Zero Depreciation Car Insurance India

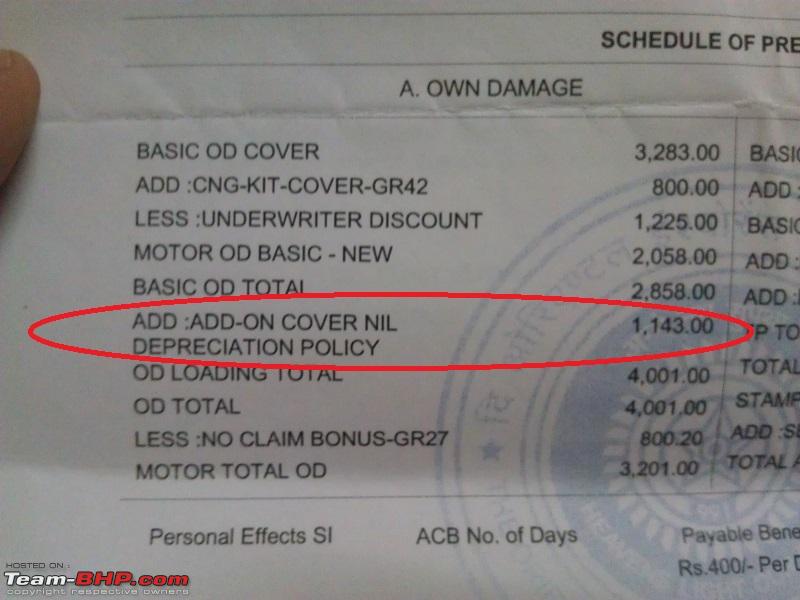

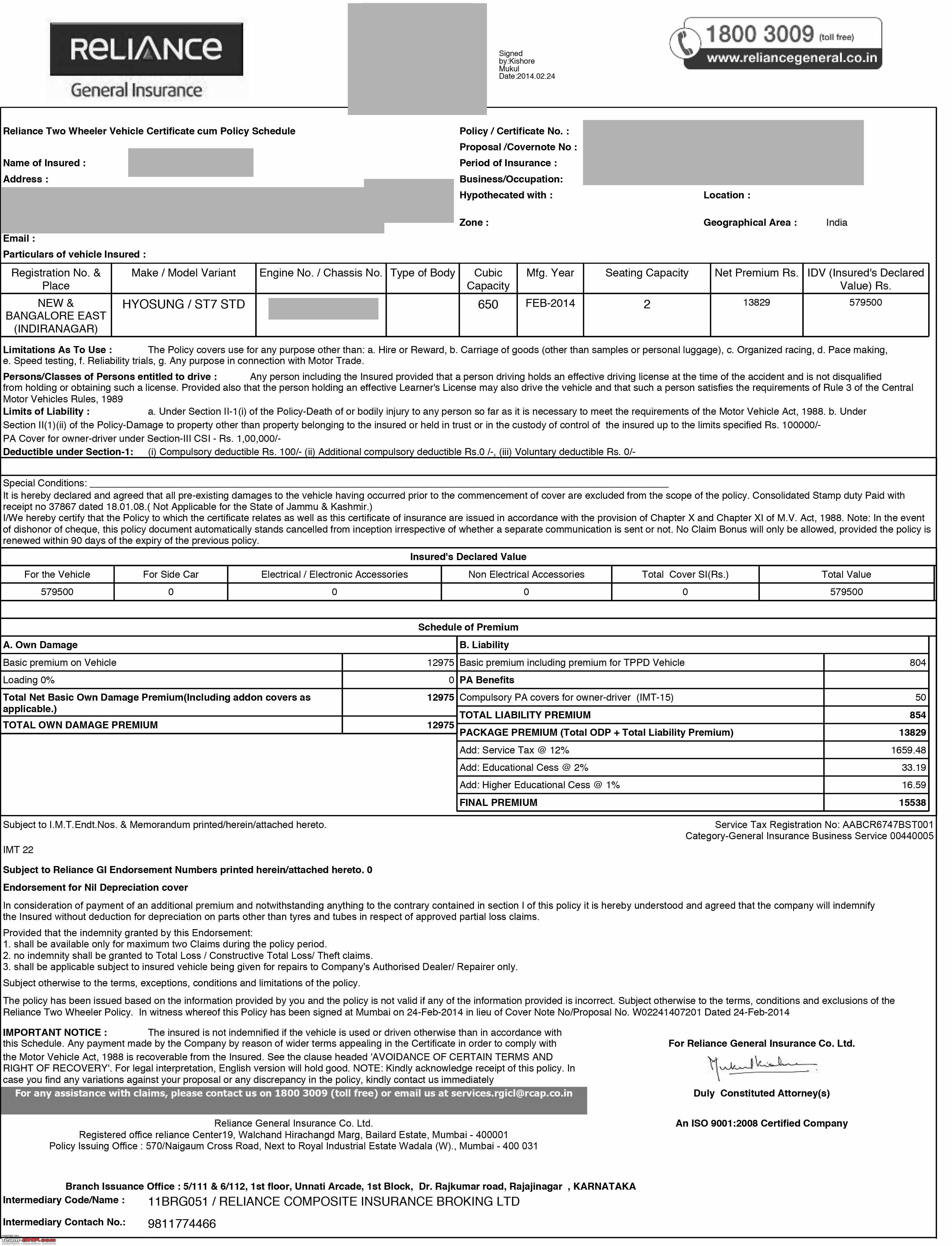

A zero depreciation add on cover also known as nil depreciation and bumper to bumper cover is a popular car insurance add on cover which is most commonly opted by car owners along with their comprehensive car insurance policy.

