Vul Life Insurance Quotes

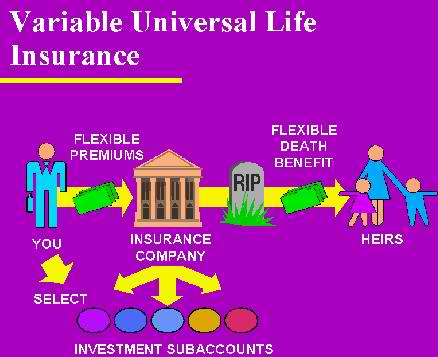

The vul is both an investment product and a life insurance.

Vul life insurance quotes - We here at i e hope that this list will help provide just a little insight into this unique insurance and investment product. Variable universal life products are long term investments designed to provide life insurance protection and flexibility in connection with premium payments and death benefits. It offers a choice of the stated investment accounts adjustable premiums and death benefits.

This way you will be able to compare different insurers policies and benefits objectively in order to determine which fits best with your specific needs. Life insurance often overlooked variable universal life insurance. Variable life insurance is a great way for workers to get the advantages of a generous death benefit combined with a good cash benefit and the opportunity for future growth.

As life insurance is meant in part to provide for your beneficiaries after your death you will need to consider what their financial needs will be when deciding how much coverage to get with variable universal life insurance. This type of policy is more likely suited for people who take the driver s seat while riding a car. With the universal life you have a life insurance component and an accumulation or cash component.

A variable universal life policy vul is set up exactly like a universal life. Whole life insurance policies don t offer the flexible premiums of variable universal life insurance policies. Another factor that you may want to consider is funeral.

Variable universal life insurance. This type of life insurance coverage provides not only a death benefit but an element of investment as well. Pro 1 death benefit.

A variable universal life insurance policy could be cheaper than other types of permanent life insurance like whole life insurance as long as the cash value outperforms the market and the various fees. The following is a list of the popular pros and cons of the variable universal life insurance policy. When shopping for variable life insurance quotes it is best to work with a company or an agency that has access to more than just one insurance carrier.

Variable life insurance vs mutual funds and term life insurance. Reasons to avoid variable universal life insurance vul most people shouldn t purchase a variable universal life insurance policy. Variable universal life insurance quotes.

A variable universal life insurance policy is a fairly complex life product. You ll need a thorough understanding of how it works to maintain the policy and make the most of its features. You should carefully consider the investment objectives risks charges and expenses of the investment alternatives before purchasing a policy.