Cash Value Life Insurance Policy

You can do this by notifying your life insurance carrier that you would like to take money out of your policy.

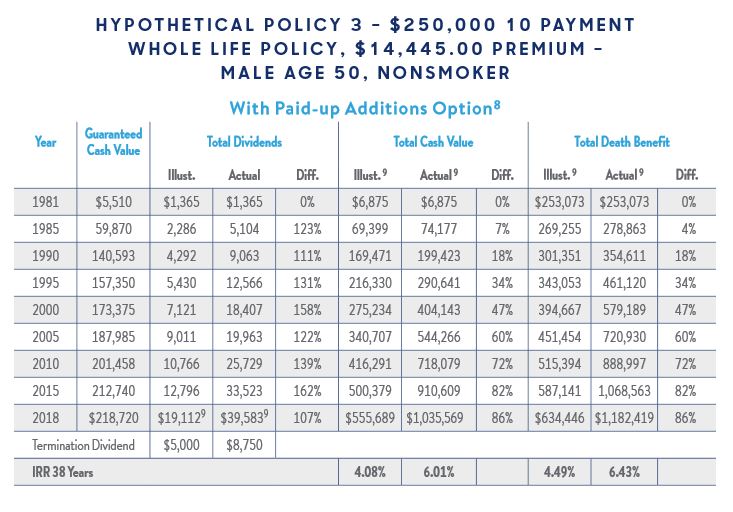

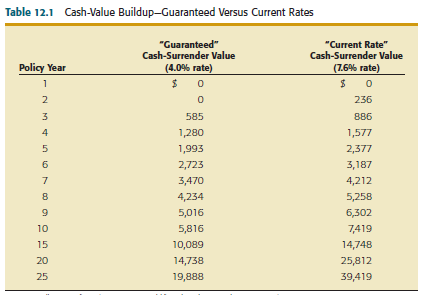

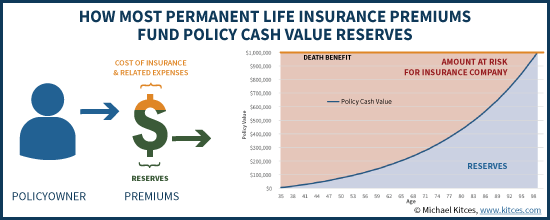

Cash value life insurance policy - Cash value is the portion of your policy that earns interest and may be available for you to withdraw or borrow against in case of an emergency. The gross amount of collections expected to be obtained through the liquidation of assets in an asset pool. 1 the following types of permanent life insurance policies may include a cash value feature.

