Car Insurance Cost In Canada

This is the highest average car insurance rate among all provinces in canada.

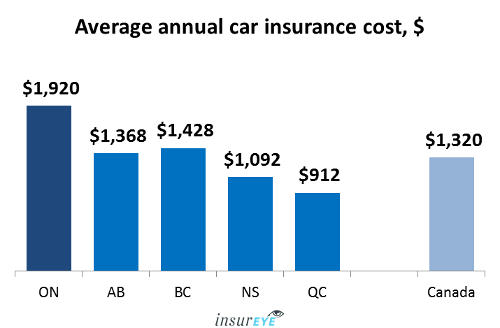

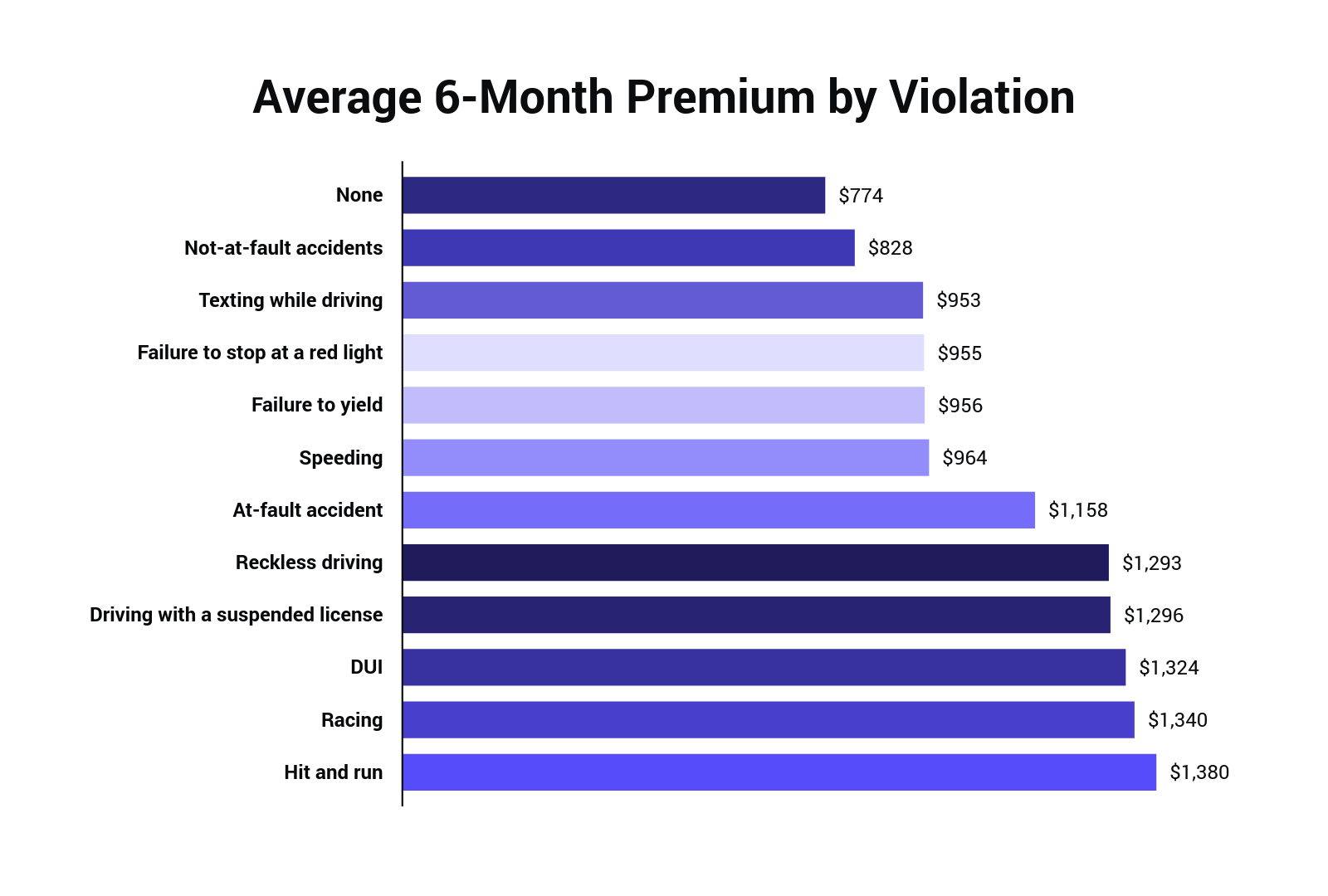

Car insurance cost in canada - In canada the auto insurance generates the highest value of net premiums among insurance sectors and accounts for more than 40 percent of the market share of the country s insurance industry. According to ibc the reason why british columbians pay for auto insurance than other drivers across the country is because of lack of competition. Car insurance rates vary across canada thanks to a multitude of factors.

