Zero Dep Car Insurance India

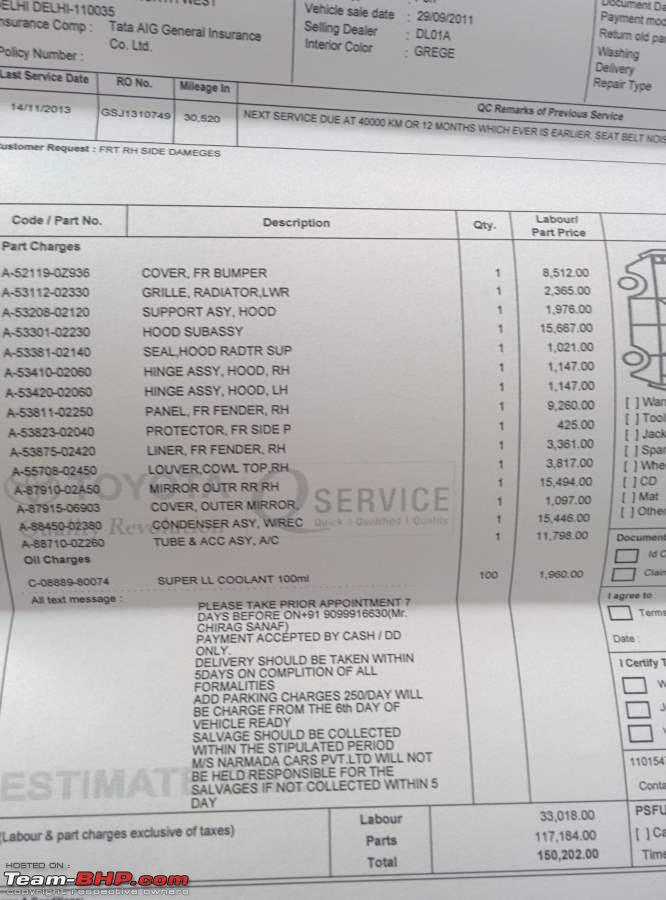

This means that if your car gets damaged in an accident you will receive the entire cost from the insurer.