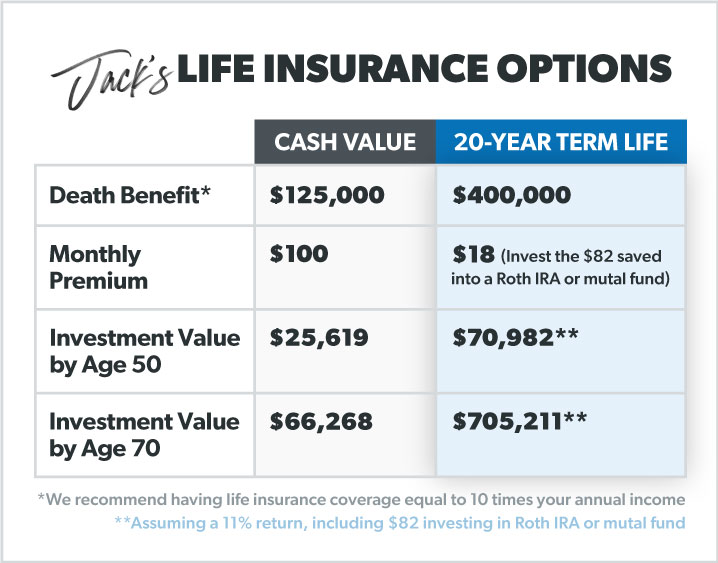

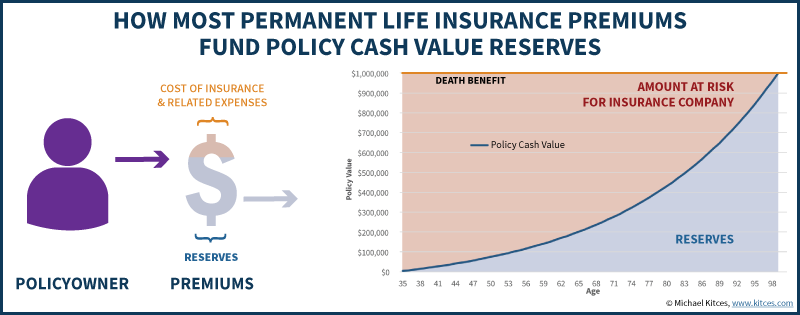

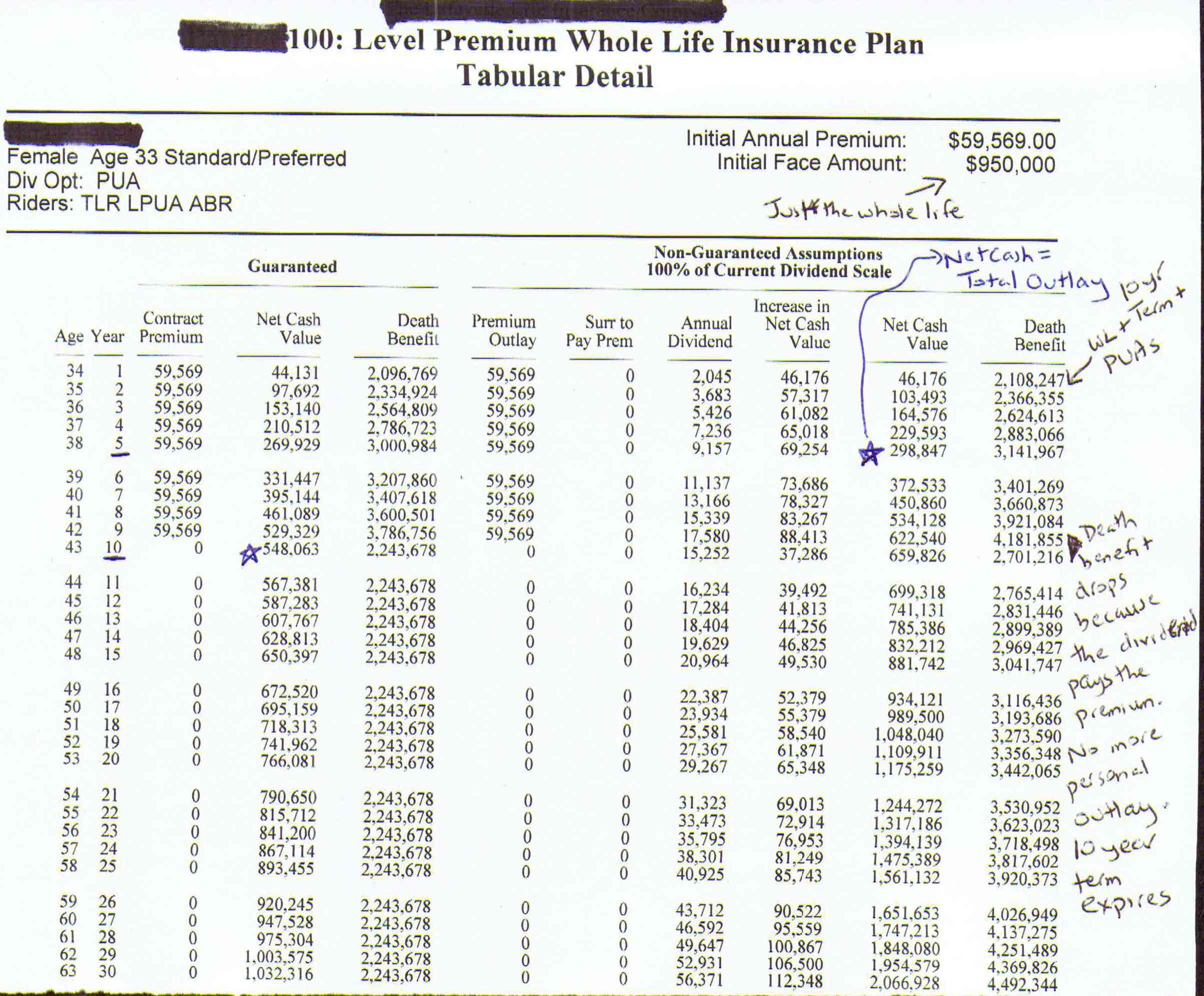

The premiums can be much higher than the same amount of term life insurance because of the cash value feature and policy fees. With indexed universal life the cash value growth is tied to a stock index such as the standard poor s 500. A whole life insurance policy guarantees a fixed rate of return on the cash value.

The yearly price of protection method is used to find out the cost of. So you re paying for two things here the life insurance part the bit that covers your family if you die and the cash value part the savings account that supposedly grows your money. A cash value insurance policy could be a good option for high income.

It s still a life insurance policy but it comes with a perk. A variable universal life insurance policy works very similarly to a universal life insurance policy except the cash value or account value is allocated to separate accounts within the life insurance policy which are essentially mutual funds. Cash value life insurance is a type of permanent life insurance that includes an investment feature.

A savings account that grows over time. A method used in actuarial analysis which is often used in the insurance industry. Cash value life insurance is a type of life insurance policy that s in place for your whole life and comes with a sort of savings account built into it.

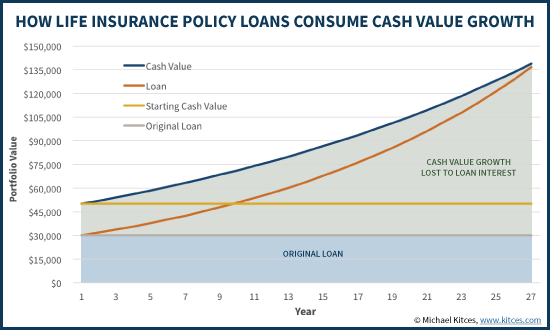

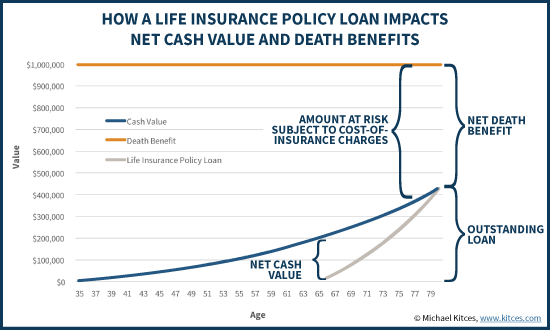

Click here to learn more about borrowing money from a life insurance policy without canceling the life insurance portion of the policy. The initial targeted cash value or itcv is used in the. The most direct way to access the cash value in your policy is to make a withdrawal from it.

The cash value will then either grow or decline depending on the fund s performance. The value of cash you can get out of your life insurance policy at any given time for example if you decide to borrow money from a life insurance policy.