What Does Auto Insurance Coverage Provide You

Aside from these standard coverage commercial auto insurance offers a few unique coverages that cannot usually be found in personal auto insurance.

What does auto insurance coverage provide you - It covers employees driving cars that are rented or borrowed rather than owned. These unique coverages include. Naturally you have personal car insurance coverage to protect your investment in your vehicle and to shield you from liability in case of a crash.

You may have coverage if you use a credit card to pay. What that means is it only applies to bodily injuries or property damage that you cause to someone else. Optional car insurance benefits include gap coverage roadside assistance and custom equipment coverage.

If you have collision coverage your insurance company will pay for the repairs to your car if it is damaged in a car accident. Some states require. Rental insurance coverage through credit cards.

Doordash does state that they provide excess auto insurance for dashers but it is liability only. Although basic coverage is required insurance companies offer unique car insurance benefits. What may not be covered by this insurance is the rental car company s loss of use and revenue it claims while the damaged car is being repaired or a loss in that car s value.

Full coverage auto insurance is a term used to describe a combination of coverages that protect both you and other people or property involved in an accident. Your full coverage policy must include liability coverage and typically includes comprehensive and collision coverage as well though it may include more depending on your additional coverage needs. If you re taking on a delivery job you may need additional auto insurance.

To avoid making a claim on your personal policy supplemental insurance is a must have. Some renters prefer to get the rental car coverage for this reason as well as to avoid making any claims on their personal auto coverage. Collision coverage applies regardless of who is at fault for the crash or whether you hit another car or a stationary object like a pothole tree ditch or light pole.

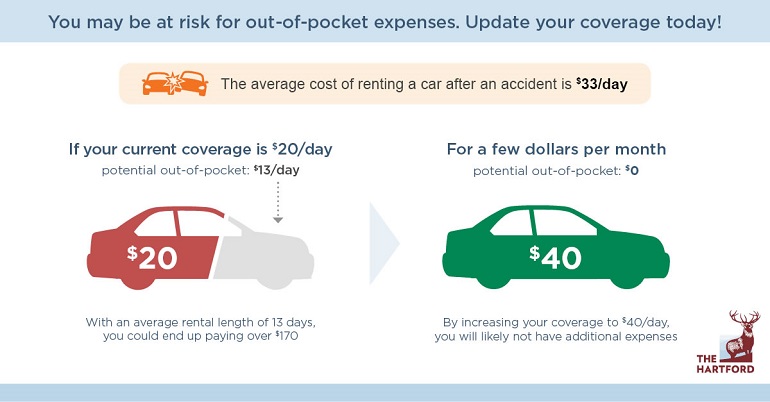

Non owner coverage most commercial auto insurance policies provide this coverage. If you re already required to carry high risk auto insurance and should keep claims or violations to a minimum. Without the right coverage you could get stuck holding the bills for a car accident.