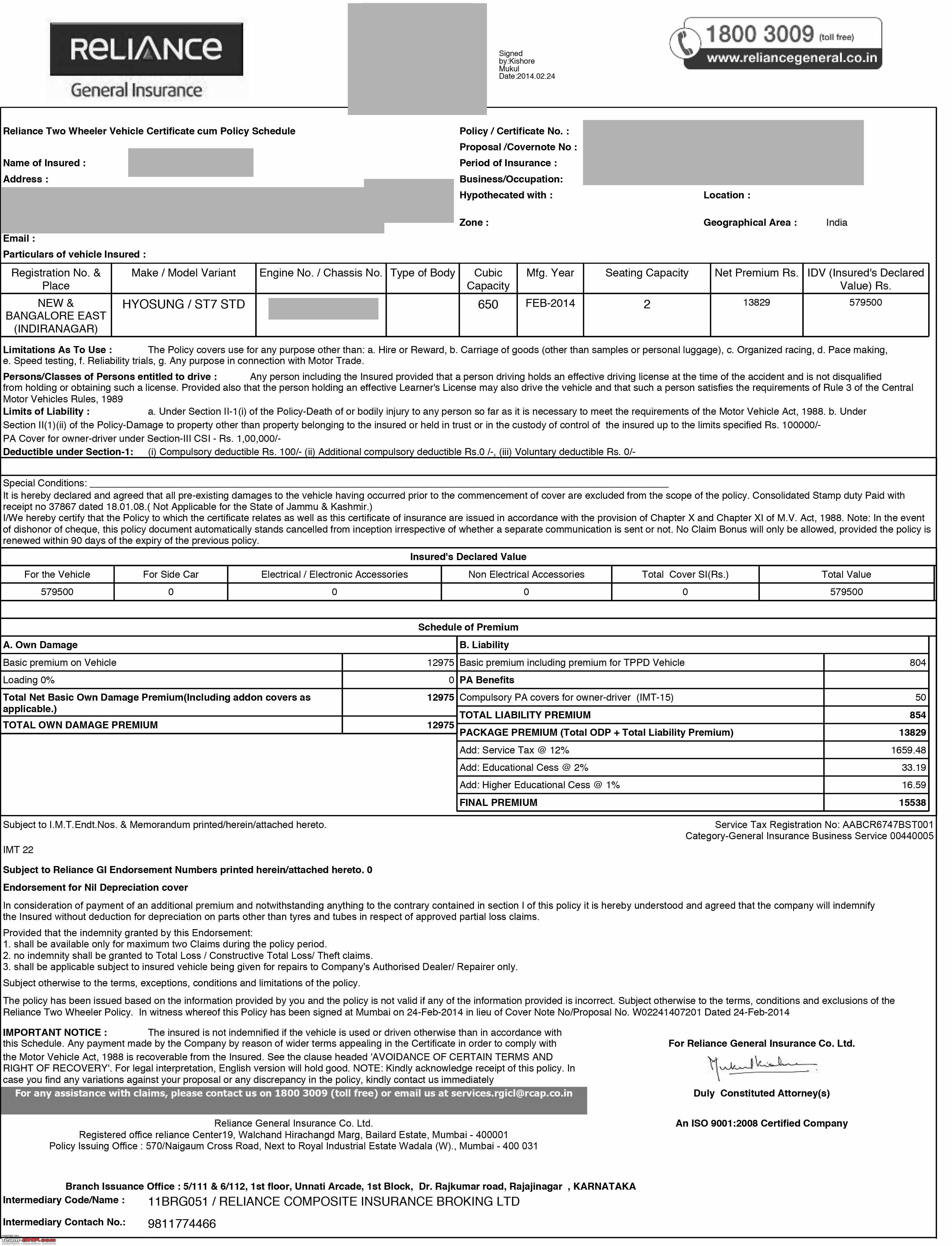

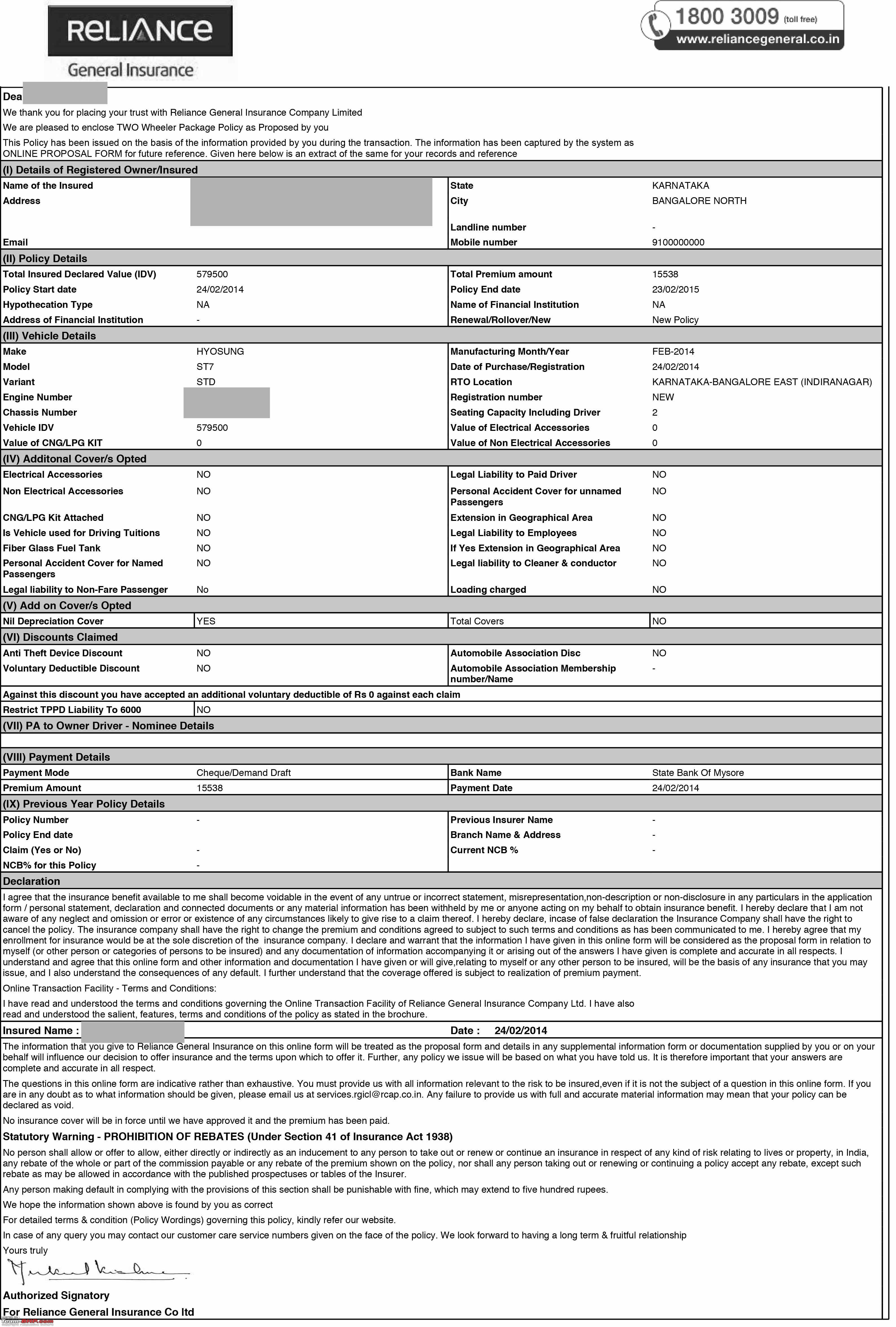

Zero dep car insurance india - Acko general insurance offers zero depreciation add on cover only for cars not older than 5 years. Zero dep insurance cover also known as zero dep policy is a type of insurance cover which offers complete coverage without factoring in depreciation value of the vehicle. Zero depreciation car insurance.

It is mandatory to have third party car insurance in india under the motor vehicle act 1. Factors that are taken into consideration while calculating zero dep car insurance premium place of registration the cost of the premium is higher in all the major cities like delhi bangalore mumbai chennai ahmedabad kolkata and pune as compared to other cities. Calculate car insurance premium in under 5 seconds calculate lowest insurance premium online in less than 5 seconds.

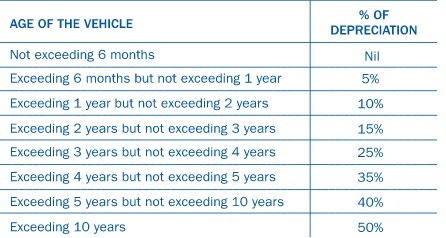

It shifts the liability of bearing the depreciation of your car and its parts from you to the insurance company. Consider the age of your car. As compared to a regular car insurance policy zero depreciation car insurance will be slightly more expensive in terms of premium.