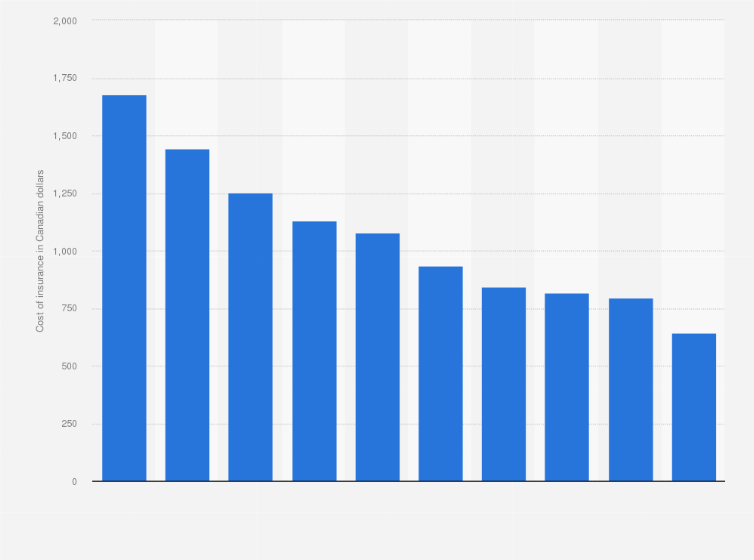

The average annual car insurance premium in british columbia is 1 680 nearly 14 higher than the next name on the list ontario 1 445. Generally private insurance coverage has proven to be the. Car insurance prices vary depending on whether the province has a private or public insurance program.

