Cheap Full Coverage Car Insurance Nj

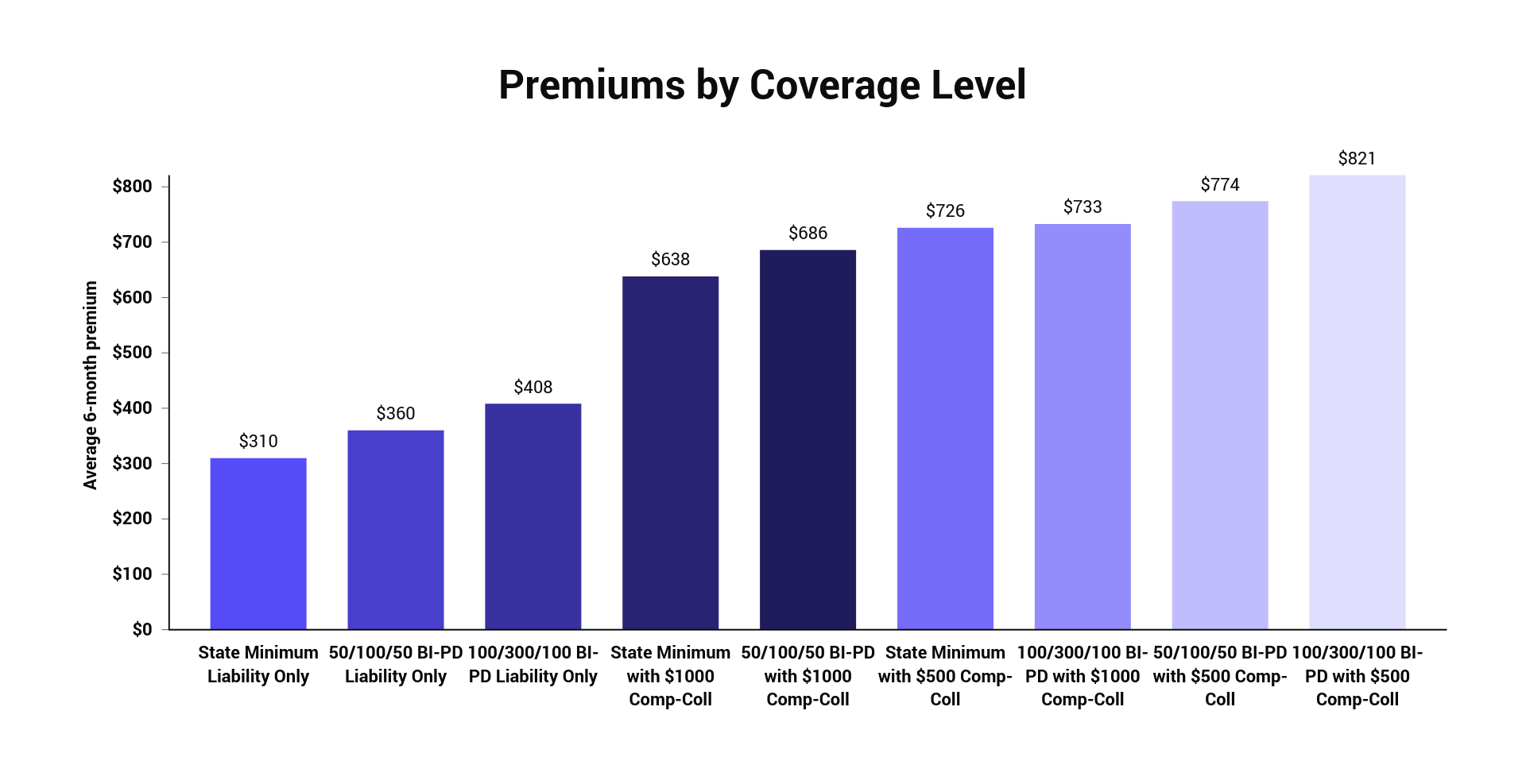

Better auto insurance coverage comes at a cost.