Policy hidden untold conditions explained. The car insurance zero depreciation policy is applicable to cars under the age limit of 3 years. Is the all encompassing car insurance policy inclusive of add on covers and protection against financial liabilities arising from a number of common everyday scenarios.

Part 2 of make in india series with facts detailed duration. A zero dep policy would cost you additional premium compared to a comprehensive policy although the benefits justify the additional cost. Comprehensive car insurance policy.

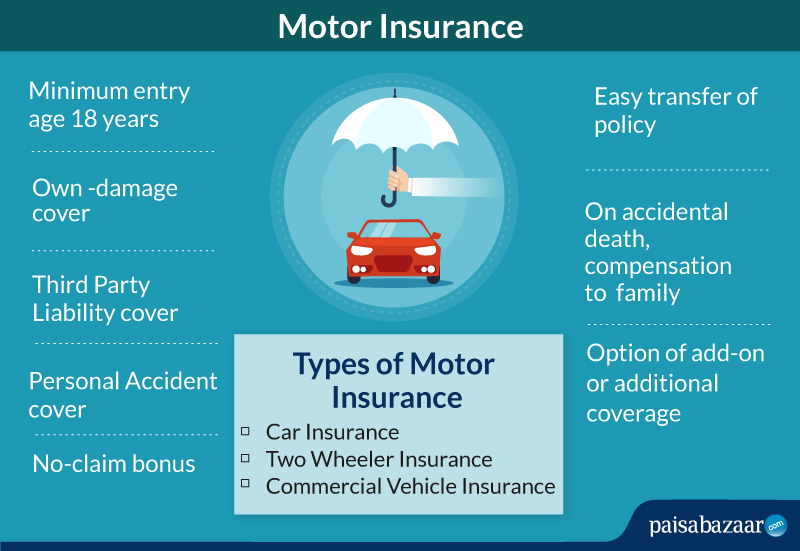

Best car insurance companies in india getting motor insurance is essential for all the car vehicle owners and drivers in india. With united india car insurance being one of the oldest insurers in india having been set up in 1938 listed below are some of the key benefits of availing a car insurance policy from united. How is zero depreciation car insurance premium determined.

Know what insurance companies do not tell about zero depreciation car insurance. United india car insurance. So in other words only new cars are eligible for 0 depreciation car insurance.

In fy 2017 2018 united india car insurance earned a net premium of rs 5 748 32 crore with an incurred claim ratio of 91 72. A zero depreciation add on cover also known as nil depreciation and bumper to bumper cover is a popular car insurance add on cover which is most commonly opted by car owners along with their comprehensive car insurance policy.