Whole Life Insurance Cash Value

Whole life and universal life policies offer this benefit.

Whole life insurance cash value - However unless you stop paying your premium it s highly unlikely your policy will be. The cash value of whole life insurance by definition it s actually called the cash surrender value is the contractual dollar amount the insurance company will exchange with a policy owner in the event the insurance policy is surrendered or cancelled. It can take decades to build up a substantial cash value but some policies.

Cash value life insurance is a type of life insurance policy that s in place for your whole life and comes with a sort of savings account built into it. While variable life whole life and universal life insurance. Life insurance can give your family an additional financial safety net.

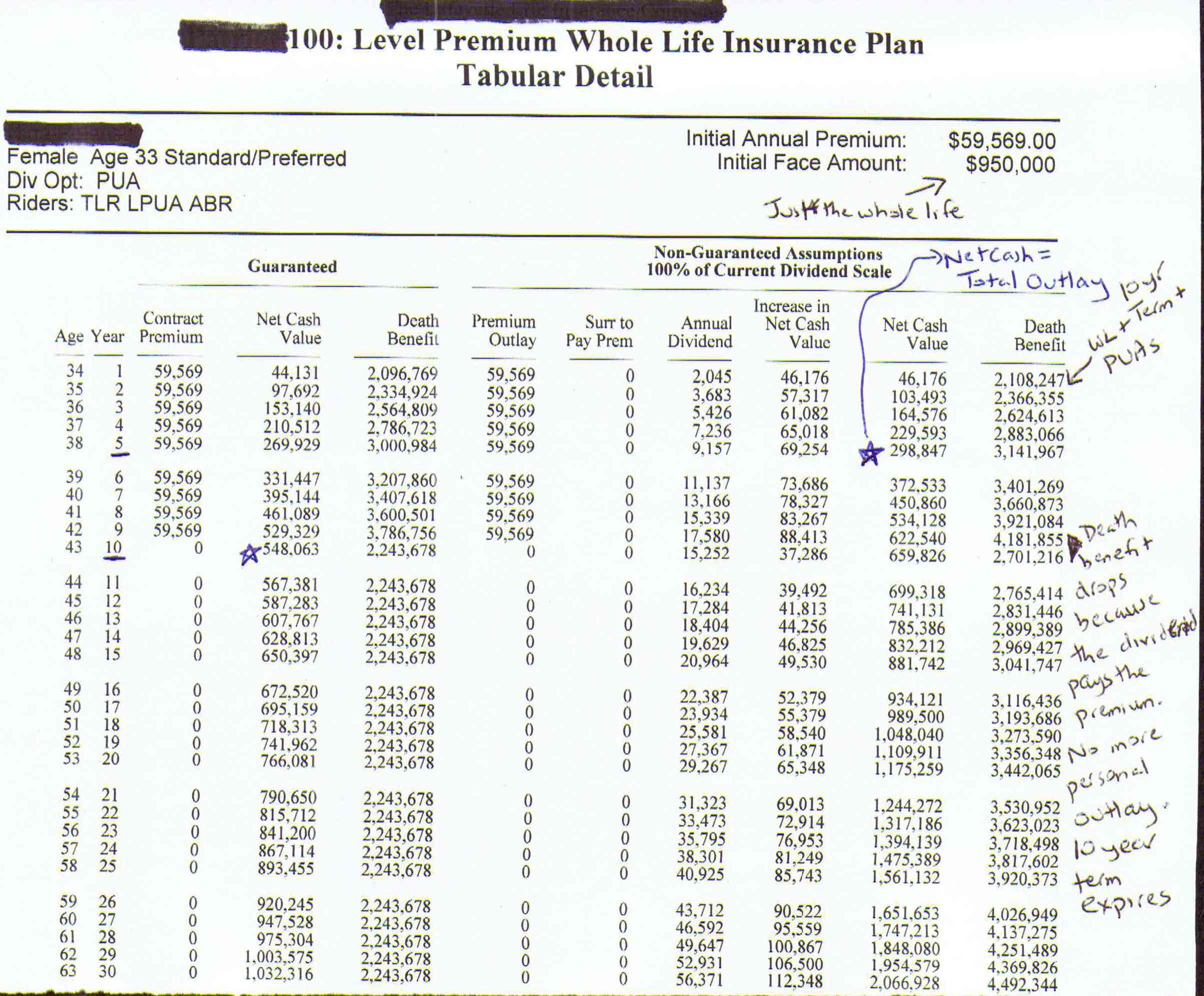

Term life policies don t. Cash value life insurance also known as permanent life insurance includes a death benefit in addition to cash value accumulation. For some whole life policies the policy itself will contain a cash value chart.

