What Is Health Insurance Deductible And Coinsurance

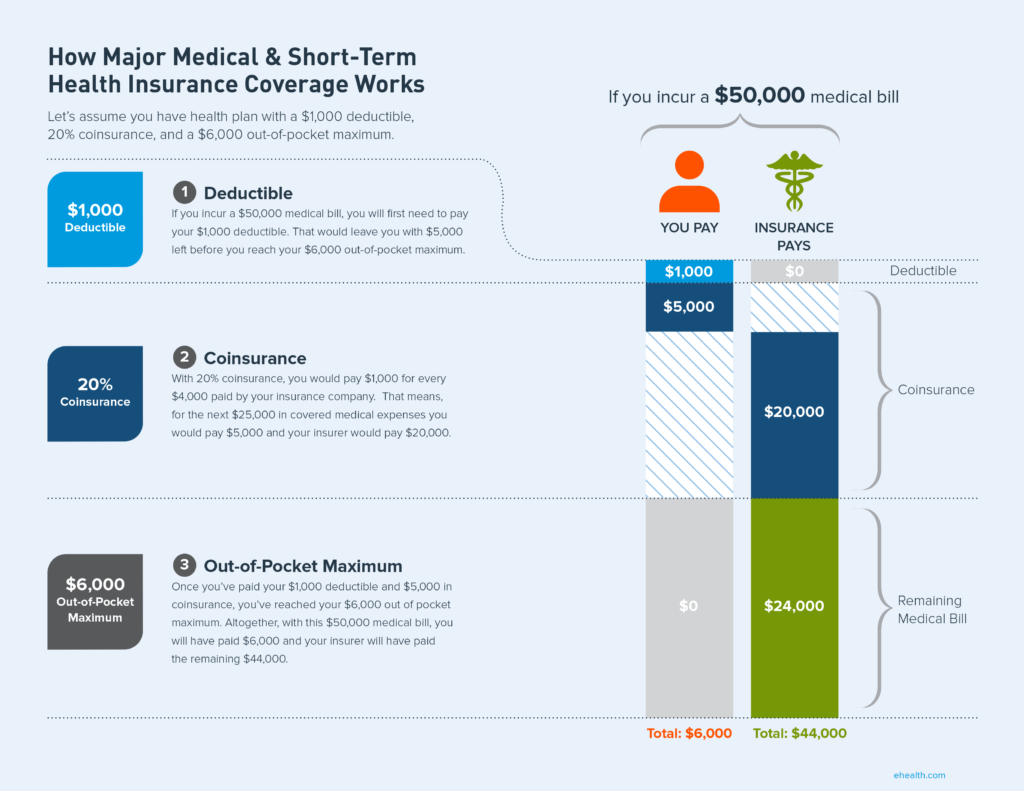

Coinsurance works after your deductible is paid.

