What Is Private Health Insurance Offset

If you or your family don t have private health insurance hospital cover or you choose to cancel your cover you will pay the medicare levy surcharge if you earn more than 90 000 single or 180 000 couples families in 2014 15 to 2020 21 financial years.

What is private health insurance offset - A statement may only be provided if you request one from your registered health insurer. As your income for surcharge purposes increases your private health insurance rebate may be reduced or you may not be entitled to any of this rebate. Depending on how much private health insurance rebate you ve already claimed as premium reductions your notice of assessment may show a private health insurance liability or tax offset.

The health insurance rebate is the carrot a government subsidy of health insurance premiums designed to encourage us to take out a minimum level of private hospital insurance cover. The law has changed regarding the way registered health insurers provide you with private health insurance information. Choose the appropriate tax claim code from the table below and include it in your tax return.

Private health insurance rebate. The australian taxation office ato calculates the amount of the rebate you re entitled to based on what you enter into. Private health insurance works with our public health care system to offer you more choice and quicker access to some health services.

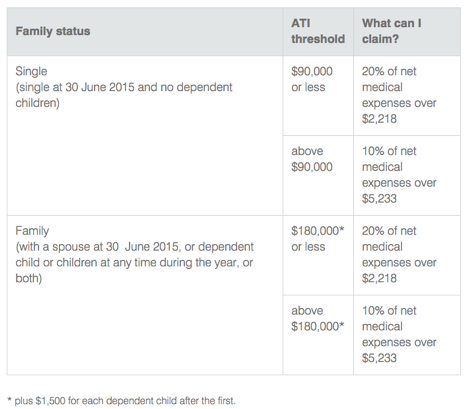

This table shows a list of health services provides information on how those services might be provided in the public health care system and what. The rebate is income tested which means your eligibility to receive it depends on your income for surcharge purposes. Your entitlement to this rebate is dependent on a number of factors.

The private health insurance tax offset or rebate is the amount that the government contributes to the cost of your private health insurance premium. This means that if your income is higher than the relevant income threshold you may not be eligible to receive a rebate. That you get back from your health insurance premiums in the form of a reduction of the premium or as a refundable tax offset.

The private health insurance rebate is an amount the government contributes towards the cost of your private health insurance premiums. It can be taken as a discount on your health insurance premiums or as a refundable tax offset at. It is now optional for health insurers to provide you with a private health insurance statement.

This table compares public and private health care services. Using the private health insurance statement that relates to the dependent child s private health insurance policy complete your tax return using the individual tax return instructions as a guide. Your rebate entitlement depends on your.

Your private health insurance statement. The private health insurance rebate is income tested.