Whole Life Insurance Table

Participating whole life comparative table by the ij staff june 09 2020 12 20pm this table is interactive.

Whole life insurance table - As a consumer you know that there is a lot that goes into comparing policies and companies. Whole life assurance table 01. Picking a company with the highest ratings both for financial stability and customer service is the key.

Whole life assurance table 01 is a unique combination of protection and saving which can be purchased at very economical premium payable annually or in half yearly quarterly installments death at any time before age 85 years terminate payment of premium and the sum assured plus bonuses if any become payable. The most popular in life insurance. Rates will continue to increase as you age due to a decrease in your total life expectancy.

Applications for life. Whole life is the most popular form of life insurance in the marketplace. Monthly rates are for informational purposes only and must be qualified for.

Below you ll find tables of sample life insurance rates for a term life insurance and no exam term policy. Life insurance companies will use age as a determinant for life insurance premiums. These policies provide 5 000 to 50 000 of insurance coverage for your entire lifetime and the are typically used to pay for final expenses.

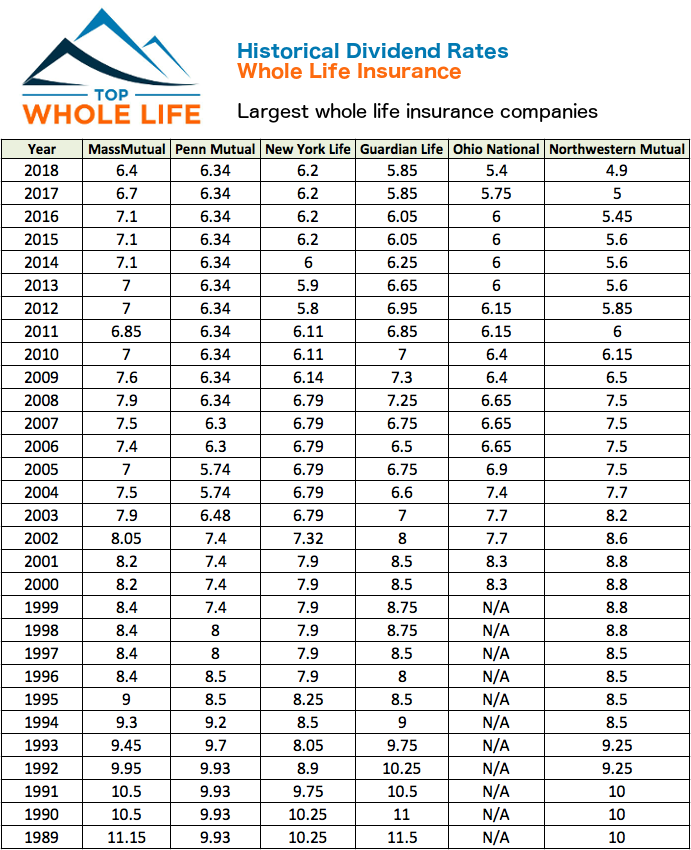

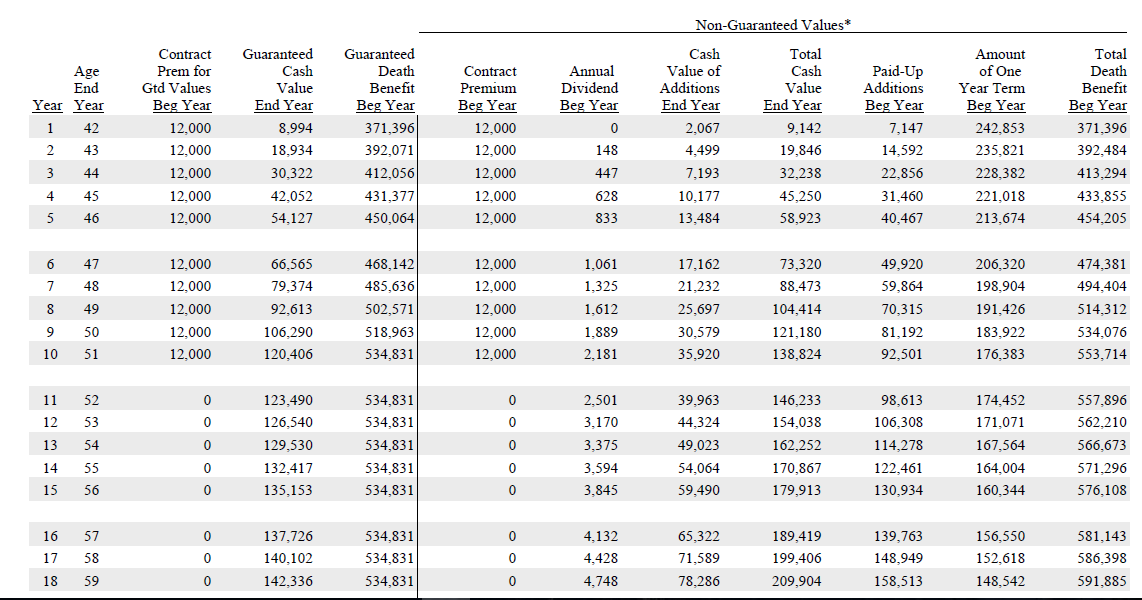

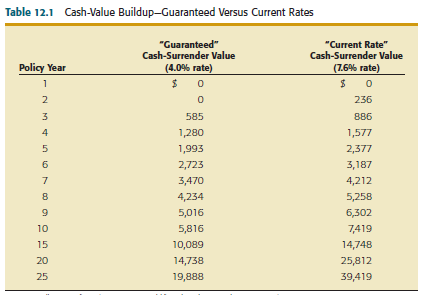

