Auto Insurance Binder

How an insurance binder works.

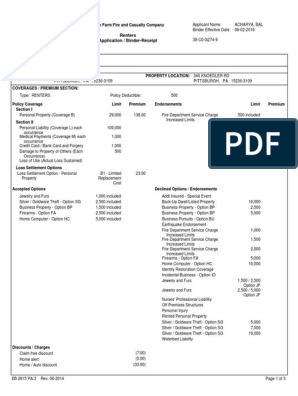

Auto insurance binder - At its simplest definition a car insurance binder is temporary car insurance. Commercial property insurance binder. An insurance binder is a one page legal contract issued by an insurance agent or company that confirms the issuer s commitment to provide insurance to the named insured.

For a car policy you should see a description of coverages such as liability collision or comprehensive coverage with the associated deductibles. Buy a house and take out a mortgage. Automobile insurance binder issued by.

Buy a new car or apply for an auto loan. What is a car insurance binder. A car insurance binder serves as a temporary form of insurance as your policy is being processed.

Liability personal injury protection and collision and comprehensive coverage. You re legally required to have proof of insurance in order to drive so you can use your binder if you are pulled. For example say the owner of a landscaping business recently acquired a truck and has insured the vehicle under a new business auto policy the policy hasn t been issued yet so the owner needs a binder to register the truck with the state s motor vehicle department.

Thanks to online quoting systems and the companies that pioneered them ahem getting an auto policy is almost instantaneous. Details your vehicle s make model and vehicle identification number vin. An auto insurance binder typically details some of the following things regarding your policy.

More about binders here. While your policy will contain all the details of your insurance your binder will provide an overview of the important points. Many insurers can quickly vet your info via online databases.

An auto insurance binder letter is temporary proof of insurance that allows you to drive legally during the 30 60 days the insurer legally has to complete the underwriting process. It serves as temporary proof of insurance or binding coverage until the full insurance policy is officially issued. A car insurance binder is often used to prove that you have obtained insurance on your car and may be a requirement of a car dealership lease or finance company when purchasing a new car.

And your insurance id card can be emailed to you on the spot. A binder will act as your insurance until the underwriting process is through and your car insurance company issues you your actual policy. Liability dwelling contents and medical payments coverage.