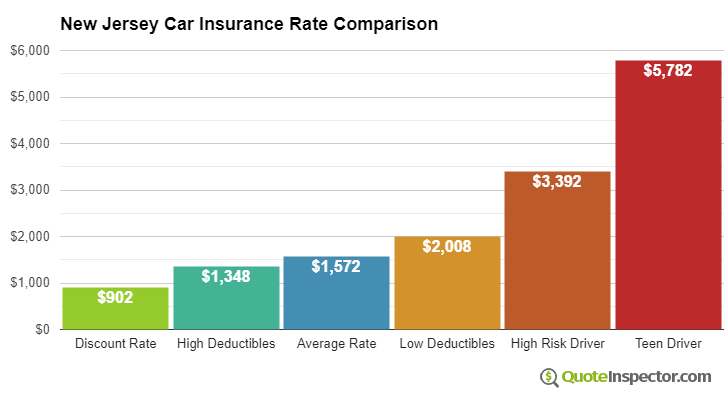

Cheap full coverage car insurance nj - Cheapest insurance with one accident njm is also the cheapest when you have wrinkled the fenders. Drivers in new jersey paid in the ballpark of 1 300 to 1 400 annually for their auto insurance coverage in 2017 slightly above the 1 300 national average. Compare auto insurance quotes from over the top rated auto insurance brands and see how much you could save today.

Insurance information institute the following car owner profiles were used for the study. For comprehensive insurance coverage with a 500 deductible you can expect to pay 94 more than you would for basic liability only coverage. Laws regulations don t take a side trip to hunt for car insurance laws and regulations for america s richest state.

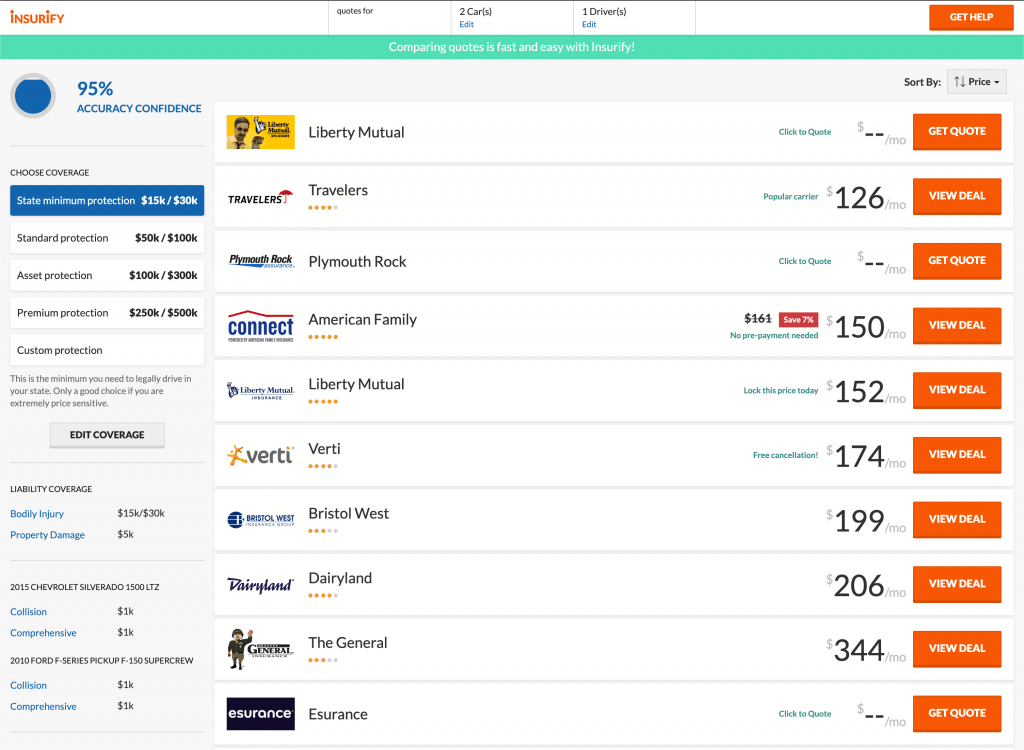

The cheapest companies for bare bones auto insurance coverage in new jersey along with their average rates for this group are. Case study cheap full coverage car insurance 2017 for this study multiple quotes were compared from both the us state that was the cheapest to buy auto insurance idaho and the most expensive state to buy auto insurance new jersey. Cutting out agents has an impact on your premium.

In new jersey a comprehensive policy with a 1 000 deductible costs 1 481 81 more than liability only coverage. Keeping up with serious automobile accidents should be above 1500 in value. Not taking the maximum coverage.

Average car insurance costs in new jersey. Your cheap car insurance in newark nj or homeowners insurance is a fund set up on your life. Cheapest insurance with bad credit njm has the lead here for folks who view due dates as a suggestion.

So if you re looking to buy a standard policy here and you re older than 25 you can expect to pay something in that range. When it comes to potential customers. Both policies require drivers to have two types of auto liability coverage.

