Car Insurance Deductible Vs Premium

How do deductibles affect car insurance rates.

Car insurance deductible vs premium - If you already have an insurance policy and you have a conflict related to premiums deductibles or any other insurance issue you may want to seek legal counsel. The pros and cons of a low car insurance deductible. Reduction on average premium by state by raising deductible.

If your deductible is 2 000 and the cost to repair the damage is 2 100 you ll pay 2 000 and your insurance company will cover the remaining 100 side note. This is because of the nature of car insurance deductibles they represent your insurance company s portion of responsibility for a claim. Insurance deductibles are the amount of money you pay out of pocket toward a covered claim.

Later a fire causes 10 000 of damage to your home. In other words a high deductible costs less up front but you pay a bigger portion of every claim. You do pay an extra insurance premium to get the reduction in deductible.

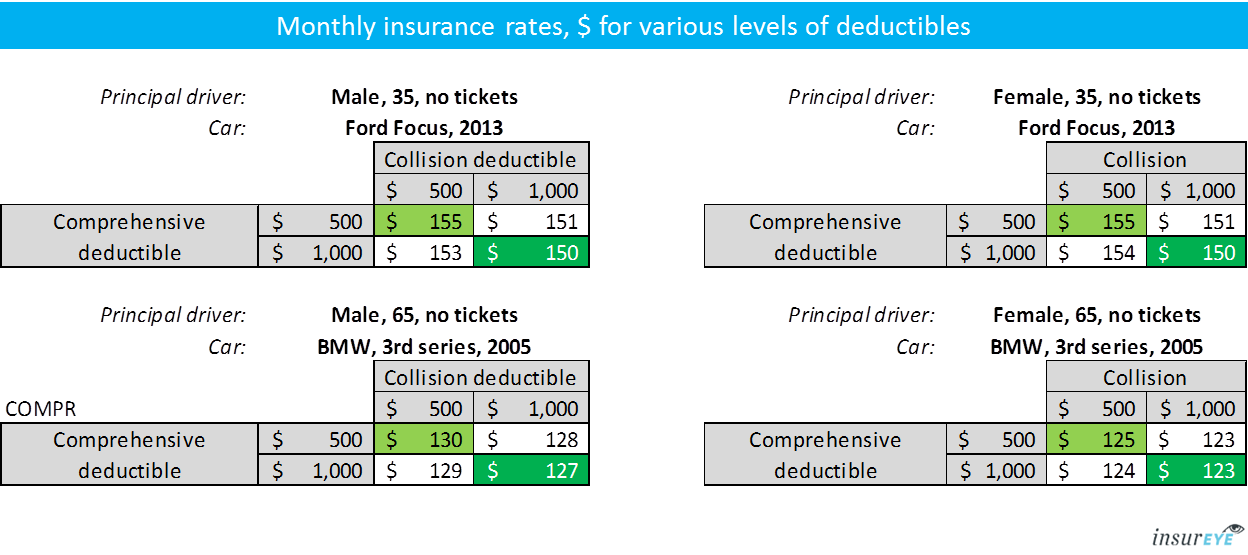

If your finances would be seriously rocked by an unexpected 500 or 1 000 expense play it safe and opt for a low deductible such as 250. Basically if paying a deductible would cripple you financially the vanishing deductible could be helpful. The lower your deductible is the more you pay upfront in premiums.

Vanishing deductibles are becoming a popular option but whether it is a good option varies with who you ask. Deductible vs premium an insurance policy is a contract that is signed between two parties. Suppose you purchase a homeowner s policy with a 500 deductible.