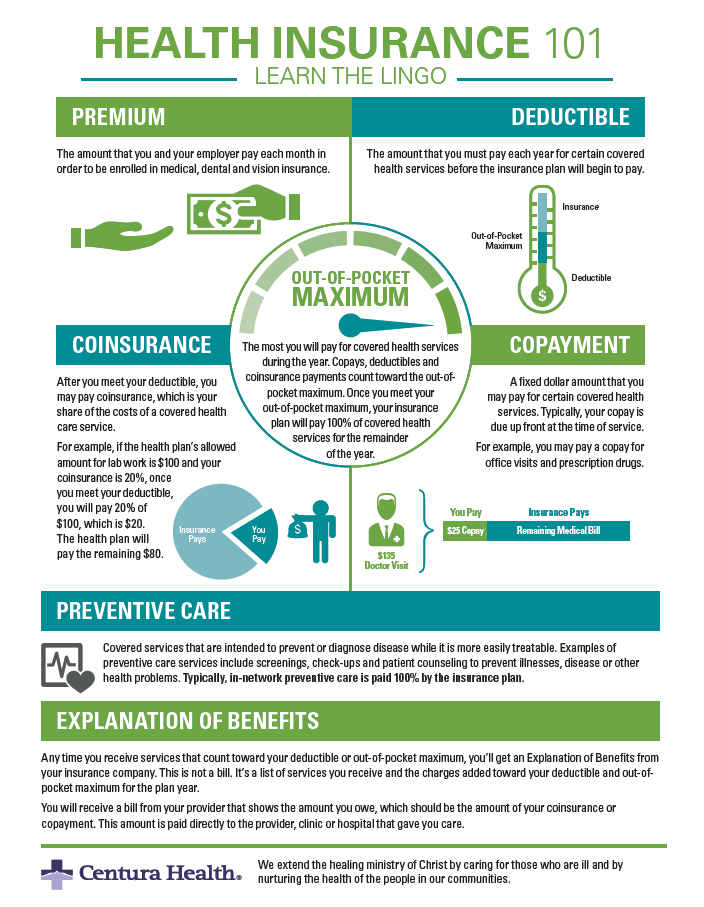

What is health insurance deductible and coinsurance - Coinsurance is the amount generally expressed as a fixed percentage an insured must pay against a claim after the deductible is satisfied. While copay deductible and coinsurance are cost sharing terms their applicability can make a huge difference to your overall health insurance plan. Even if your premium amount is reduced in a cost sharing policy your liability towards the share you have to pay on claim will increase and so you ll always need to have readily available money to cover the cost.

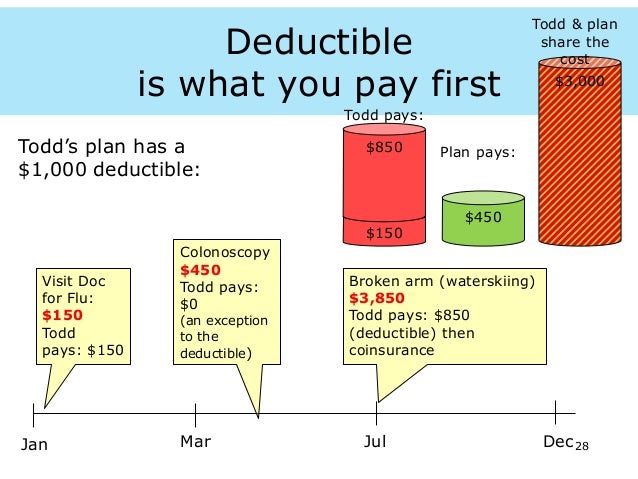

If your plan s deductible is 1 500 you ll pay 100 percent of eligible health care expenses until the bills total 1 500. In health insurance a coinsurance provision is similar. Coinsurance vs deductible coinsurance and deductible are payments made by a patient towards the cost of a medical bill under a medical insurance policy.

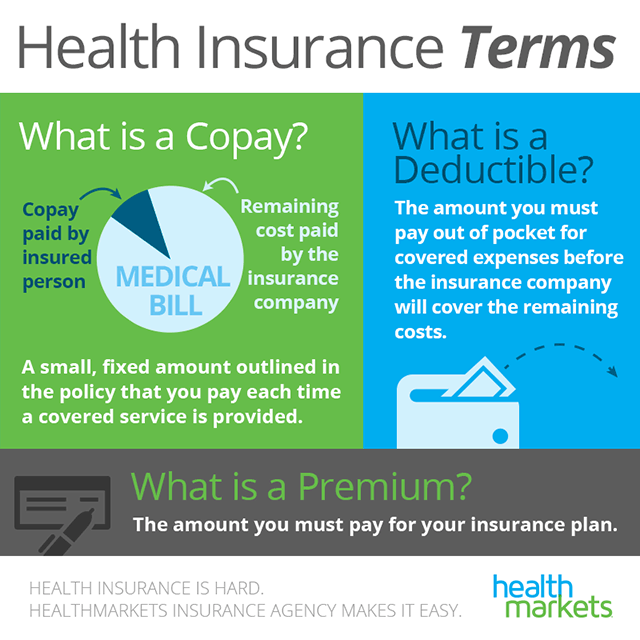

But a few insurance plans also implement copayment and deductible clauses simultaneously. Understanding copays coinsurance deductibles and out of pocket maxes can help you avoid unexpected medical bills. Deductibles and coinsurance are clauses that are mostly implemented together under one single insurance plan.

