access to more than just one insurance carrier. The feature of variable universal life insurance vul is a combination of variable life and universal life insurance.

As long as you don t exceed the government limits and turn the policy in to a modified. A variable universal life policy vul is set up exactly like a universal life. The vul is both an investment product and a life insurance.

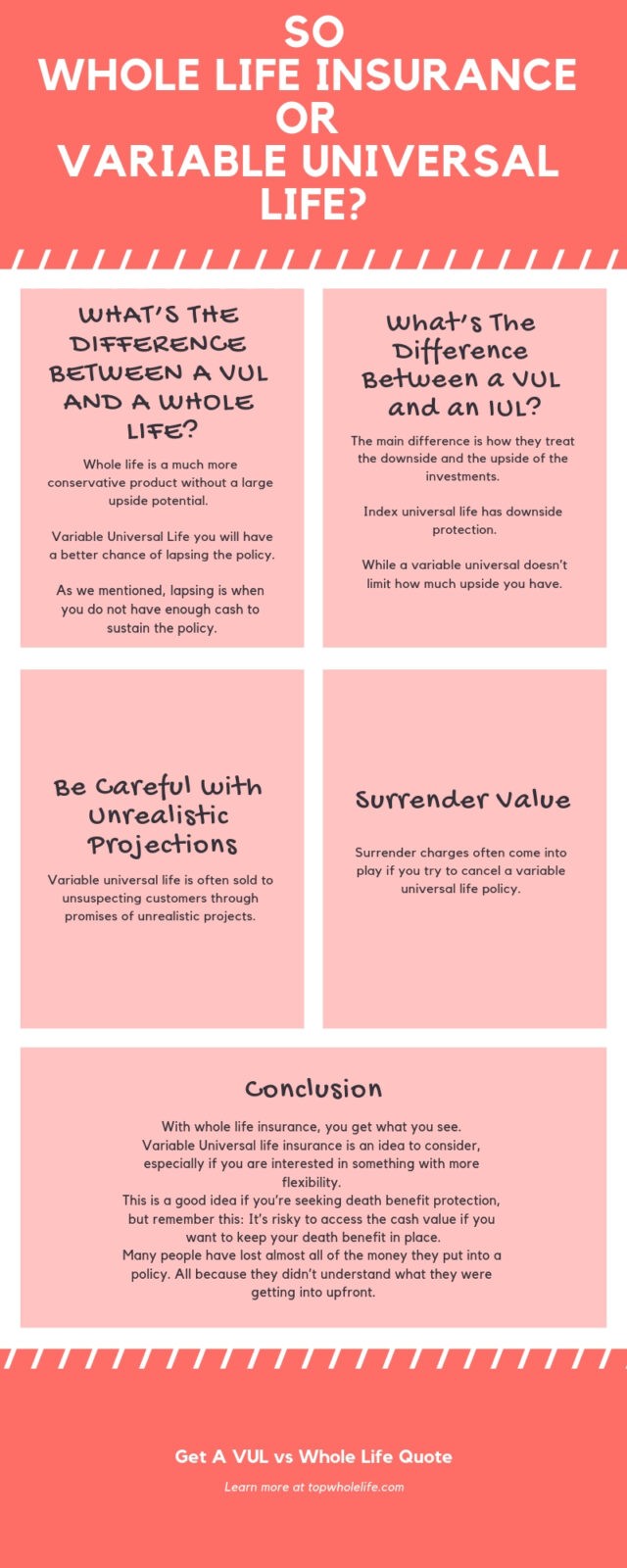

For the young investor variable universal life insurance accomplishes the old term motto but provides a life insurance that does not expire and an investment option with a greater potential for growth than a whole life or a traditional universal life. You can choose what assets you want your premium to go into without worrying that your policy could lapse if the assets have a negative rate of return. Variable life insurance is a great way for workers to get the advantages of a generous death benefit combined with a good cash benefit and the opportunity for future growth.

Pros of variable universal life. It combines many of the unique benefits of life insurance with with earnings power of an investment account. Tax deferred cash value growth.

With the universal life you have a life insurance component and an accumulation or cash component. Many advisors will point to the high fees of a variable universal life insurance product and declare it a bad investment but this really only tells part of the story.