Compare Auto Insurance Quotes Massachusetts

In massachusetts a comprehensive insurance policy with a 1 000 deductible costs 983 61 more than basic liability only coverage.

Compare auto insurance quotes massachusetts - Compare those rates to the state averages for car insurance coverage. Find the best auto insurance in massachusetts. As in every other state it s a good idea and required to carry auto insurance if you.

Before you buy car insurance in massachusetts you should learn about minimum ma car insurance requirements and why more coverage may be a better choice for some drivers. Guide to massachusetts car insurance massachusetts car insurance liabilities. Massachusetts law sets minimum liability coverage limits of 20 40 5.

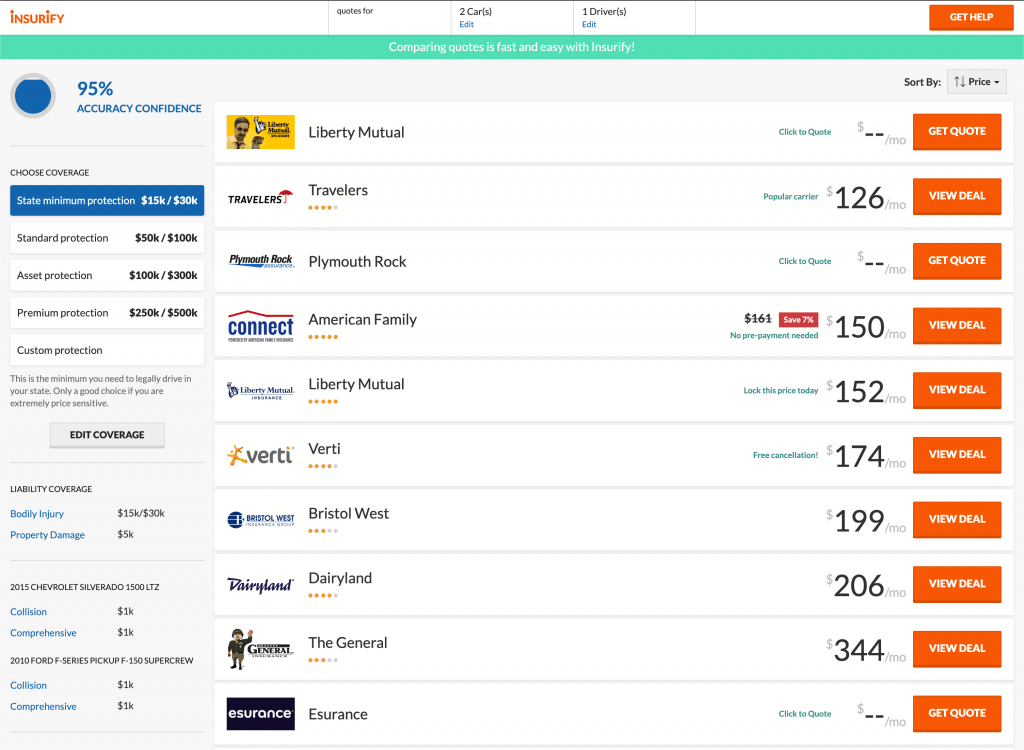

Ask for a personalized quote if you want to know which companies have the best price and value for your budget. Massachusetts also requires drivers to carry uninsured motorist coverage and personal injury protection. Bodily injury liability coverage and property damage liability coverage.

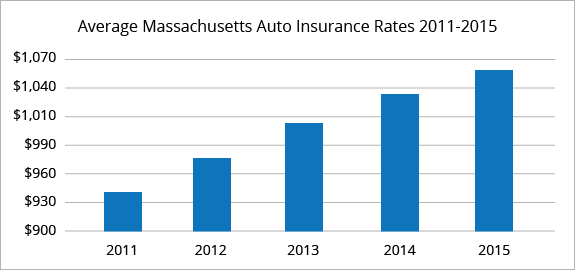

Massachusetts is one of 12 states in the country using a no fault car. Compare car insurance companies for free to get the cheapest insurance quotes and coverage. Massachusetts deregulated car insurance in 2008 going from a system where the state dictated rates to one where insurance companies set their own.