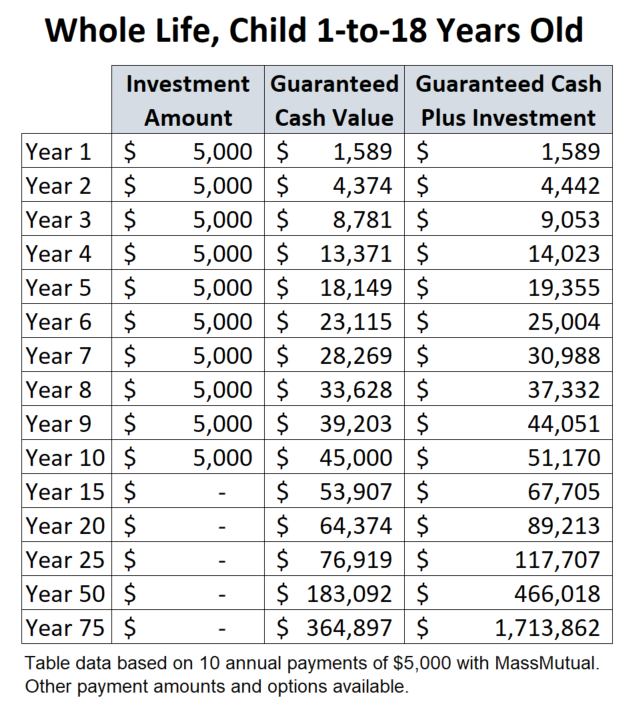

Term life insurance offers low cost protection with guaranteed level premiums for a fixed duration typically 10 15 20 or 30 years whole life insurance offers lifetime guaranteed coverage with the additional benefit of accumulating cash values. It s a great debate among life insurance professionals consumers and financial planners. The following sample whole life insurance quotes are based on a preferred plus female wanting ordinary whole life insurance to age 100 with an a rated insurance company or better.

Since whole life insurance policies are a true long term investment your relationship with the insurance company will literally last a lifetime. An actuarial life table is a table or spreadsheet that shows the probability of a person at a certain age dying before their next birthday and is used by insurance companies to price products. Do your homework and make sure that you feel comfortable with your insurance broker.

If you want to get the best whole life insurance rates you are going to have to do the research the good news is we have done all the research for you. Of course actual policy rates will vary from person to person so be sure to get your own quote for a more accurate estimate. They represent the best prices a person in excellent health can get.

What is whole life insurance. The term life insurance quotes below are for a 20 year term life insurance policy with a death benefit of 500 000.