Life Insurance Gift Tax

Life insurance payouts are made tax free to beneficiaries.

Life insurance gift tax - So i decided to answer that question and provide a guide to life insurance gifting to give you some tools to use in case you step over the state and federal estate tax threshold. A method of contributing to charity by taking out life insurance on yourself with the charity as a beneficiary. If you transfer a life insurance policy to a beneficiary tax authorities regard the transaction as a gift.

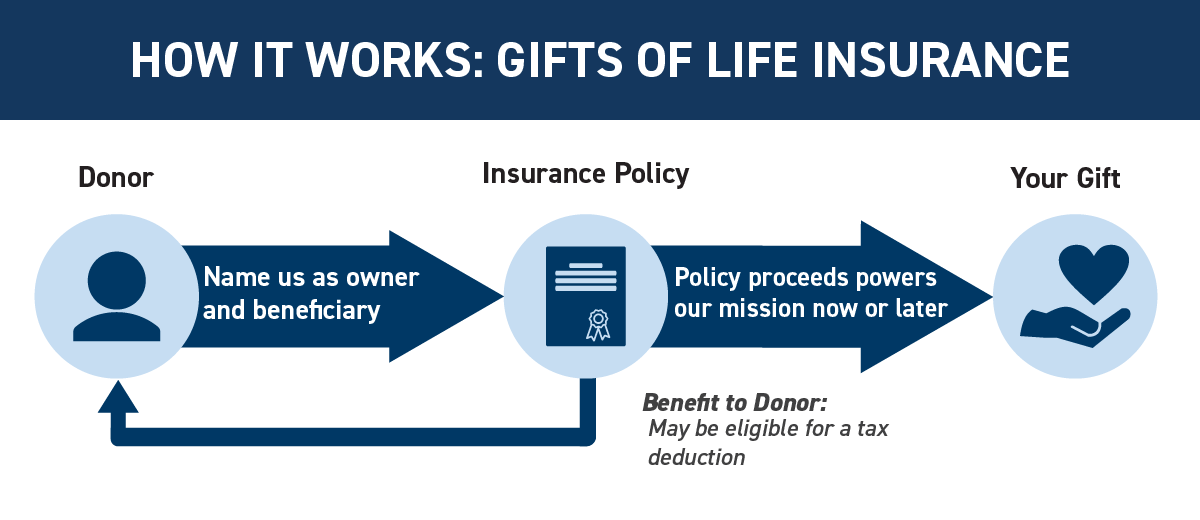

But there are times when money from a policy is taxable especially if you re accessing cash value in your own policy. Oftentimes the cost of the life insurance policy or the premium is larger than the exclusion resulting in an unwanted gift tax. Life insurance policies can also be used as effective help for charities since gifts of this nature with the purpose being beneficial to charitable organizations are exempted from gift taxes.

Under current gift tax rules if you transfer a policy with a present value of more than 15 000 to another person gift taxes will be assessed. Which ones you pick will depend on your financial situation. However you or your beneficiary might be subject to estate taxes inheritance taxes gift taxes or the generation skipping transfer tax.

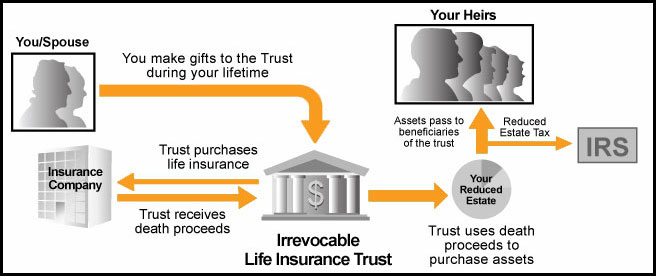

Making a gift of a life insurance policy can prove to be anything but simple for clients who may not know what questions to ask in order to ascertain the potential tax consequences of the transaction. The estate and gift tax benefits of premium financing are the most attractive components of this life insurance strategy. One of the top 10 questions that clients come to me with is.

Because a life insurance death benefit isn t considered taxable income for most people income tax usually doesn t apply. When this happens you have to get creative and somewhat complex. In this article we ve outlined a few strategies that may help you reduce or avoid a gift tax liability.

Charitable gift life insurance. Using charitable gift life insurance may allow. There are several methods within premium financing you might employ to avoid these taxes.

Is life insurance taxable. There s an assumption in the question that it s the recipient who would be responsible for the taxes on the gift. Here s how it works.

/irrevocable-life-insurance-trust-ilit-estate-planning-3505379_FINAL-6d6885e041c040bb89b0f30828fc2b05.png)