Whole Life Insurance Cash Value Calculator

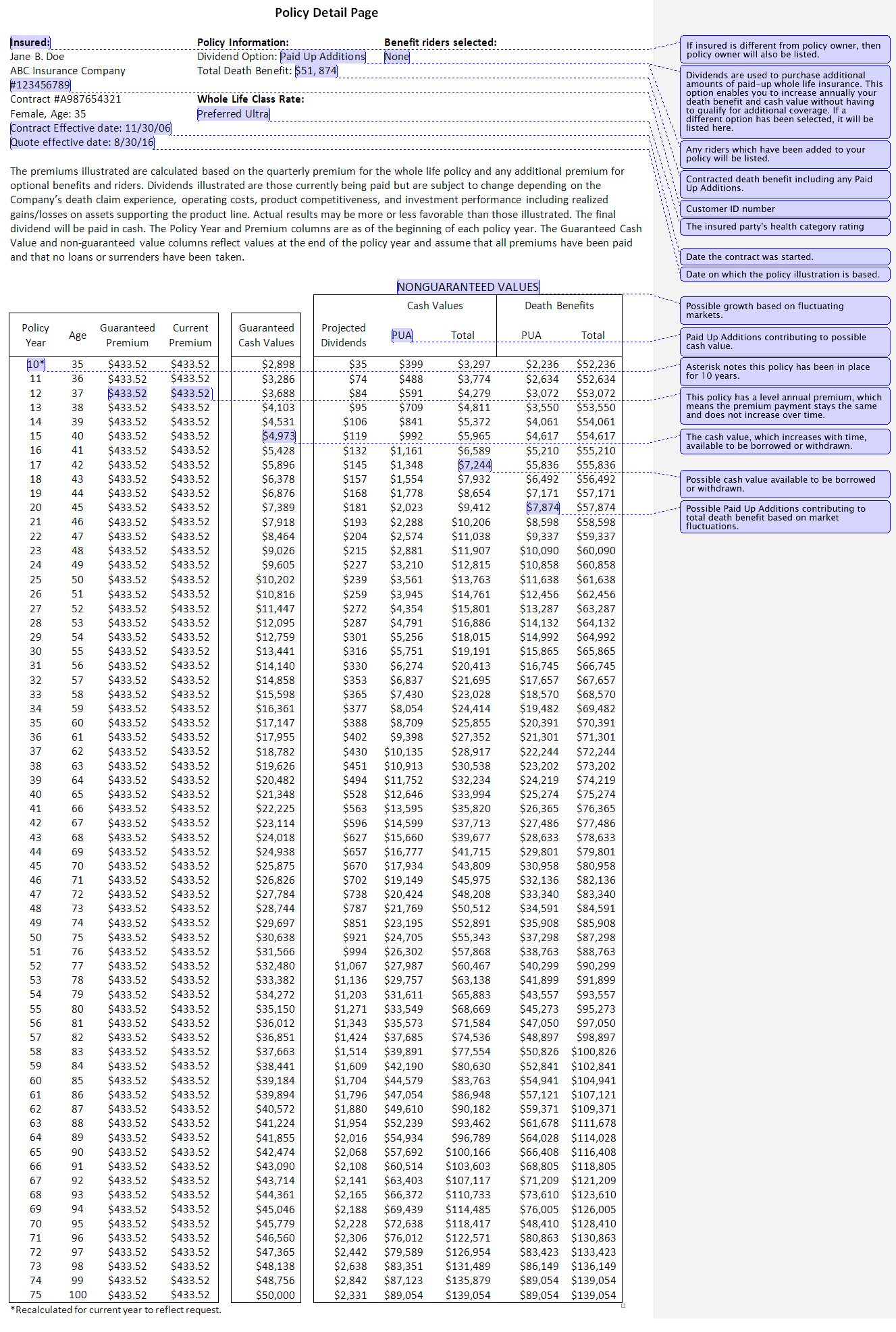

The calculation of cash surrender value is based on the savings component of whole life insurance policies.

