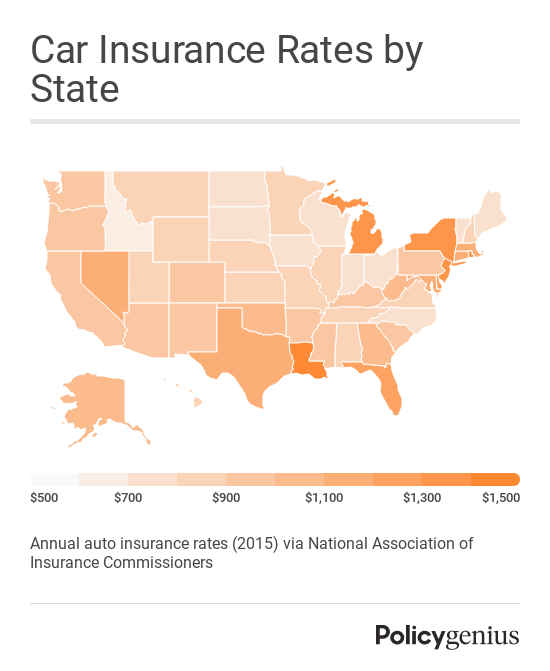

Car Insurance Rates By State

State required insurance minimums can also raise or lower insurance costs.

Car insurance rates by state - As an example michigan uses a unique no fault insurance system that in many ways is responsible for its high premiums. The rates shown here are for comparative purposes only and should not be considered average rates available by individual insurers. Average car insurance rates by state may vary based on legal regulations and insurance companies efforts to price accurately based on these differences.

Your state s car insurance minimum requirements and laws will have a major affect on your rates. States set car insurance regulations and minimum insurance requirements which can have a major impact on the rates paid by residents. Call us toll free.

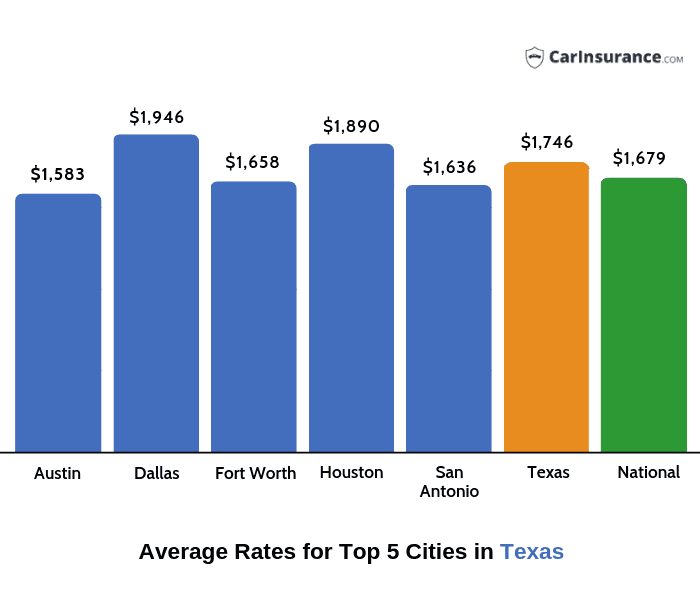

Because car insurance rates are based on individual factors your car insurance rates will differ from the rates shown here. For instance drivers in no fault states such as michigan and florida often pay more for insurance than do drivers in. State car insurance rates change dramatically by state and between cities.

Prior approval of auto insurance rates and. The minimum coverage limits for policies issued or renewed after july 1. State car insurance rates id has the cheapest car insurance rates at 56 66 mo or 680 yr.

La has the most expensive car insurance rates at 117 08 mo or 1 405 yr. See car insurance rates by zip code plus state laws.