What Is Auto Insurance Premium

Private car insurance private car insurance is the fastest growing sector in india as it is compulsory for all the new cars.

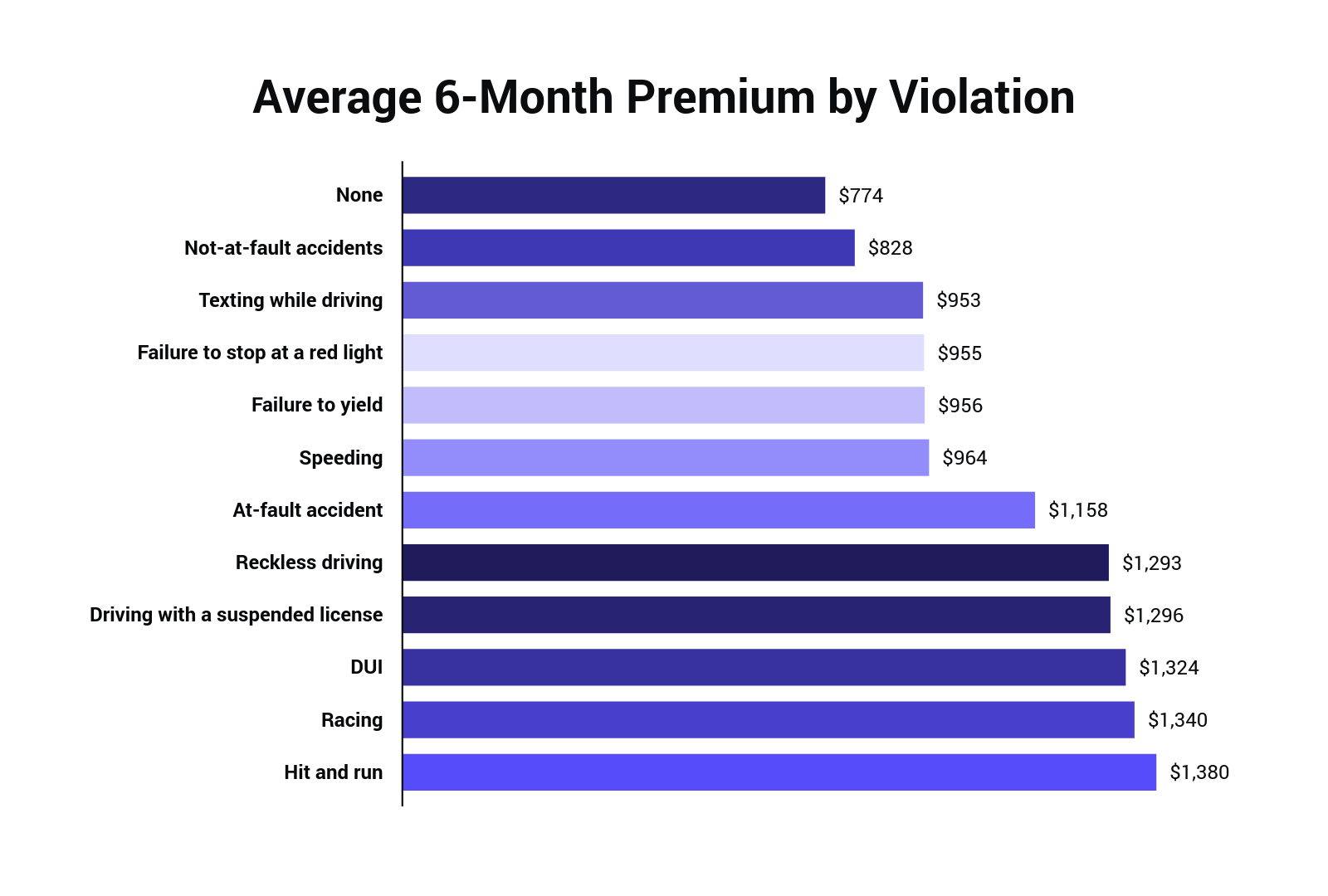

What is auto insurance premium - But let s say your premium only goes down. In general the more risk you pose the higher your premiums will be. Once you ve paid your premium your insurer will pay for coverages detailed in the insurance policy like liability and collision coverage.

Most insurance companies divide premiums into monthly installments or allow clients to pay the entire balance up front. An insurance premium is the amount of money an individual or business must pay for an insurance policy. Insurance premiums are paid for policies that cover healthcare auto home and life insurance.

From the type of car you drive to your age and gender car insurance companies use a variety of factors when determining your premium amount. A car insurance premium is the regular cost you pay to keep your policy active. In exchange for your paying a premium the insurance company agrees to pay your losses as outlined in your policy.

That means that for taking on a bigger risk of 750 you d save 500. Your car insurance premium is the amount you pay your insurance company on a regular basis often every month or every six months in exchange for insurance coverage. Averages varied from state to state with a low of 298 in north dakota and a high of almost 870 in new jersey.

Whether you are purchasing life insurance car insurance health insurance or any insurance you will always pay more premium more money for higher amounts of coverage. The average liability insurance premium nationwide was about 538 in 2015 according to the 2017 auto insurance database report from the national association of insurance commissioners or naic. This can work in two ways the first way is pretty straightforward the second way is a little more complicated but a good way to save on your insurance premiums.

The amount of premium depends on the make and value of the car state where the car is registered and the year of manufacture. If you don t have a lot of claims you d make back that 750 in two years. Let s say your car insurance premium is 1 200 per year with a 250 deductible and bumping it up to a 1 000 deductible drops your premium to 700.