Zero Dep Car Insurance Policy

Loss or damage to your car due to natural calamitiesloss or damage to your car against unplanned activitiespersonal accident coverthird party legal liability a comprehensive car insurance policy with a zero depreciation cover offers all the.

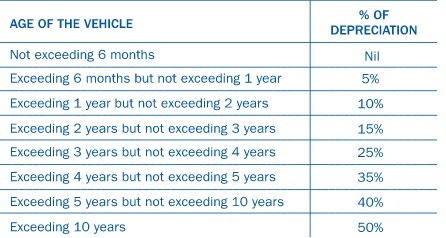

Zero dep car insurance policy - Consider the age of your car. Zero dep insurance cover also known as zero dep policy is a type of insurance cover which offers complete coverage without factoring in depreciation value of the vehicle. Furthermore this value will keep reducing overtime.

A zero depreciation car insurance is a comprehensive car insurance policy with the zero depreciation add on cover included. Policy with zero dep. So in other words only new cars are eligible for 0 depreciation car insurance.

In a zero depreciation policy the insured gets the total cost of the damage or loss that is caused to the insured car. Differences between zero depreciation and comprehensive car insurance policy. The car insurance zero depreciation policy is applicable to cars under the age limit of 3 years.

The depreciation value of the replaced or damaged parts is usually deducted at the time of claim but with zero dep policy one can claim the full amount. The value of a car gets reduced the moment you take it out of the showroom. A comprehensive car insurance policy protects your car from every possible danger.

Strengthen this protection by choosing from a wide range of add on covers. Give your vehicle the attention and care it deserves by choosing the right car insurance policy and add on covers. Without the zero depreciation cover all insurers account for depreciation on your car s parts and therefore pay you your claim only after subtracting the amount of.