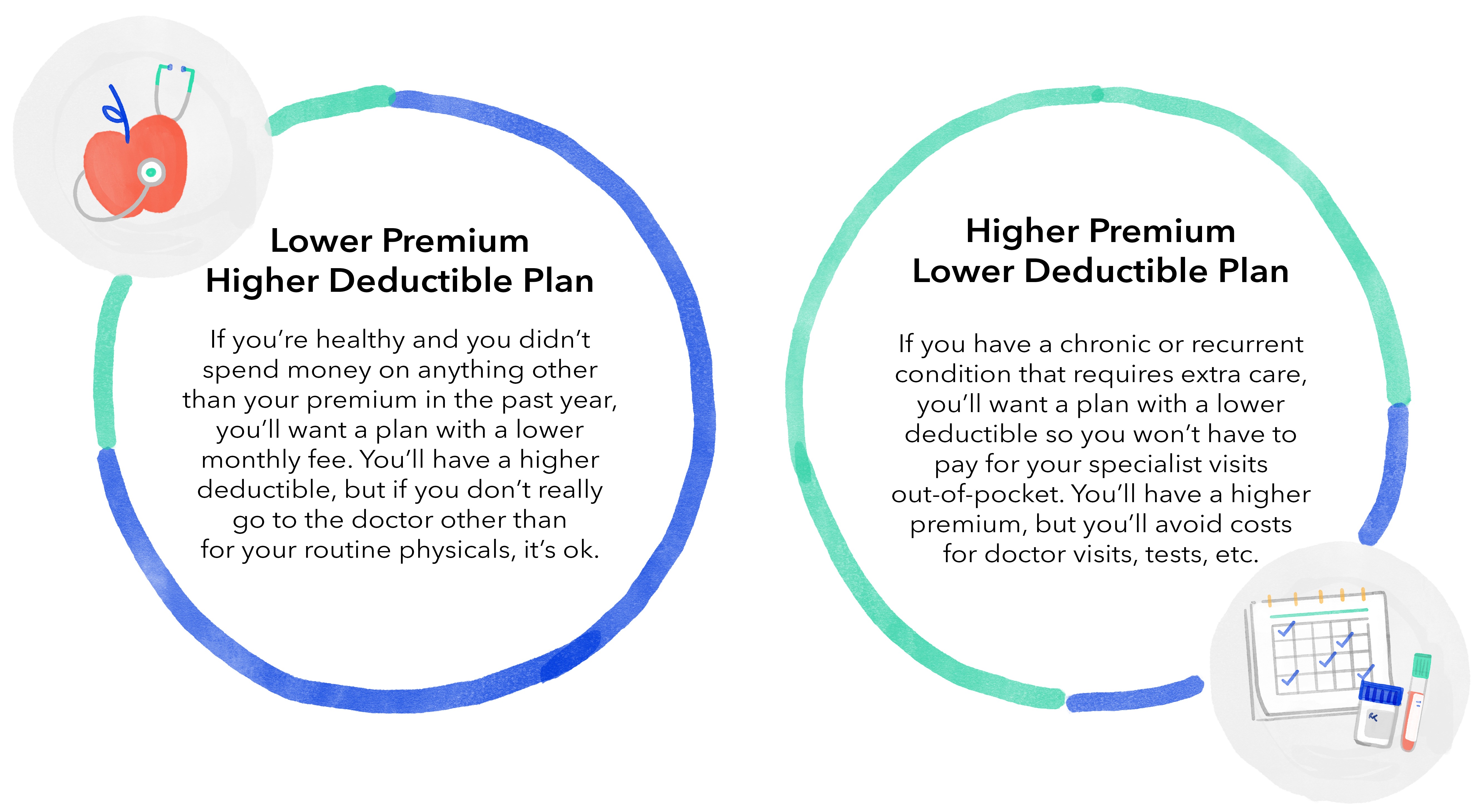

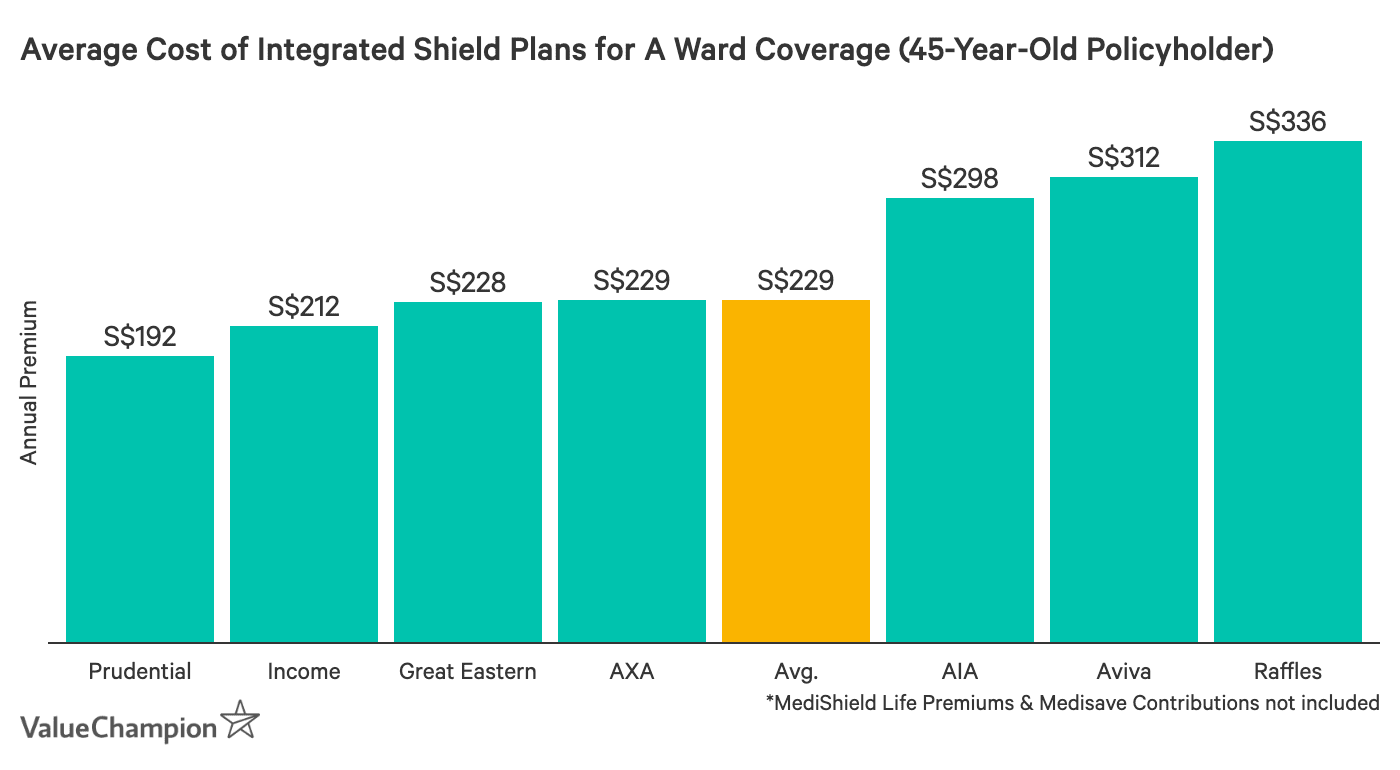

When deciding on a health plan comparing deductibles premiums copays coinsurance and out of pocket maximums should help with your decision. A health insurance deductible is what you must pay for health care services before your health plan kicks in payments. Let s say your health insurance plan s allowed amount for an office visit is 100 and your coinsurance is 20.

A deductible is the amount you pay for health care services before your health insurance begins to pay. After that you share the cost with your plan by paying coinsurance. Once you ve paid your deductible your health plan begins to pick up its share of your health care bills.