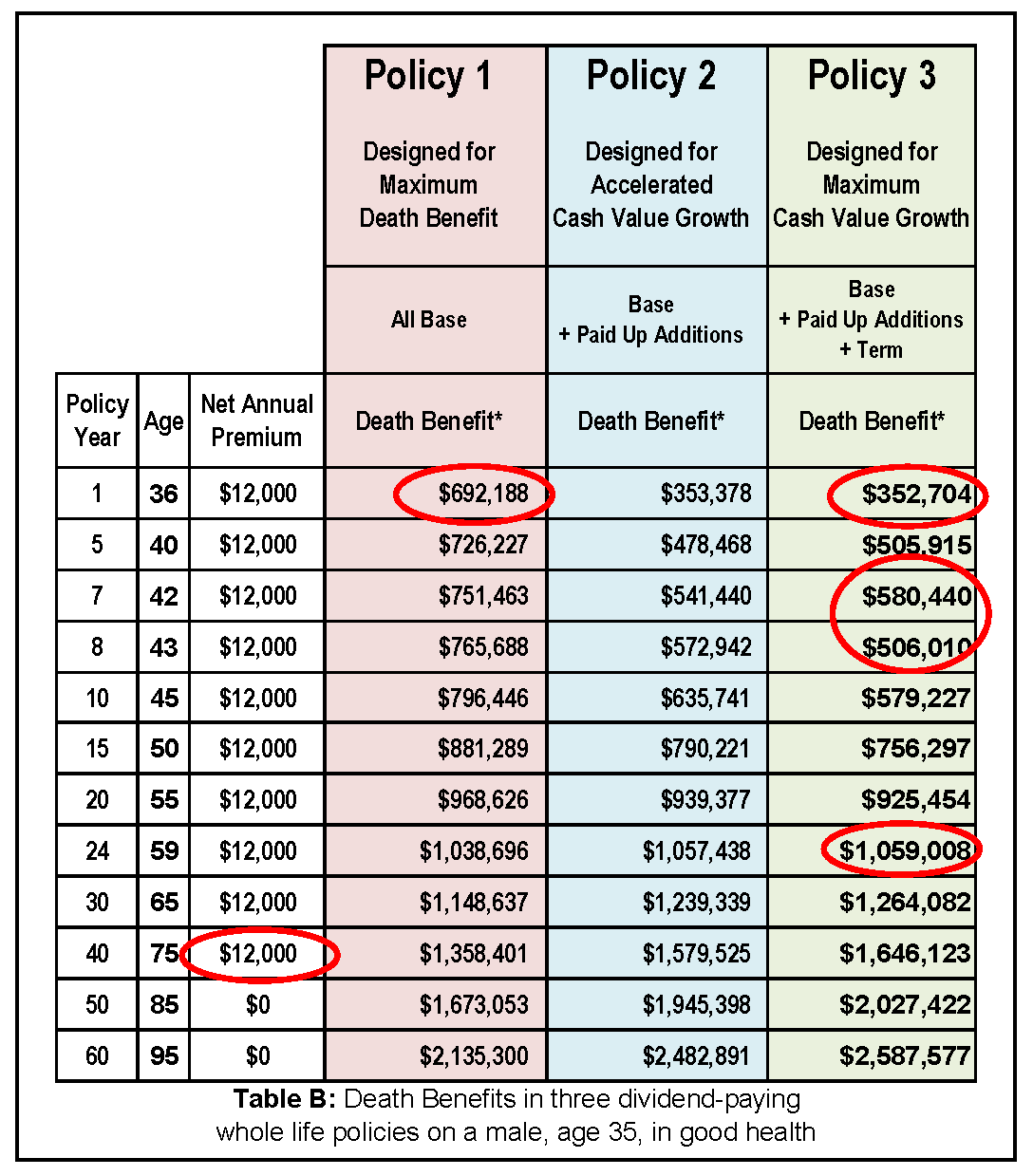

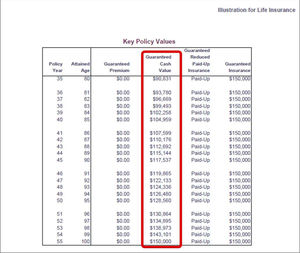

Whole life insurance cash value calculator - The longer the policyholder has contributed to the policy the higher the eventual cash surrender value will be. This includes variable life universal life and whole life insurance plans. You can receive the cash value as a lump sum.