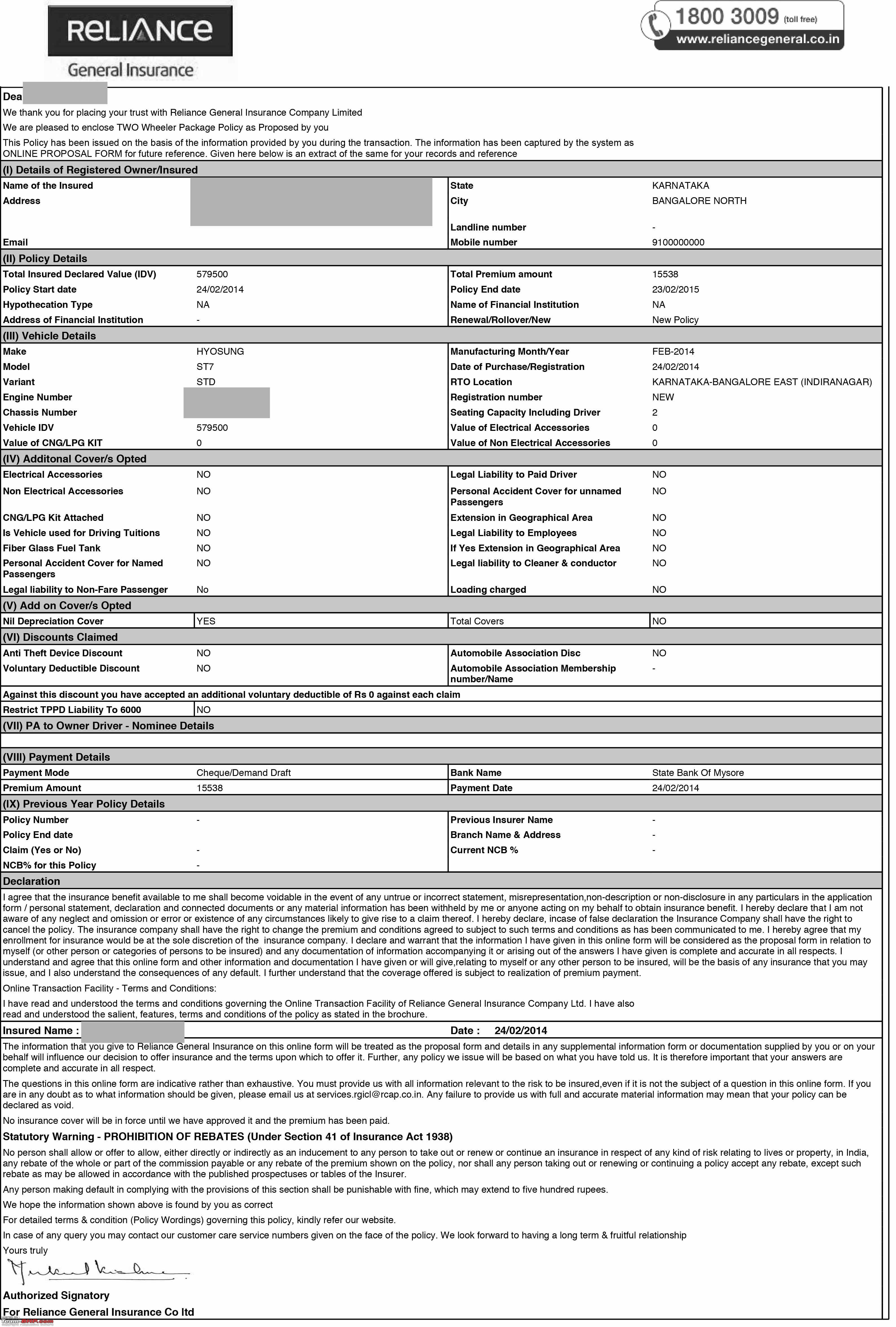

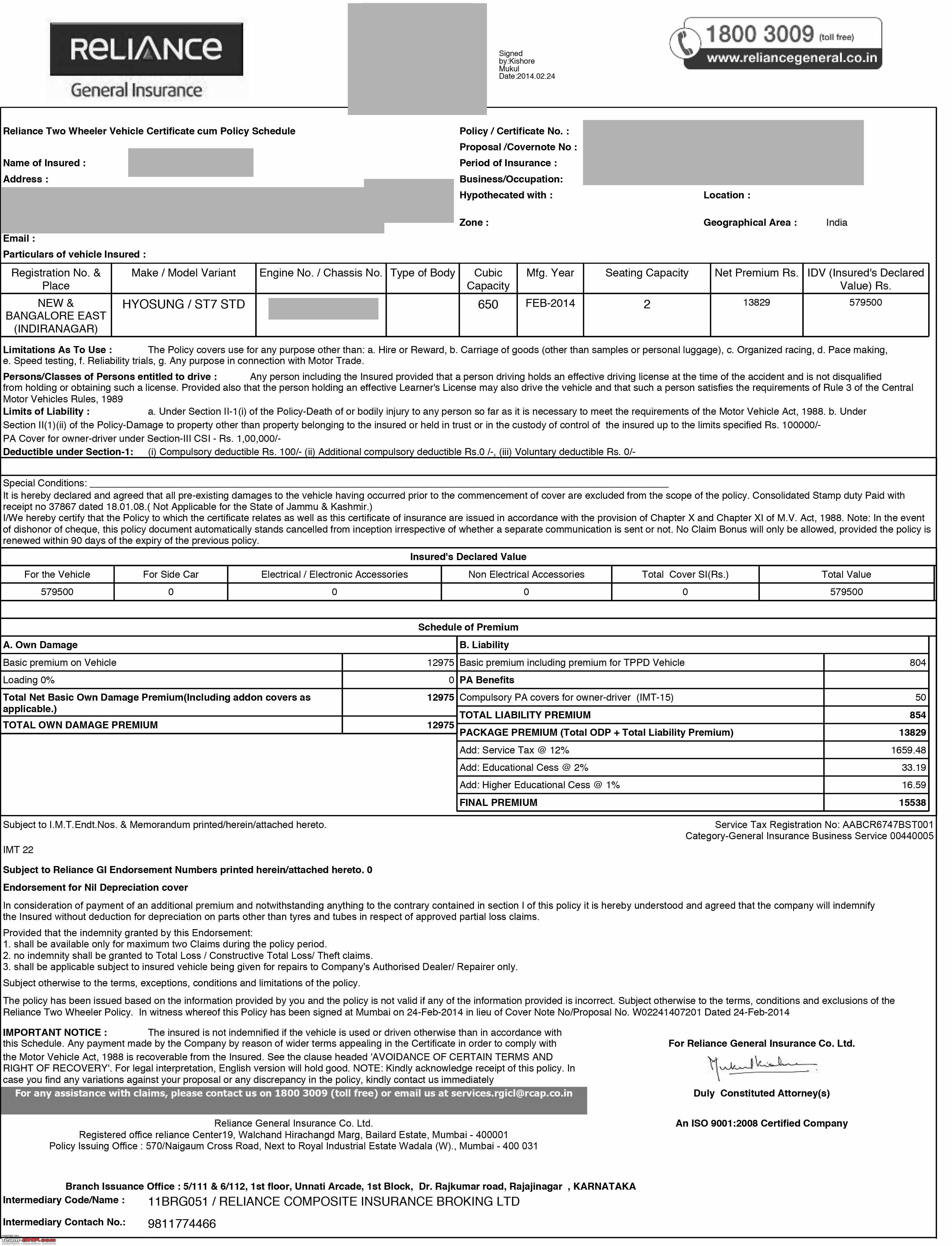

How a zero dep car insurance policy benefits you during claims. Icici lombard car insurance policy offers zero depreciation cover that is it provides coverage on replaced parts with no deduction for depreciation for the first two claims in a policy year. This cover is highly beneficial for car owners as it ensures no deduction on account of depreciation for replaced parts in case of an accident.