So you re paying for two things here the life insurance part the bit that covers your family if you die and the cash value part the savings account that supposedly grows your money. Cash value builds at a fixed rate determined by the insurer. Whole life cash value is invested in a large pool of treasuries corporate bonds and guaranteed investment contracts.

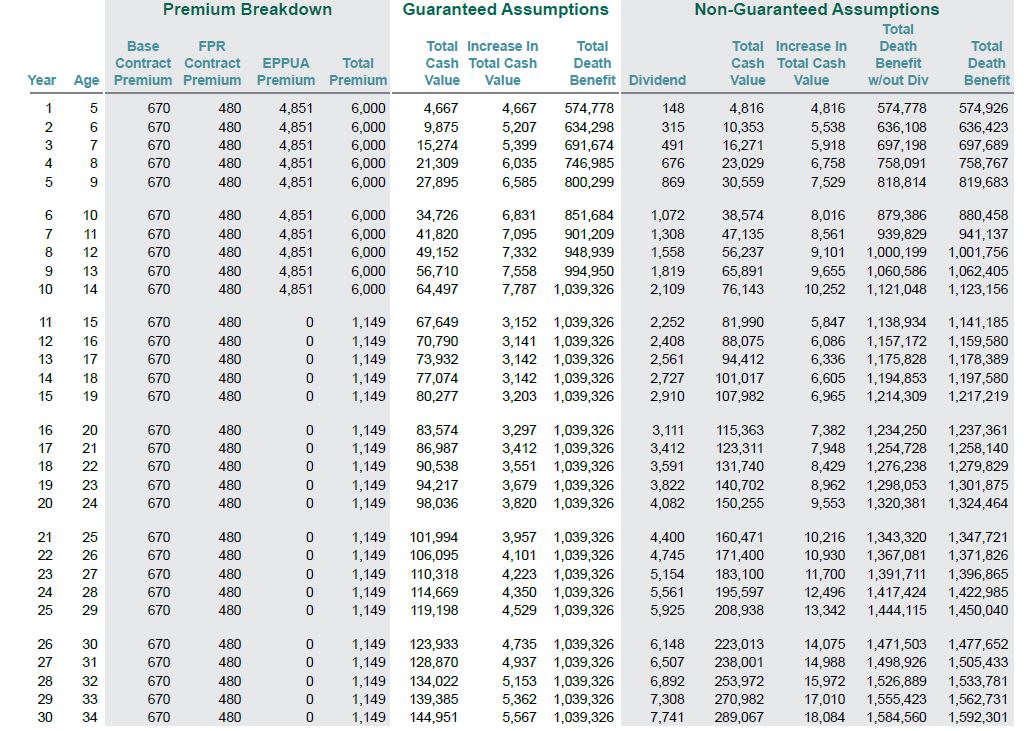

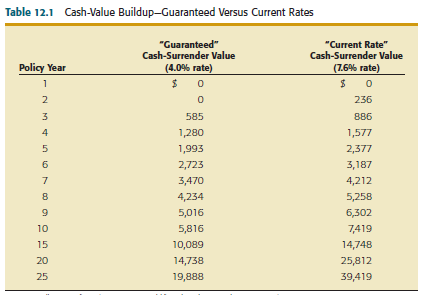

The chart shows how much the cash value is expected to appreciate over the years. Cash value life insurance policies such as whole life insurance typically cost 6 to 10 times more than term life insurance for the same death benefit amount. Cash value is one of them.

Each line in the chart includes the number of years the policy holder maintains the policy and the corresponding cash value per 1 000 in death benefits. The cash value inside a whole life policy is a part of your asset allocation. The length of time it takes to build cash value on a life insurance policy depends on the type of policy you purchase.

Based upon market interest rates and the performance of the insurer. It s designed to reach the size of the death benefit when the policy matures typically when you turn 100. There are big differences between term life insurance and the multiple types of permanent life products like whole life and universal life.

According to one study about 45 of people who purchase whole life insurance surrender their policies within the first 10 years due to the high cost of premiums.