When you cash out your policy there may be fees charged by the insurance company. Cash value life insurance also known as permanent life insurance includes a death benefit in addition to cash value accumulation. The cash value portion is non taxable so long as it does not exceed the amount of total premiums you paid the cost basis when you cash in a portion or surrender the policy.

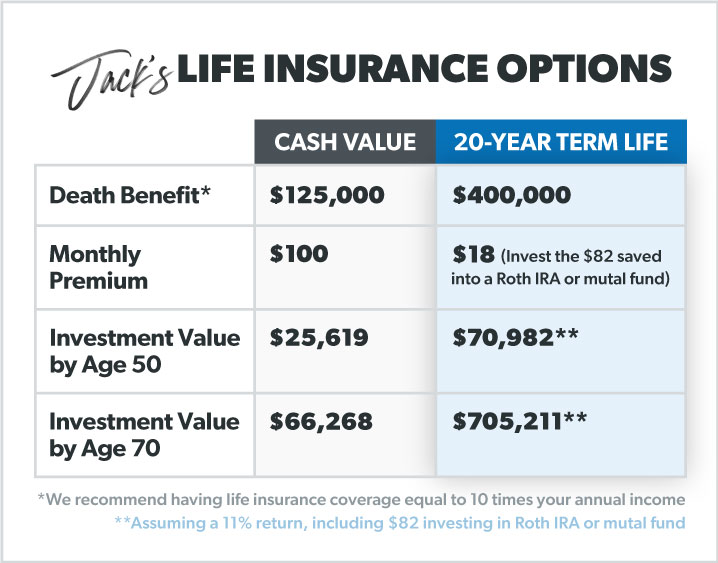

Cashing out on your life insurance when you decide to surrender your life insurance policy you are essentially requesting to cancel the life insurance in exchange for any cash value that has accumulated. There are big differences between term life insurance and the multiple types of permanent life products like whole life and universal life. Whole life insurance cash value you can cash in either a portion of the cash value accumulation or receive the full amount if you surrender the whole life policy.

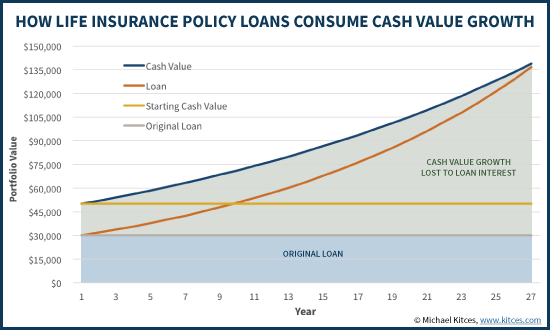

Cash value is one of them. Or you can use it as collateral when applying for bank loans. Cash value life insurance whether whole life iul or vul allows for the tax free growth of funds in a policy s cash account unless the policy is canceled or surrendered transferred or assigned to another owner or the irs no longer designates the policy a life insurance contract.