This means that if your car gets damaged in an accident you will receive the entire cost from the insurer. This gradual reduction in the market value of a car is called depreciation. This implies that your car will be devoid of its general depreciation during car insurance claims.

Zero depreciation car insurance. Acko general insurance offers zero depreciation add on cover only for cars not older than 5 years. A zero depreciation add on cover also known as nil depreciation and bumper to bumper cover is a popular car insurance add on cover which is most commonly opted by car owners along with their comprehensive car insurance policy.

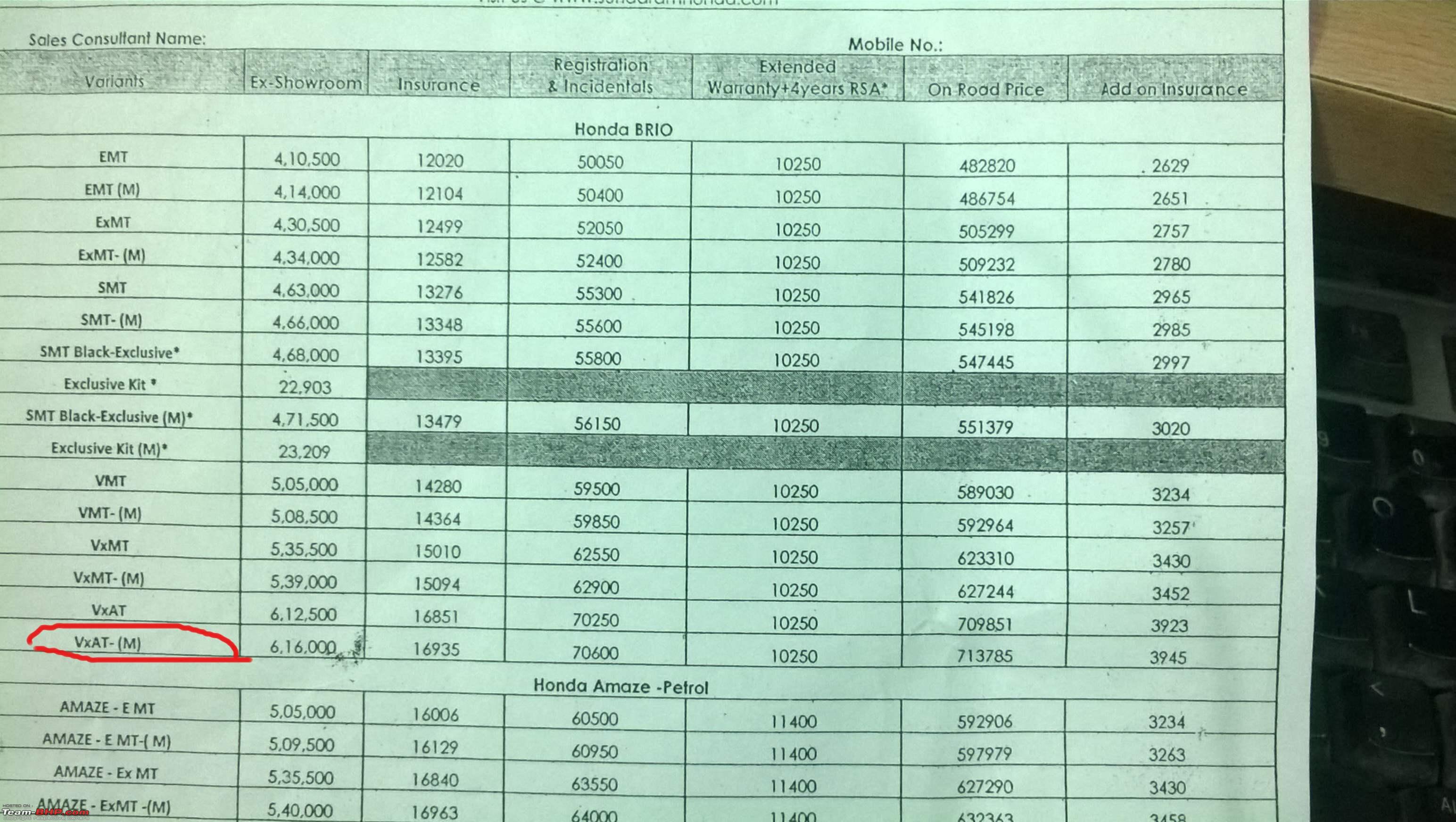

Depreciation basically is a decrease in the value of an object with time. A zero dep policy would cost you additional premium compared to a comprehensive policy although the benefits justify the additional cost. As compared to a regular car insurance policy zero depreciation car insurance will be slightly more expensive in terms of premium.