Annual Deductible Health Insurance

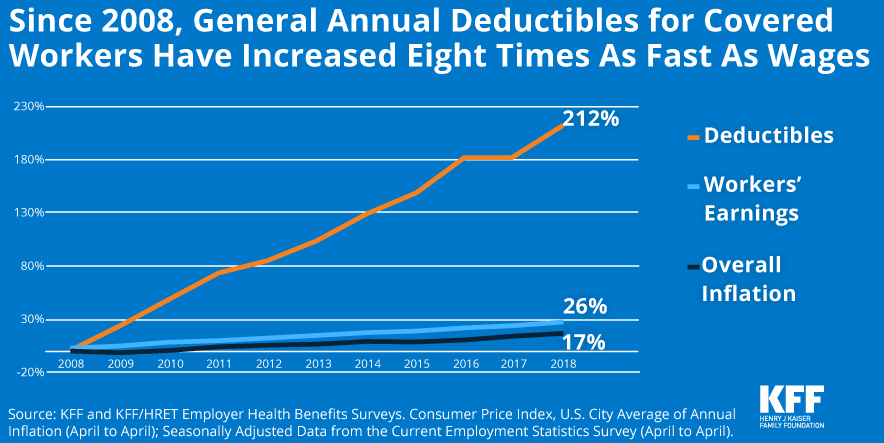

Your annual deductible can vary significantly from one health insurance plan to another.

Annual deductible health insurance - Now suppose the same patient has a 2 000 annual deductible before insurance starts to pay and 20 coinsurance after that. Stated otherwise a deductible will. So if your annual deductible is 500 you would have to spend 501 in the doctor s office before you could file a claim.

In march he sprains his ankle playing basketball and treatment costs 300. It represents the amount you have to spend before your insurance policy kicks in. A deductible is a specific dollar amount your health insurance plan may require you to pay out of pocket toward covered medical care each year before your health plan begins to pay for covered medical expenses.

All marketplace plans cover preventive care. High deductible health plans carry higher deductibles but they can offer access to health. Unlike auto renters or homeowners insurance where you don t get services until you pay your deductible many health insurance plans provide some benefits before you meet the deductible.

Screenings immunizations and. With a 2 000 deductible for example you pay the first 2 000 of covered services yourself. A deductible is the amount that you re responsible for before your insurance coverage applies.

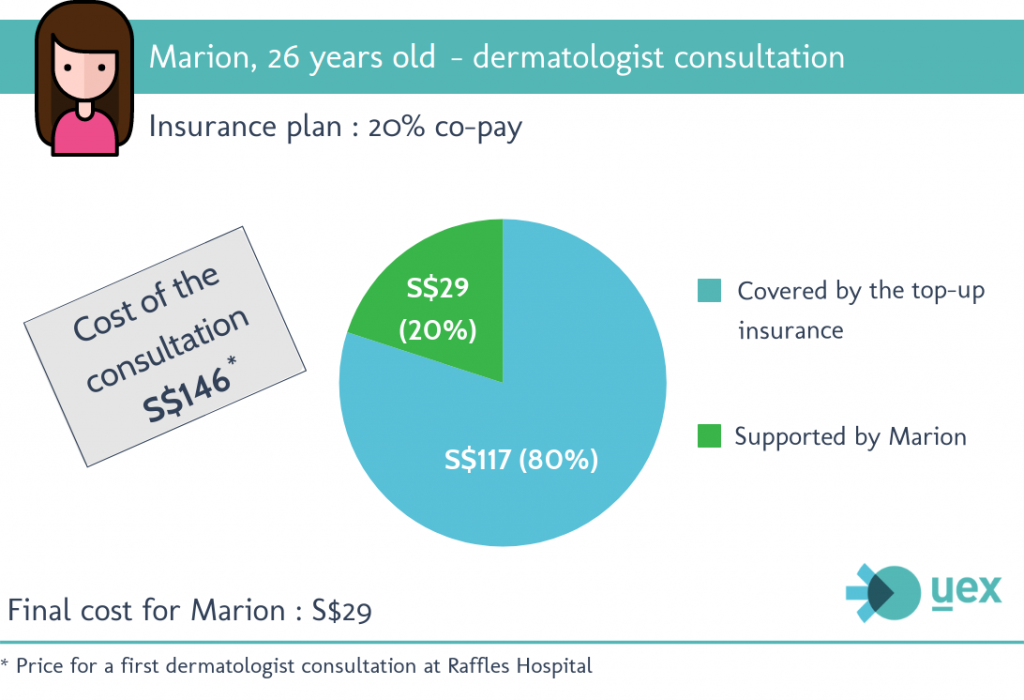

By including an annual deductible in your health insurance the price of your top up will drastically shrink. The amount you pay for covered health care services before your insurance plan starts to pay. If your health insurance requires a per episode deductible as well as an annual deductible money you pay toward the per episode deductible might not count toward your annual deductible.

The annual deductible is a popular concept with health and certain other types of insurance. Your insurance company pays the rest. A health insurance deductible is different from other types of deductibles.

However if in the same year marion returns to the hospital her health insurance will cover entirely all the expenses. After you pay your deductible you usually pay only a copayment or coinsurance for covered services. Co pay is an option that is also used in some insurance contracts for some coverages.

Your health insurance deductible is the amount you pay before your insurance plan s benefits begin. If you have separate deductibles for in network care and out of network care the amount you ve already paid toward your in network deductible doesn t.