Whole Life Insurance Example

The most obvious difference at least superficially is cost.

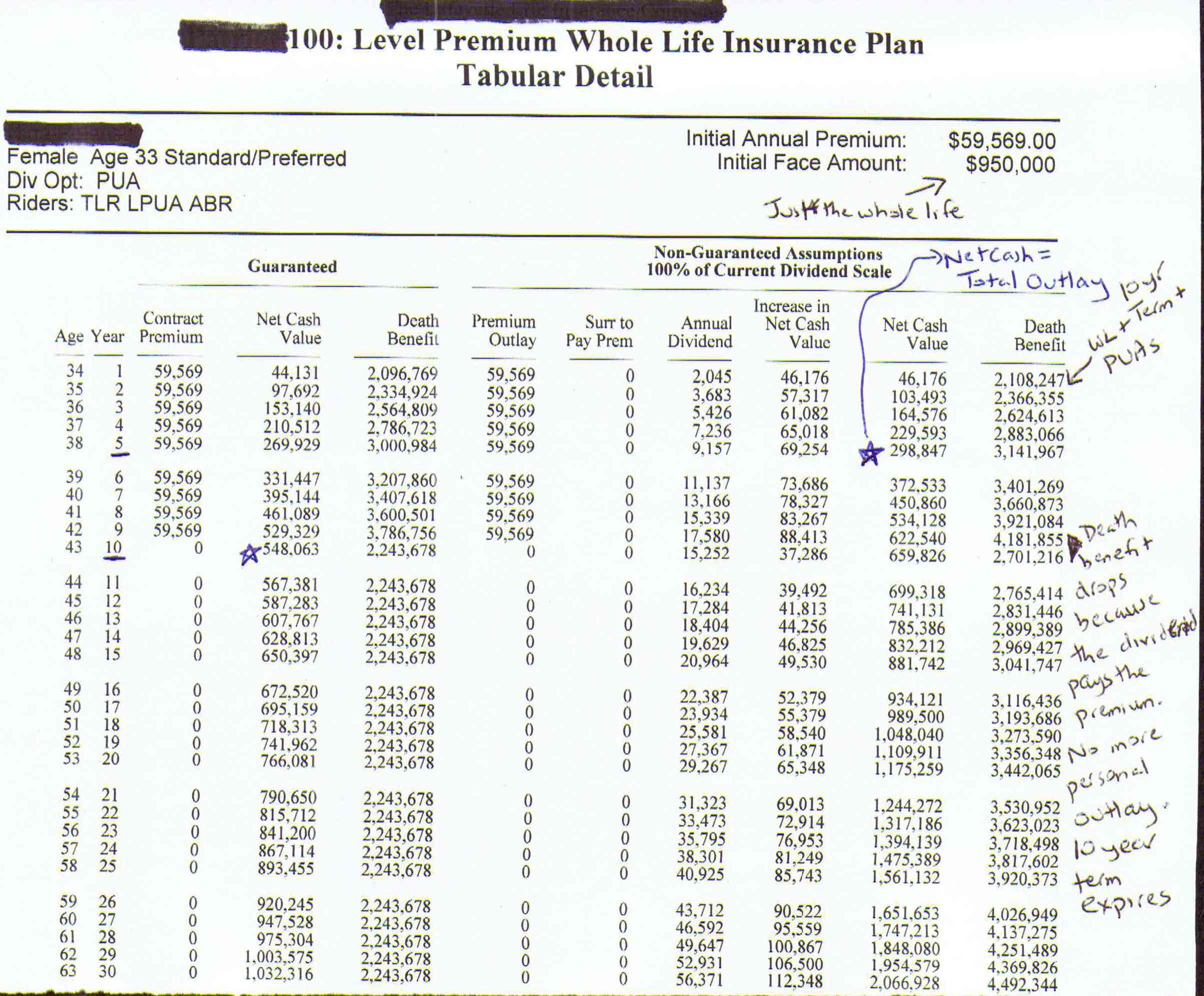

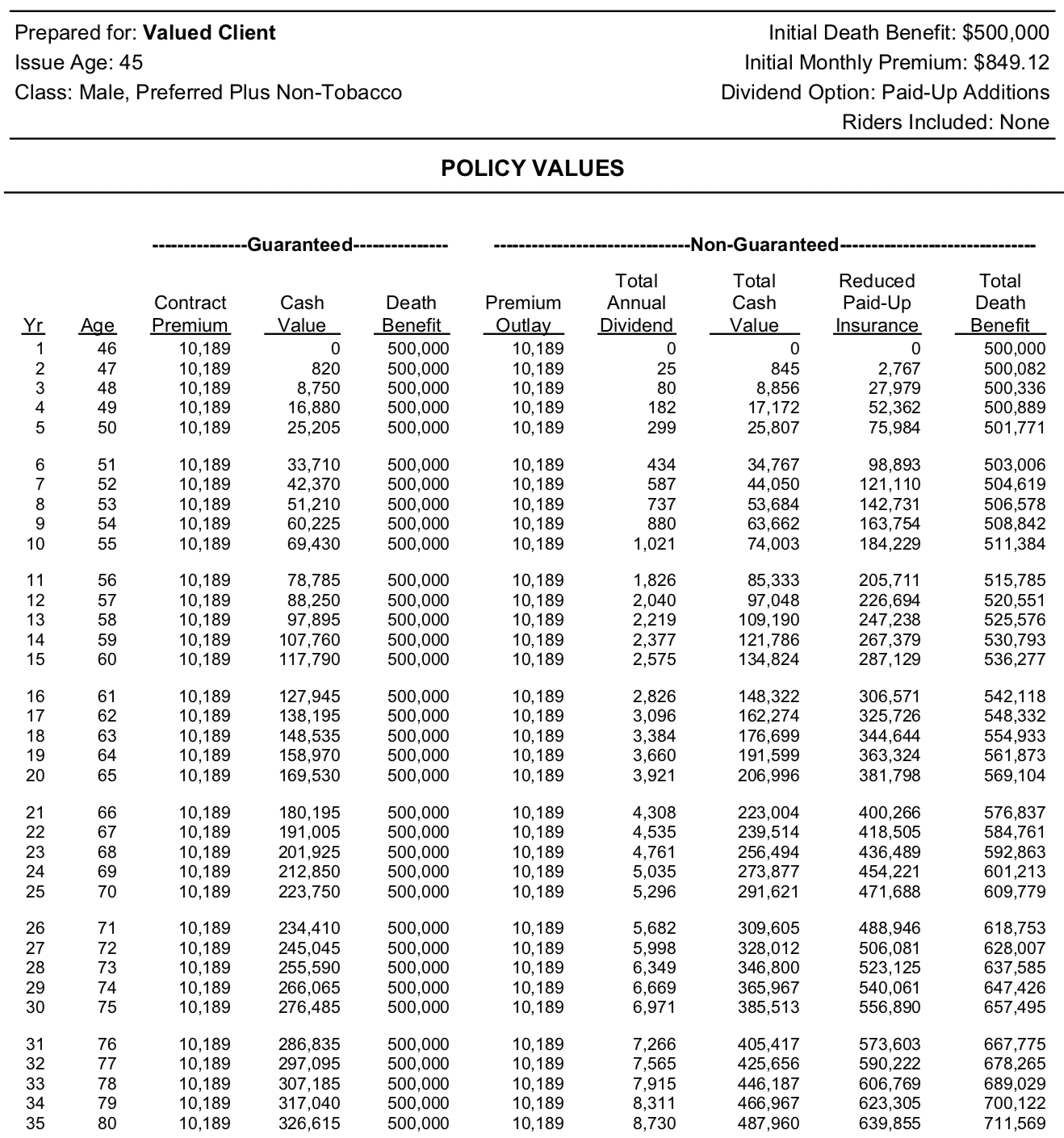

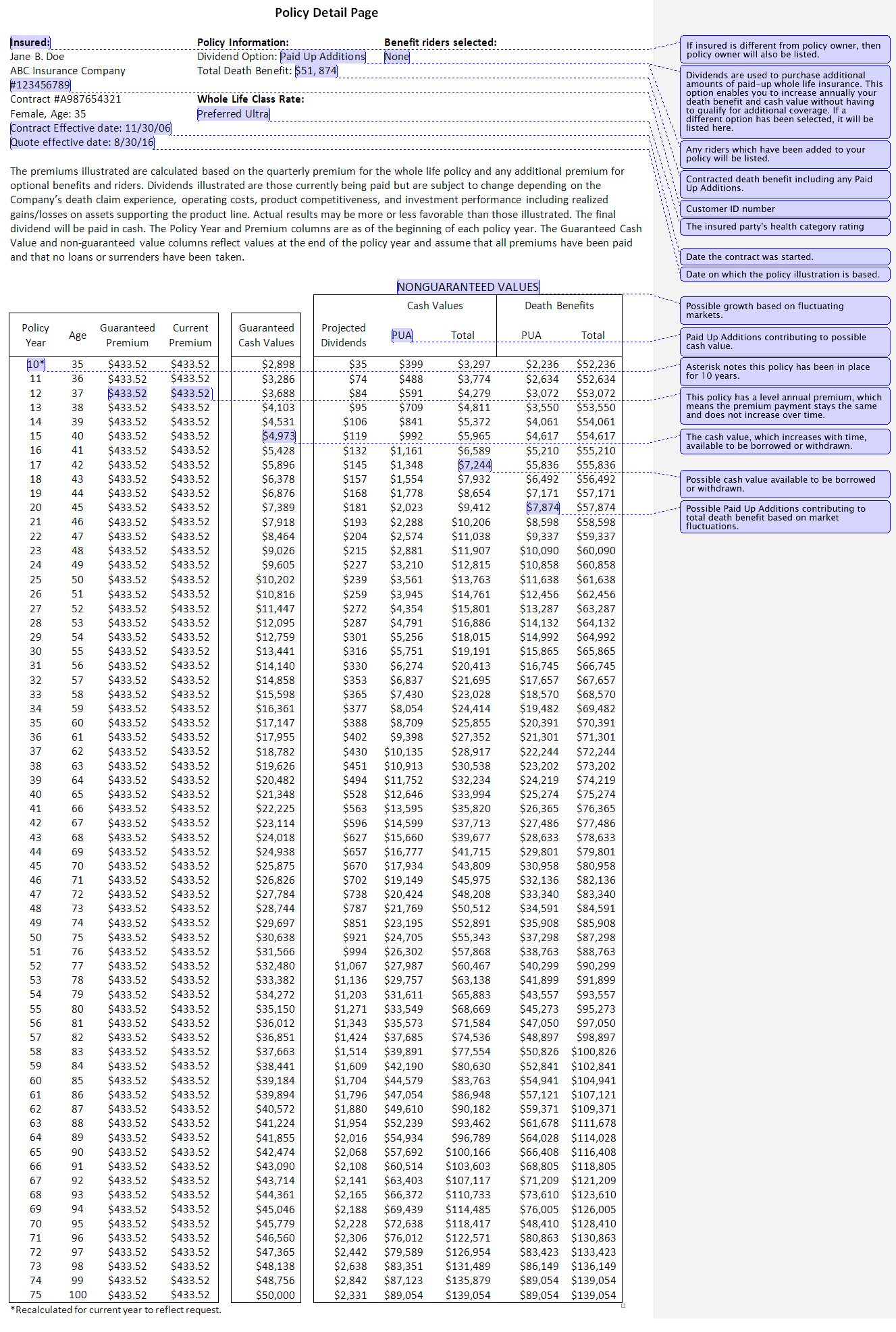

Whole life insurance example - What is the difference between term and whole of life insurance. The caller in question was 38 years old. The following sample whole life insurance quotes are based on a preferred plus female wanting ordinary whole life insurance to age 100 with an a rated insurance company or better.

The cost is fixed based on your age when you buy it and usually doesn t increase. Just like term life insurance beneficiaries exist in a whole life insurance policy. A week or two ago on the suze orman show she had a caller with a whole life insurance policy.