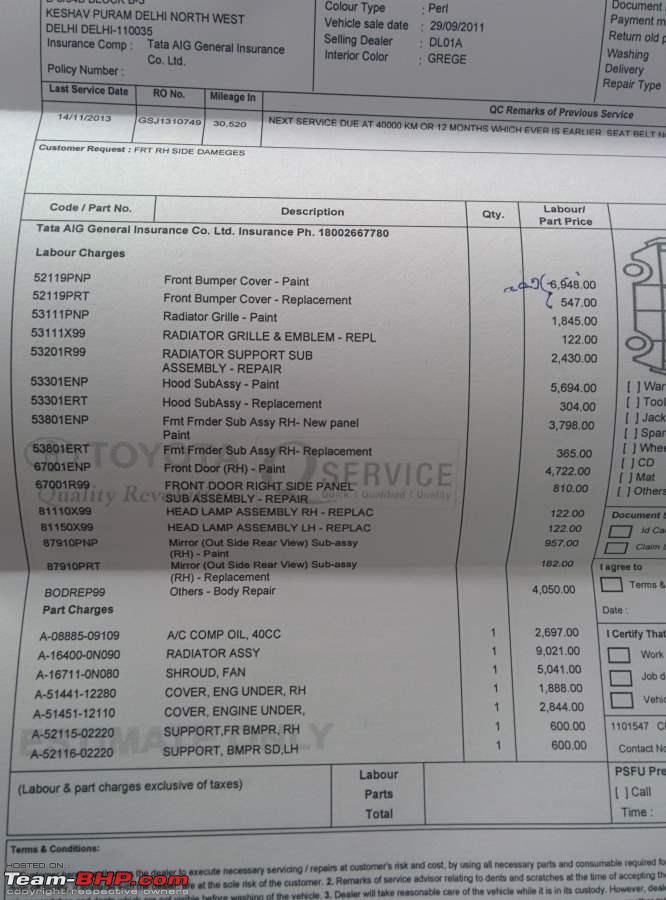

Zero depreciation car insurance india - Bumper to bumper policy buy zero depreciation car insurance online in india. The depreciation value of the replaced or damaged parts is usually deducted at the time of claim but with zero dep policy one can claim the full amount. Hdfc ergo motor insurance.

With zero depreciation add on when you file an insurance claim due to damage loss to your car the insurer covers the entire cost without accounting for counting in the vehicle s depreciation. 4 zero depreciation car insurance add on is strongly recommended for the luxurious car owners or the people who are based in high accident risk locations. In a zero depreciation policy the insured gets the total cost of the damage or loss that is caused to the insured car.

Learn why zero dept is better than the normal cover. Car insurance companies offer you few add on covers when you purchase car insurance one of the covers is zero depreciation. 5 claims can be made in certain specific cases to the limited number of claims for minor issues concerning slight bumps or dents in the car.

Here are the top car insurance companies in india that offer the zero depreciation benefit as an add on. Many of us are not aware of the benefits and the meaning of this cover insurance buyers usually say no to add on covers as we think it is simply a tactic for the salesperson to increase our bill amount. Zero deprecation is an attractive prospect for customers who want a smooth claim settlement in the future along with peace of mind.

New india assurance ltd. Majority of insurers including icici lombard do not offer zero dep cover for cars above 5 years of age. Zero depreciation car insurance.

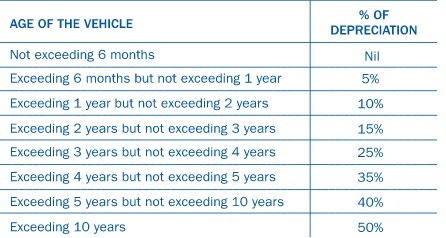

Chola ms zero dep insurance offers theft of your car damage to your car due to natural calamities damage to your car due to an accident or fire and many more. Zero depreciation car insurance cover promises full settlement coverage for your new car. Age of the car.

Tata aig auto insurance. The reason for insurance companies not renewing a similar policy beyond five years is that the depreciation of the vehicle is fairly low in its initial years. Zero depreciation car insurance is only applicable to new cars but some of the insurers offer zero dept car insurance for cars more than 3 to 5 years.

Check out our zero depreciation car insurance today. Factors affecting zero depreciation. It shifts the liability of bearing the depreciation of your car and its parts from you to the insurance company.