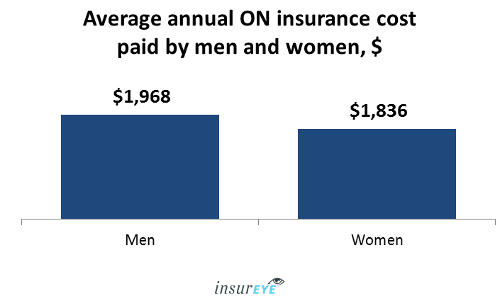

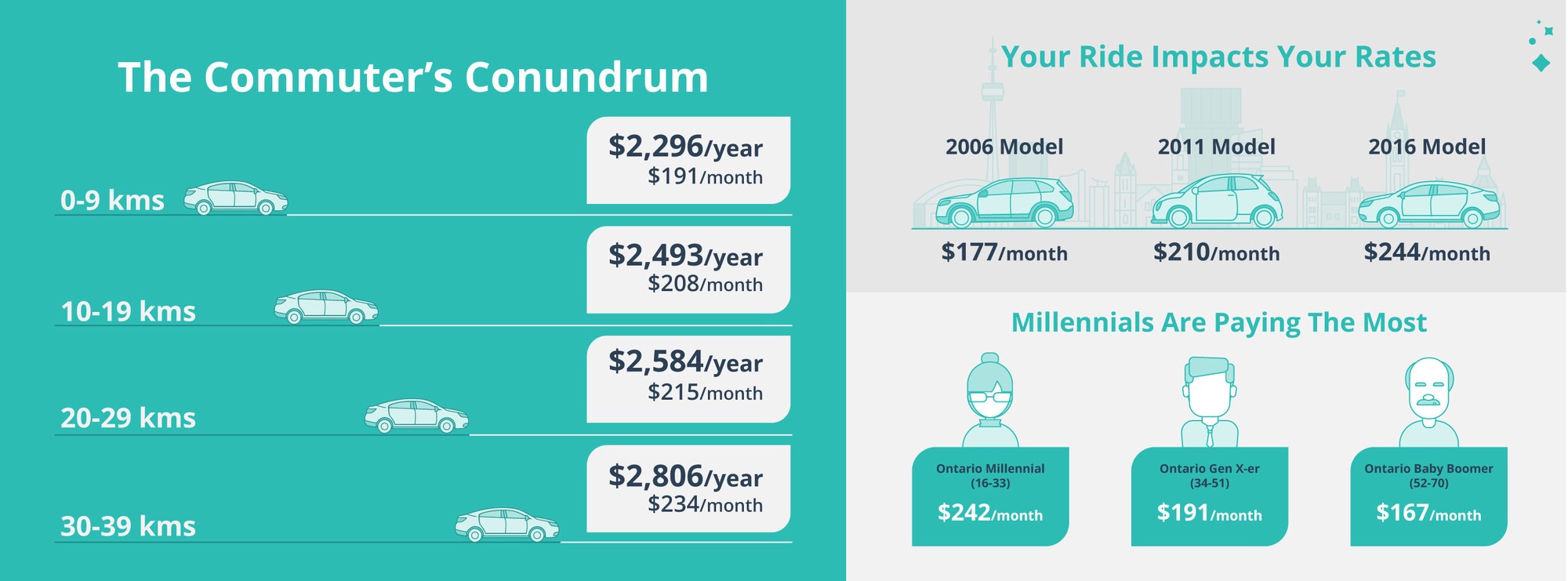

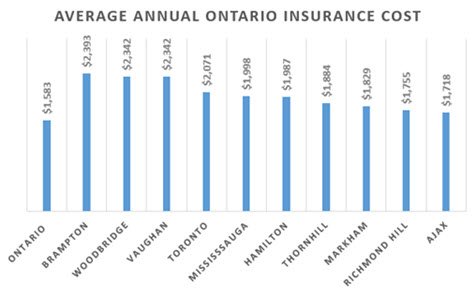

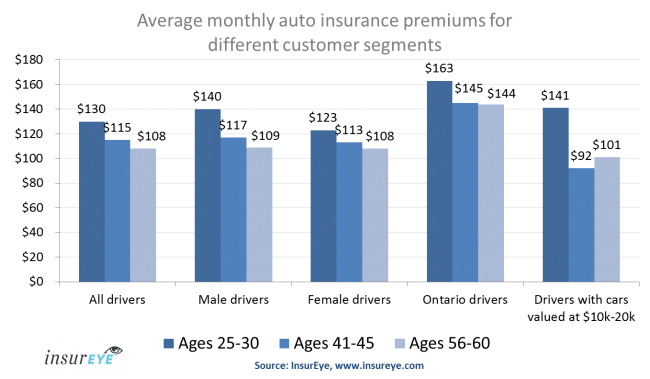

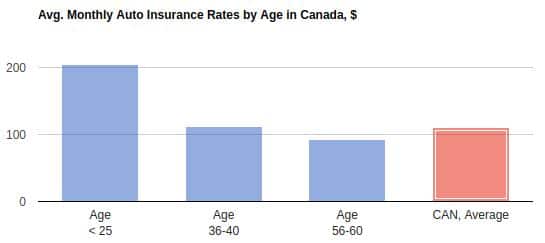

The average monthly car insurance rates in ontario are between 125 to 158 depending on which part of the province you live in. This answer depends on a range of factors like your location driving history age the car being driven and much much more. In short the answer is not well according to a recent report british colombians are paying the highest premiums in canada.

The truth is that the cost to insure a car in canada will be similar to u s. Car insurance rates are set to increase by up to 22 in 2020. A luxurious car would normally attract higher rates due to the theft risk involved and the cost of replacement.

Under icbc s monopoly british columbians will again pay the highest auto insurance prices in canada with premiums now averaging 1 832 annually. When shopping for a car check the insurance rating for the car you re thinking of buying. Insurance bureau of canada s consumer information centre.

While the average car insurance rate in ontario is 2 638 you should check out the average rates by city to get a better idea of what you can expect to pay in your area. You can get rating information from. If you are ready to start getting online car insurance quotes for usa car insurance that may apply to canadian car.

Cars with better ratings are cheaper to insure. If your canadian car insurance costs are expensive than shopping around and comparing rates will help you save on car insurance. How bc auto insurance prices compare to other provinces.

Saskatchewan british columbia and manitoba rely on insurance coverage run by the province. Insurance companies assign ratings based on the claims made on different makes and models. However monthly averages can be a deceptive number because rates can vary significantly from city to city and from driver to driver.

What is a good car insurance price. The other areas in canada have. On average nova scotia drivers can expect to pay around 891 per year for car insurance up from 735 annually just five years ago.