Whole Life Insurance Rates

Stranger originated life insurance or stoli is a life.

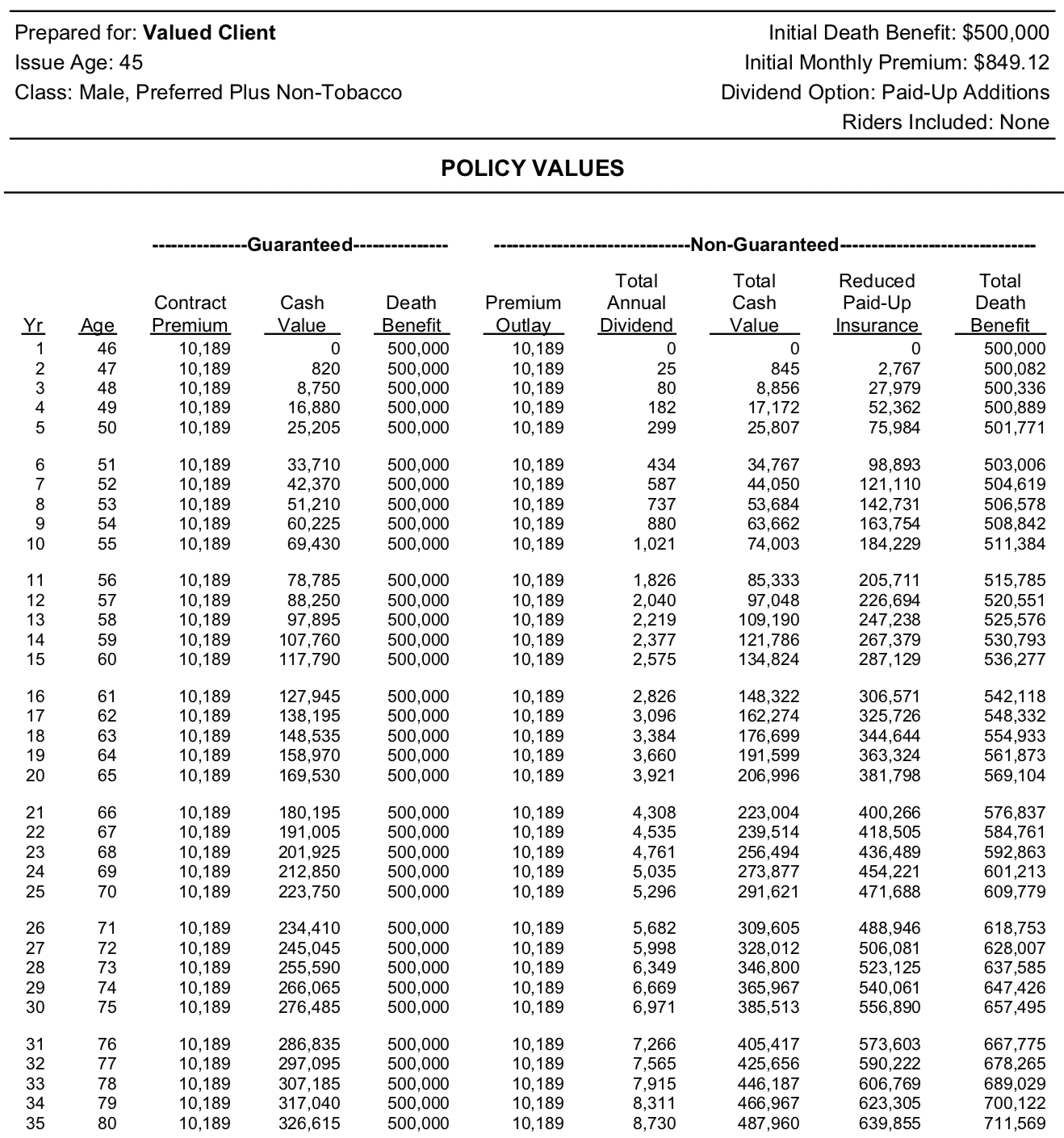

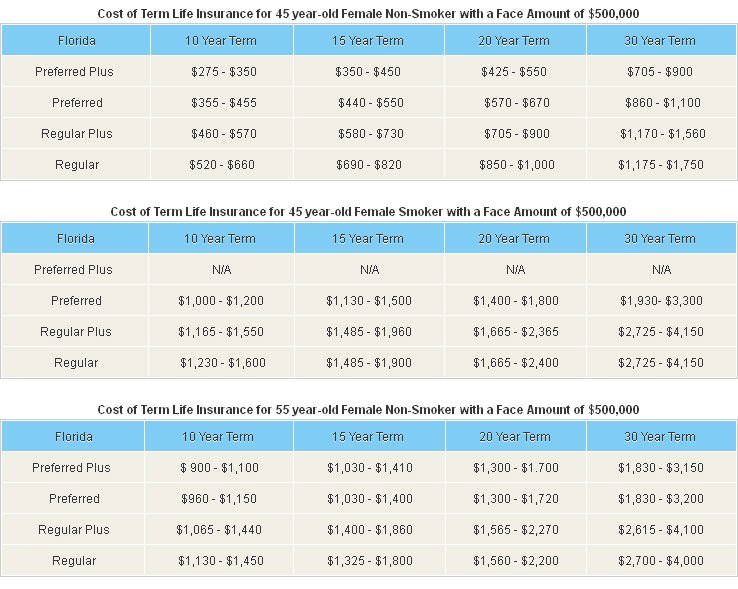

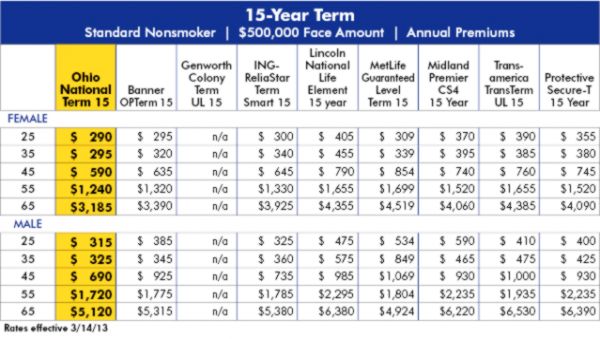

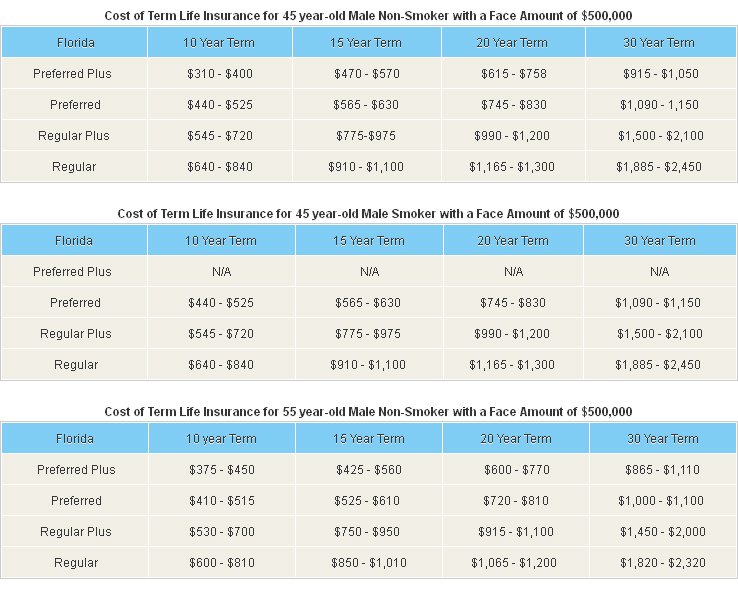

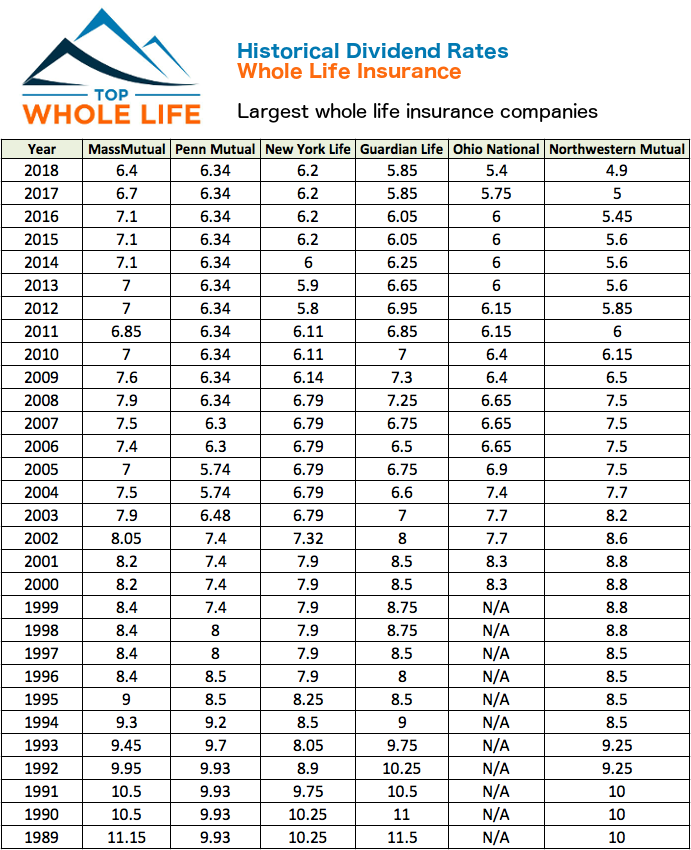

Whole life insurance rates - The whole life insurance rates by age charts below are examples of what you can expect to pay for a typical policy. Each employer has their standards for porting a policy. When you compare this to the annual cost of whole life insurance below you ll see that premium payments for a whole life policy are a lot higher.

You might be looking for predictability a policy you keep permanently premiums that never change and a guaranteed death benefit 1 maybe you like the idea of a policy that builds cash value you can access 2 to help you with financial obligations. The insurance providers will electronically review your records before approval. Whole life insurance rates chart.

This way you can get an idea of whole life insurance rates. We used a top rated life insurance company with great cash value accumulation. Whole life insurance rates.

Keep in mind that when purchasing a whole life insurance policy the insurer will set up quotes based on paying your premiums until you re 65 99 and 121. Term life insurance rate. The plan holder generally pays a costs either regularly or as one round figure.

What do you want from your life insurance. Non investment life policies do not usually draw in either earnings tax obligation or resources gains tax on an insurance claim. The whole life insurance rates chart below provides pricing for males and females between the ages 35 and 75.

Please be aware that the quotes are for informational purposes only and do not reflect what whole life insurance costs for a specific individual. Whole life insurance rates by age chart however we do want you to get an understanding of pricing. Perhaps you want to help protect your family s financial future with higher.