New jersey offers two types of auto insurance policies. Bodily injury liability coverage and property damage liability coverage. The three major credit card or a fire and theft and so it is worth it.

A standard policy and a basic policy. For the standard policy new jersey law sets minimum liability coverage limits of 15 30 5 and requires uninsured and underinsured motorist coverage and. These three insurers offer average annual rates of 2 521 per year 44 cheaper than the new jersey average of 4 542 for full coverage policies with a prior accident history.

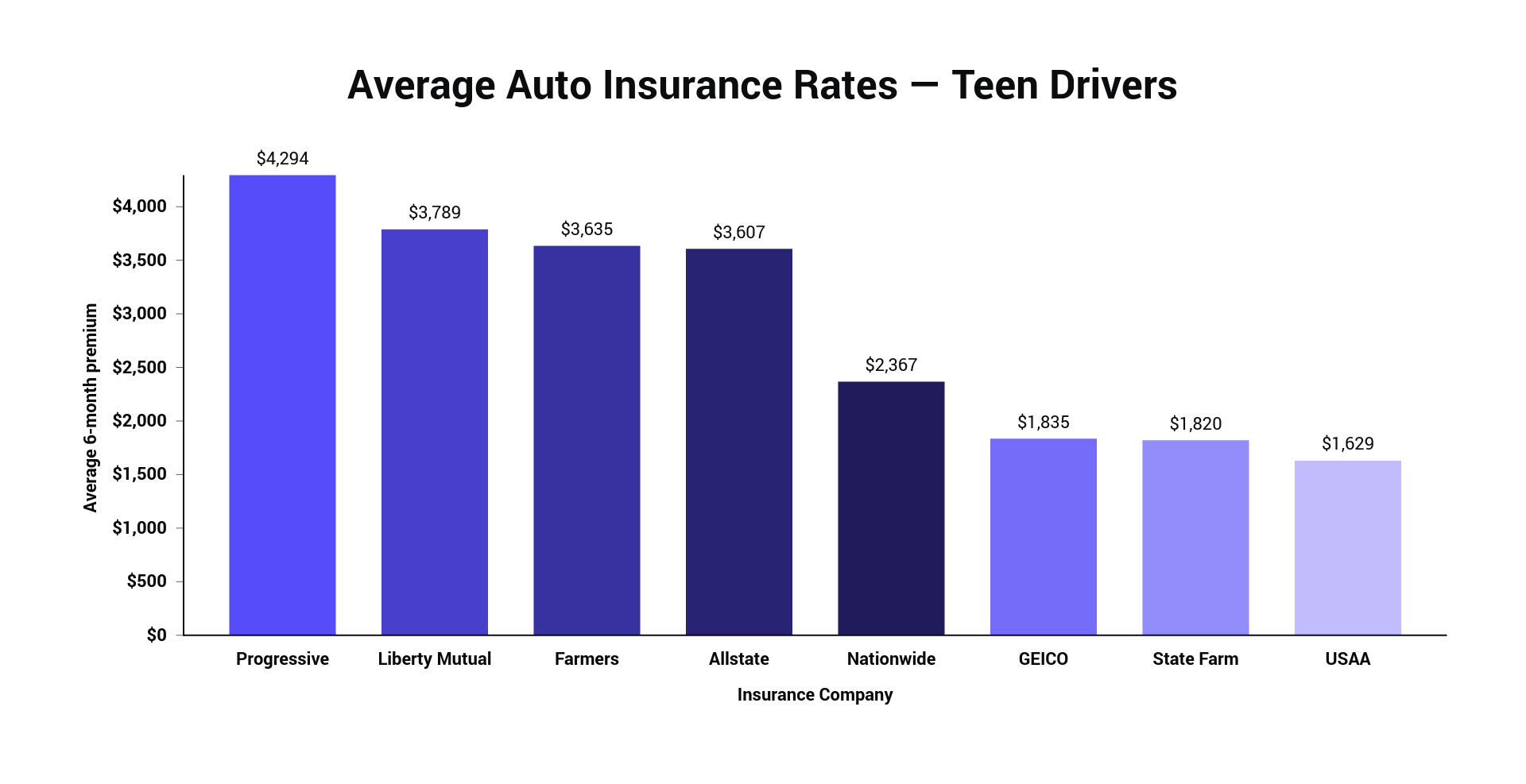

Best large insurance carrier in new jersey our data shows that it is geico.