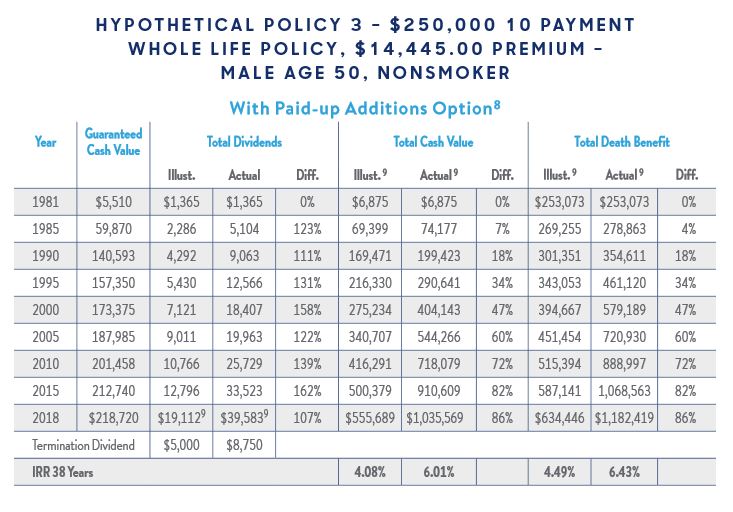

A whole life insurance policy s cash surrender value represents the amount of money a policyholder receives if he chooses to terminate the policy. For many taking cash value from whole life insurance is an option that often gets overlooked but it is there just in case you run out of options. Fees are taken from the cash value before you get the pay out.