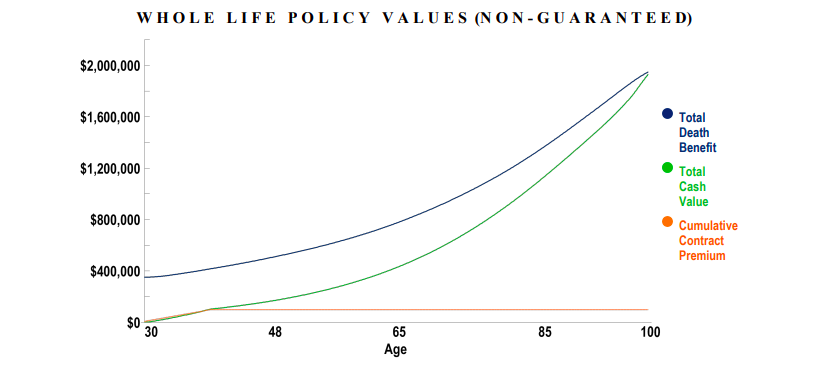

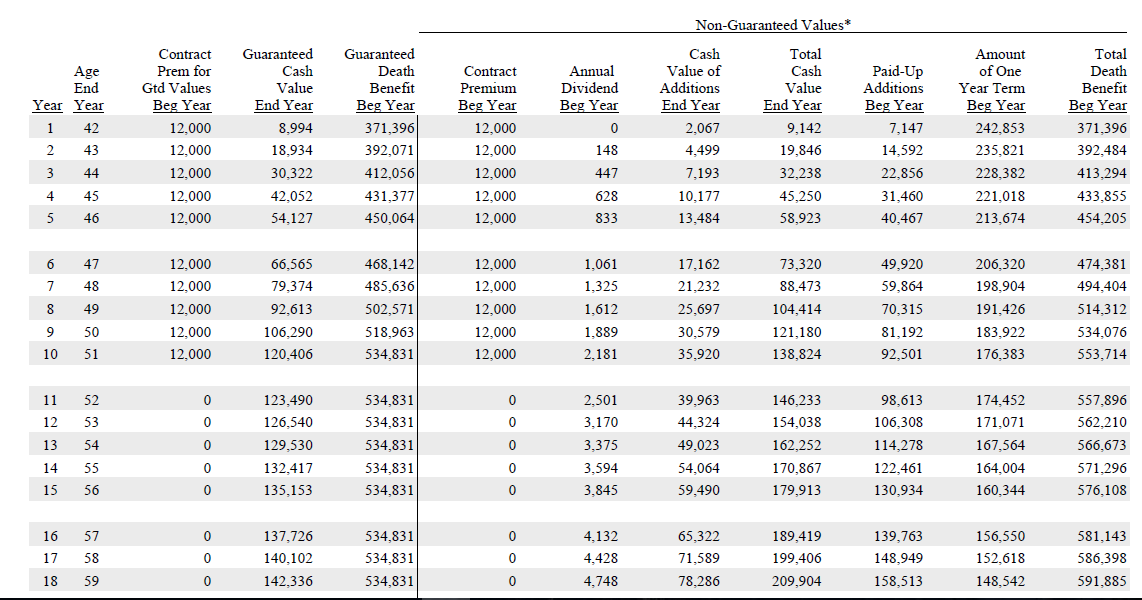

The distinction between basic whole life and high early cash value whole life insurance is vitally important for example. The biggest problem with term life insurance is that it is purchased for a stated period of time. Whole life insurance is a safer permanent life insurance choice than some others it can provide guaranteed interest premium and death benefit so you know what to expect.