You pay 20 of 100 or 20 the insurance company pays the rest. Premiums are what you pay to have health insurance but out of pocket costs when you need health care services including copays and coinsurance can also reach into the thousands each year. A deductible is a fixed amount you pay each year before your health insurance kicks in fully in the case of medicare part a for inpatient care the deductible applies to benefit periods rather than the year.

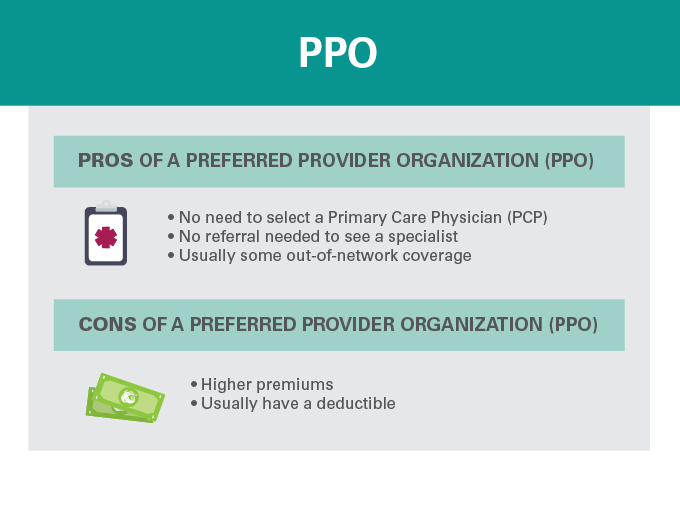

Most insurance plans have a deductible which is an amount that you pay before your plan kicks in. If your plan has a 1 000 deductible then you d have to pay 1 000 entirely on your own before thinking of coinsurance. Should you opt for a health insurance plan with copayment coinsurance and deductible clauses.

A deductible plays a major role in your health insurance costs.