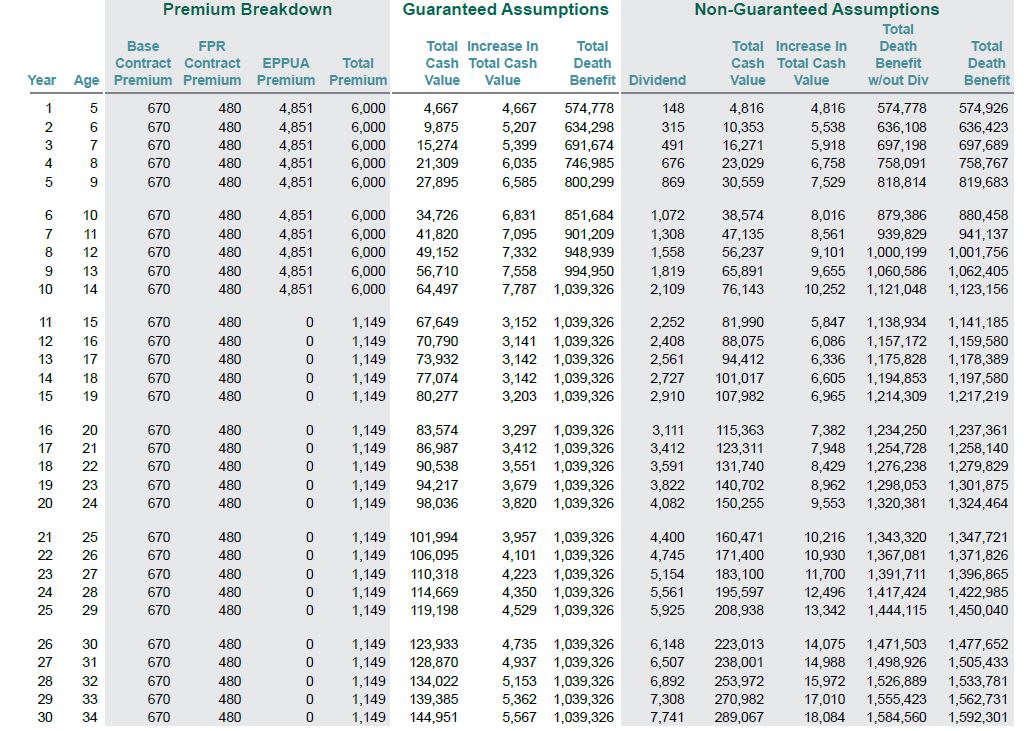

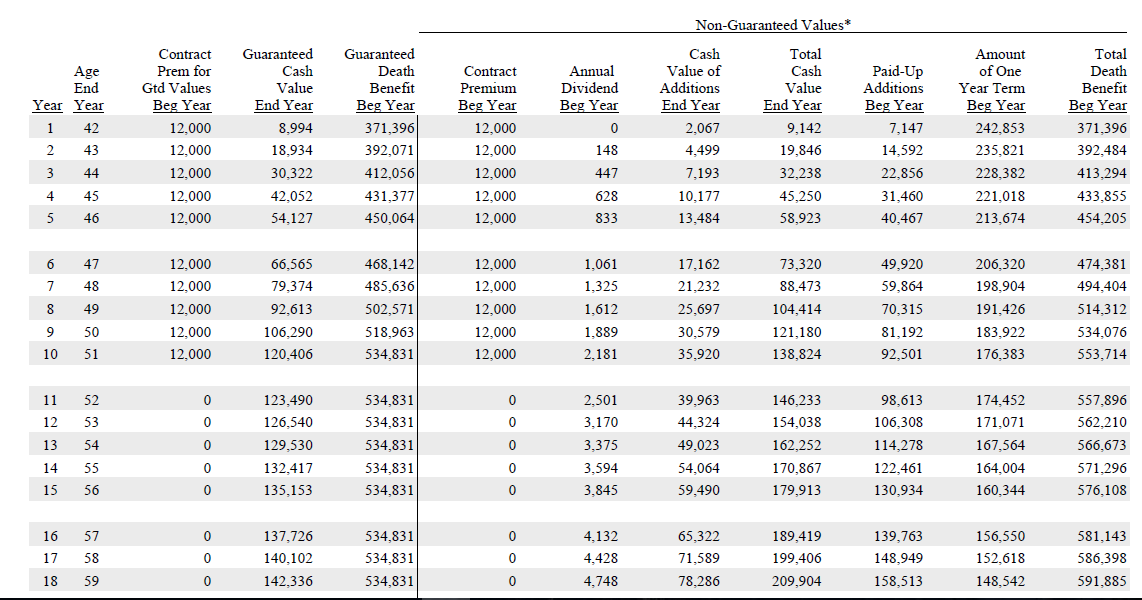

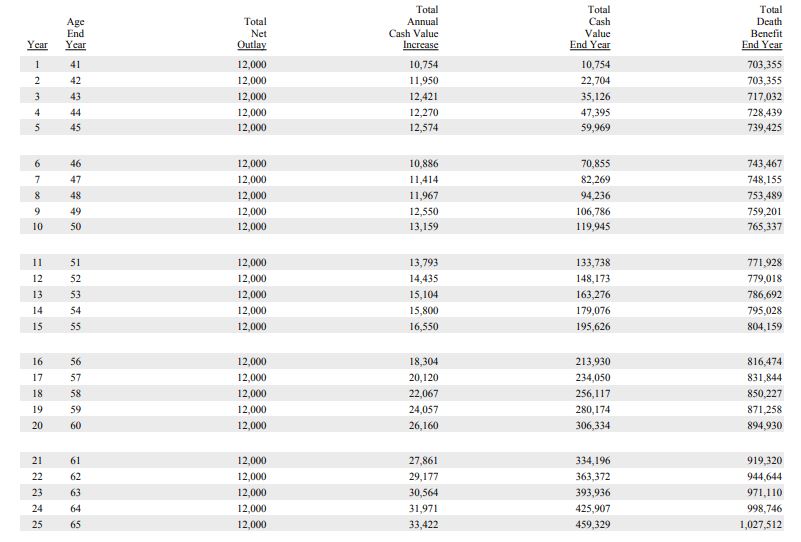

Whole life and universal life policies offer this benefit. This will give your rate of return expressed as a percentage value. You can calculate the rate of return for whole life insurance by subtracting the total premiums paid from the total cash value of the policy dividing this sum by the total premiums paid and multiplying the resulting figure by 100.

Policy holders can choose to receive the cash value as a lump sum or take out a bank loan using the policy s cash value as collateral. The cash value continues to grow as long as you maintain your eligible life insurance plan. Some types of life insurance policies including whole life universal life and variable life can accumulate cash value during the policyholder s lifetime.

Life insurance can give your family an additional financial safety net.