We provide average car insurance rates for your location so you can compare quotes and also outline massachusetts auto insurance laws. In 2018 massachusetts drivers were involved in more than 140 000 crashes 20 of which resulted in injury. As a result it is more important than ever to shop around and compare quotes.

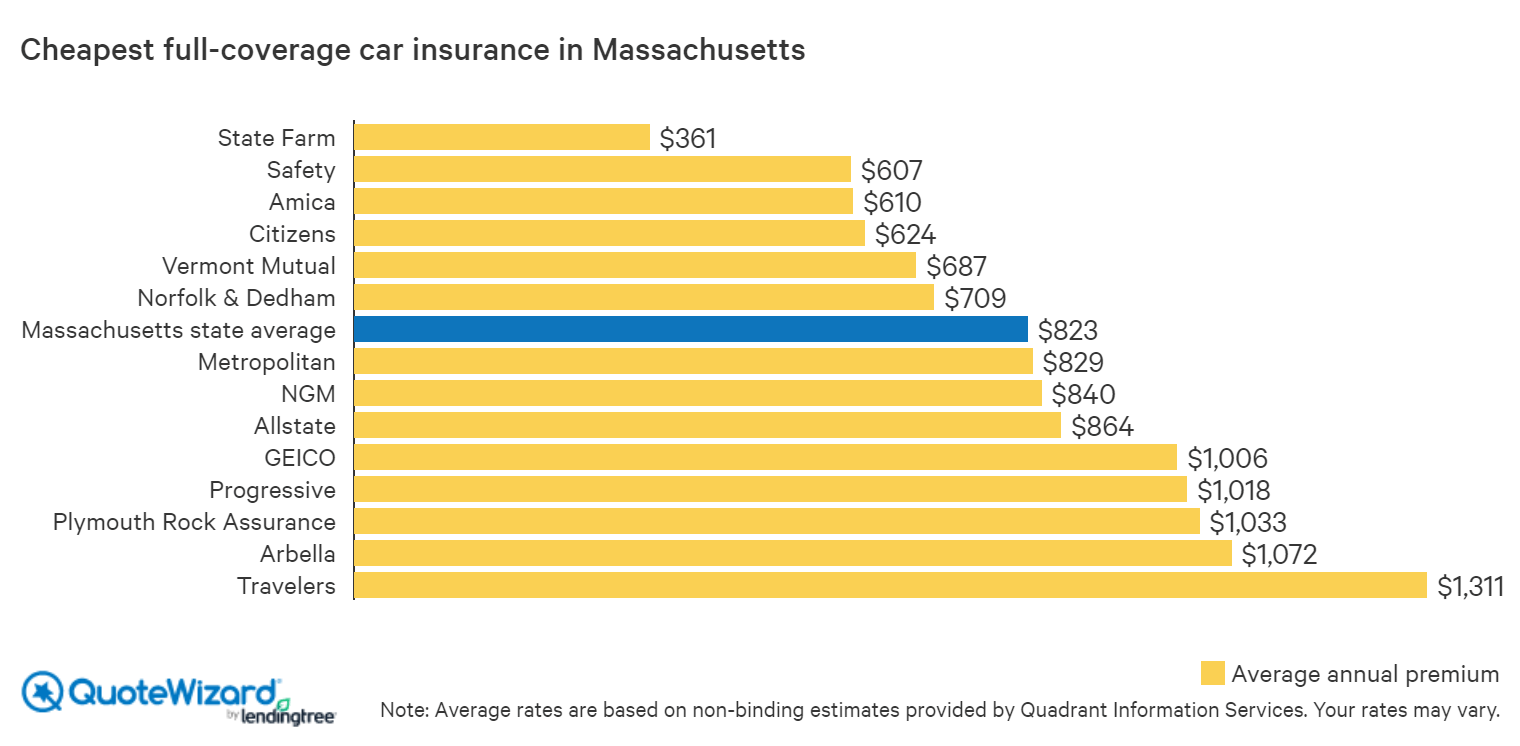

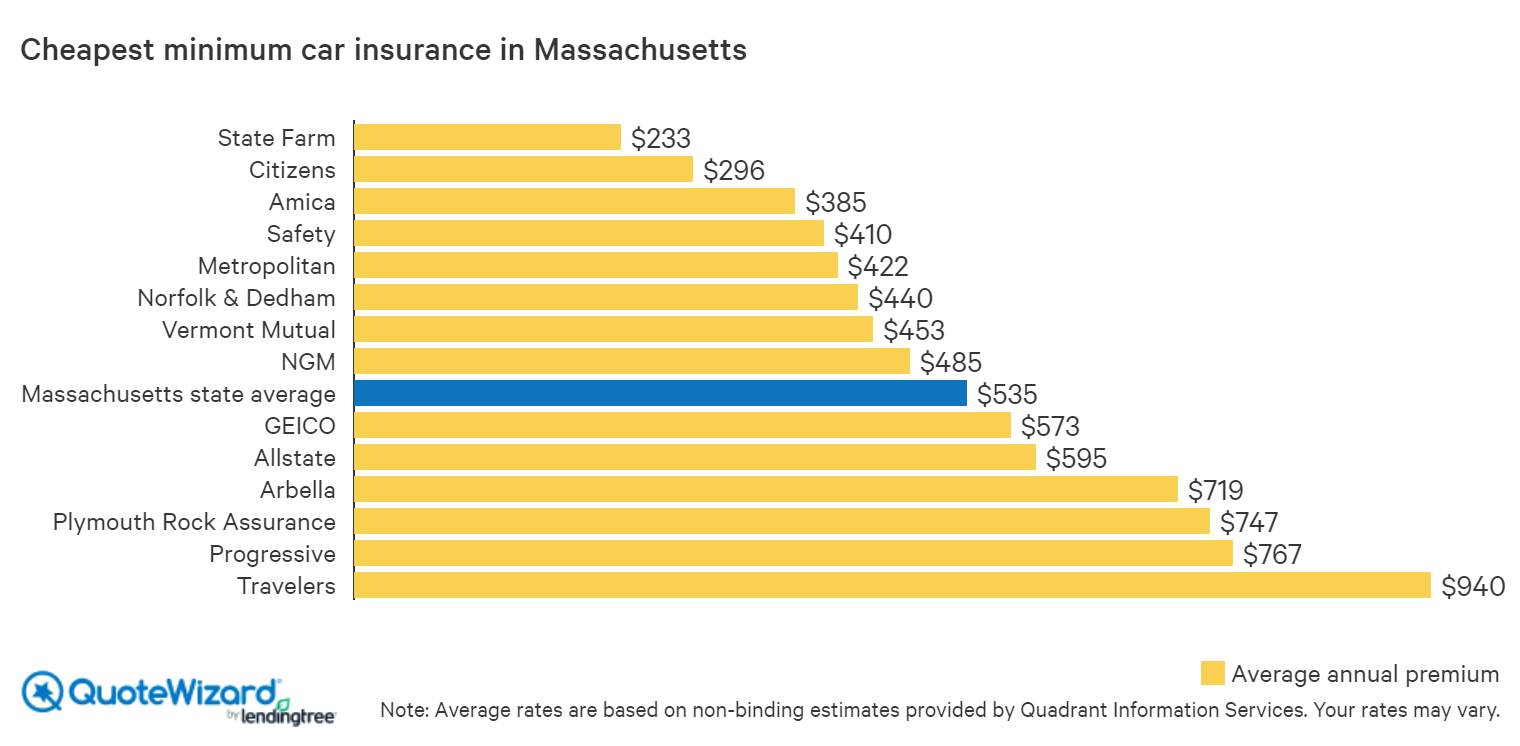

Our data shows a typical driver in massachusetts spends 535 annually on minimum coverage and 823 annually on full coverage. The tool produces examples of insurance premiums based on one of seven common profiles with varying levels of coverage levels and driving experience. It s worth noting that better car insurance comes with a price.

State farm isn t the only company that provides affordable car insurance in massachusetts. Compare premiums for private passenger automobile insurance across companies for seven policy examples in massachusetts. The premiums listed are.

For a comprehensive policy with a 500 deductible you can expect to pay 93 more than you would for a liability only policy. We used general profiles to determine car insurance premiums in massachusetts.