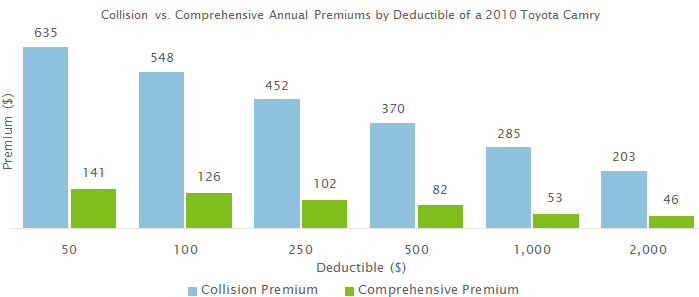

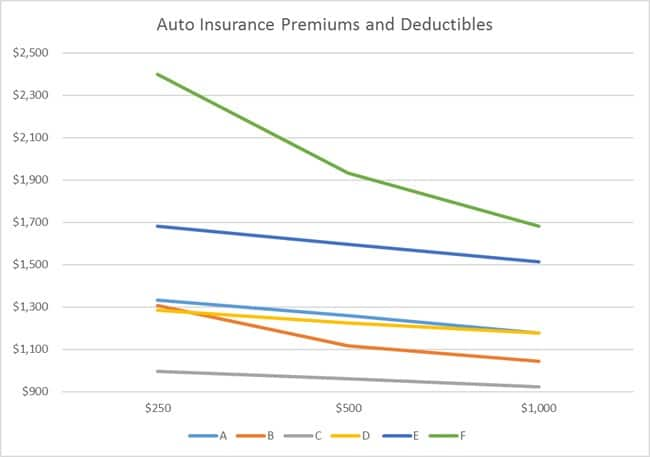

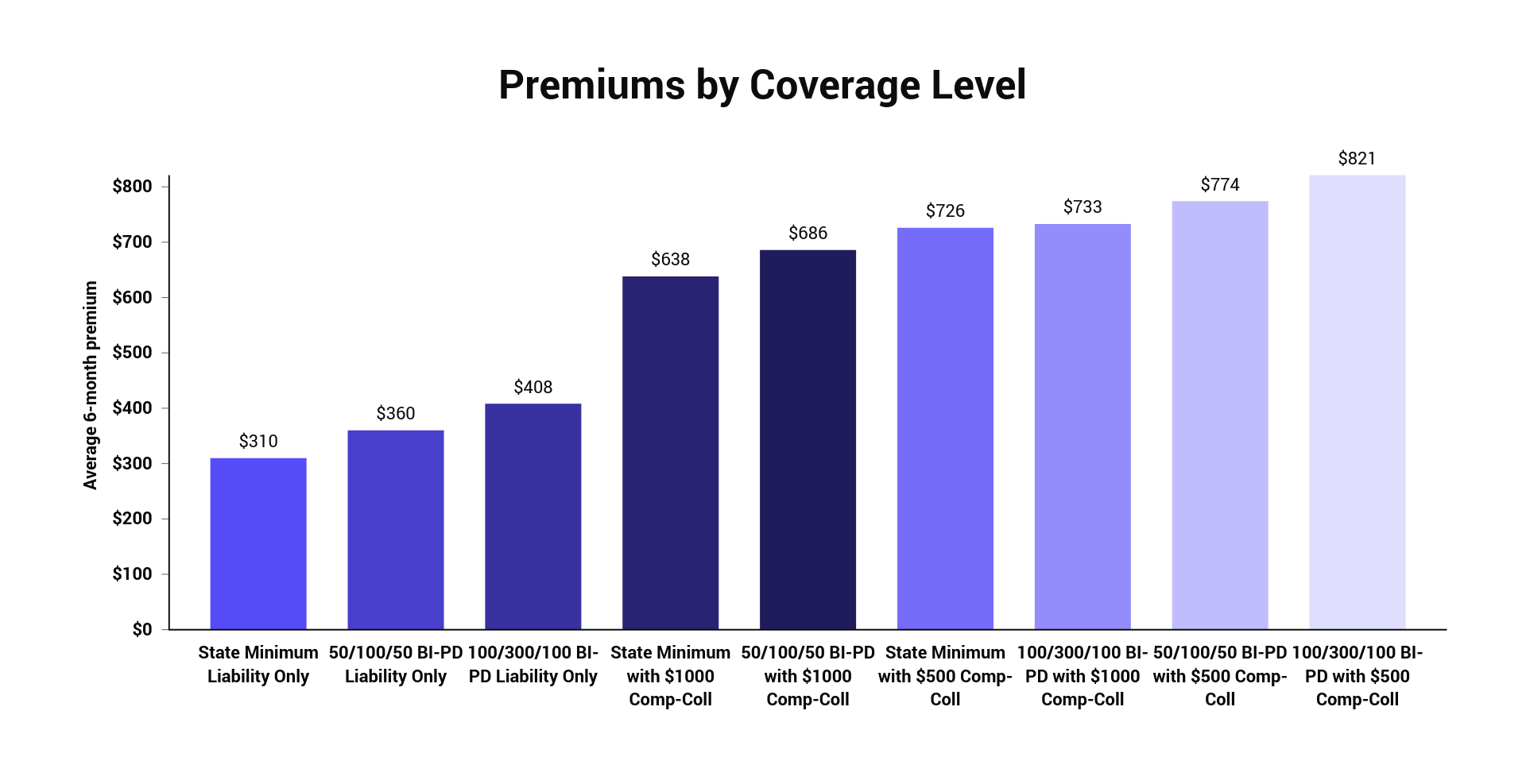

Below are the average rates in each state for three deductible levels. Insurance policies are taken out by businesses and individuals to help guard against large financial losses. There are many issues to consider when shopping for insurance.

Having a low car insurance deductible gives you peace of mind especially if you re on a tight budget. Most insurance policies have a deductible. Get legal help with premiums deductibles and other insurance issues.

The greater the risk the higher your premium. A car insurance policy with a 500 deductible could have a 1 500 annual premium for example while a policy with a 1 000 deductible might charge 1 337. For example suppose you select a 500 deductible when you purchase dwelling coverage on your home insurance policy.

The insurer and insured in which the insured will pay a fee to the insurer who will in return promise to pay for any loss covered in the insurance policy. When you submit an insurance claim the deductible is the amount you must pay out of your own pocket before your insurance company kicks in to help.