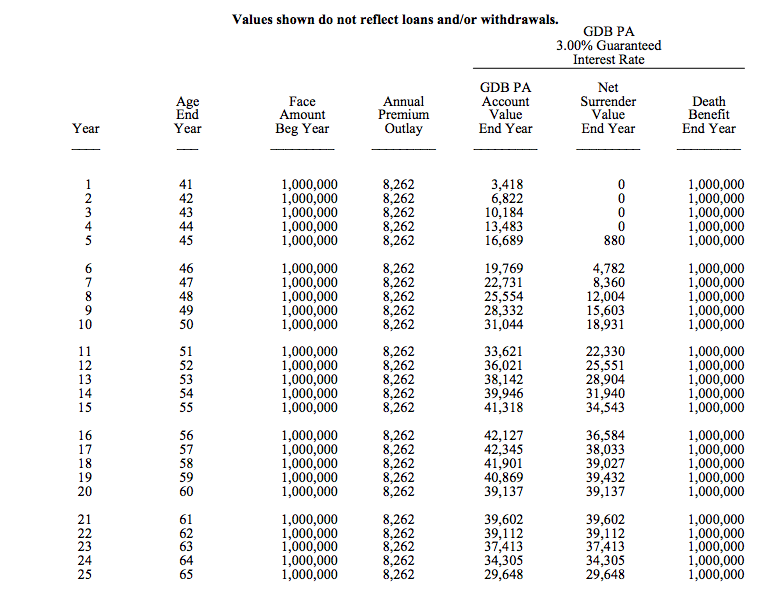

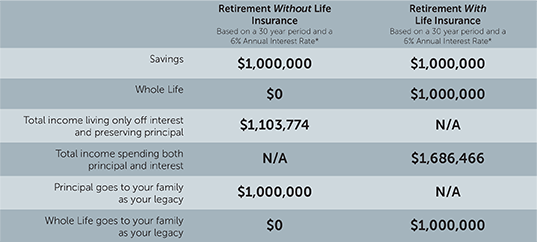

As an example say someone buys a 10 000 whole life policy on his or her life at age 25. In some cases whole life insurance premiums are three to five times as much as term life premiums at least at the onset. Whole life insurance will provide a death benefit tax benefits and cash value but will cost you a lot more than the cheaper more straightforward term life insurance option.

To whom it may concern. They receive the death benefit upon the contract holder s death. Monthly rates are for informational purposes only and must be qualified for.

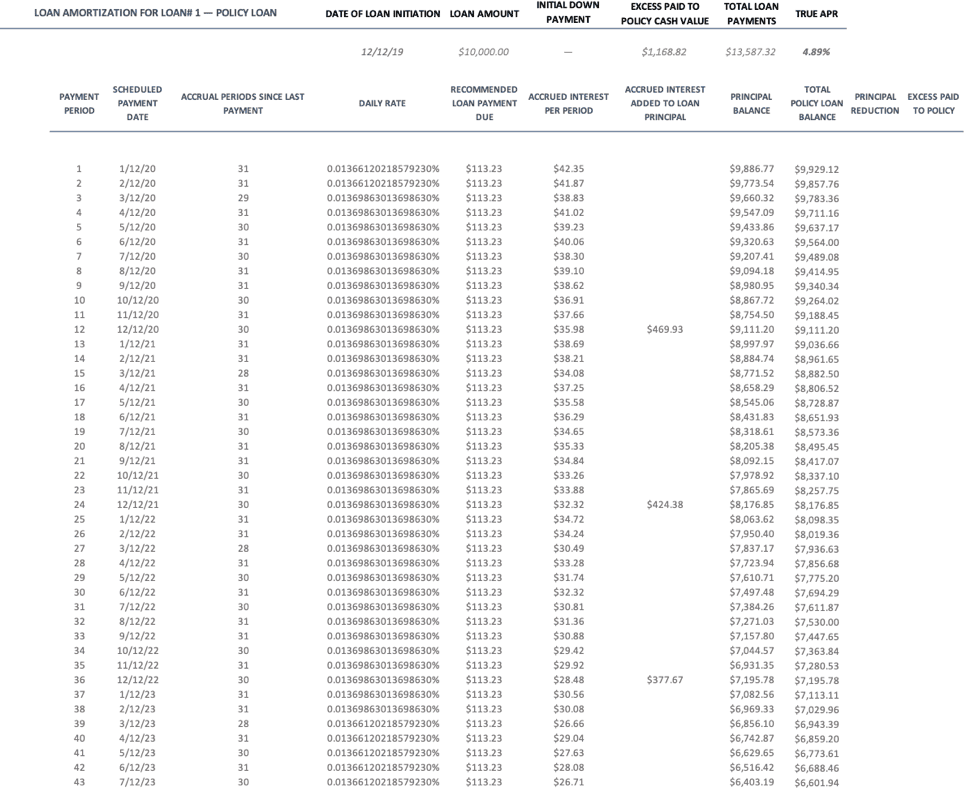

Put very simply a whole life insurance policy is an insurance policy that has a cash value built up. The selling of a life insurance policy by a terminally ill person so that person can receive a benefit from the policy while still alive and the purchaser of the policy can receive a. Insurance company name insurance company address re.

It will only pay out if you pass away during the term of the policy. Some of the money you pay into whole life insurance builds cash. Cancellation of life insurance policy.

Term and whole of life insurance are the two main types of life insurance available on the uk market. Then you have policies that pay dividends versus those that don t single premium policies level premium policies 10 pay policies and so forth. Whole life policies guarantee that the amount of life insurance coverage you buy at the start of the policy remains the same throughout your lifetime as long as the planned premiums are paid.

Whole life insurance was created to address the problems with term insurance. A term life insurance policy is designed to last for a certain period of time called the term.