Different Types Of Health Insurance Deductibles

It is the amount over which the top up health insurance plan gets triggered.

Different types of health insurance deductibles - Compulsory deductibles an amount fixed by the insurance company that the insured has to pay in claim of a claim. The individual deductible and the family deductible. A catastrophic health plan has a deductible of 8 150 for an individual and 16 300 for a family in 2020.

But any claim amount less than the deductible amount will be paid under the top up policy. This is the cost you pay each month for insurance. While copay deductible and coinsurance are cost sharing terms their applicability can make a huge difference to your overall health insurance plan.

3 different types of health insurance deductibles. The in network ppo deductibles will be lower than the out of network non ppo deductible. Five major types of health insurance.

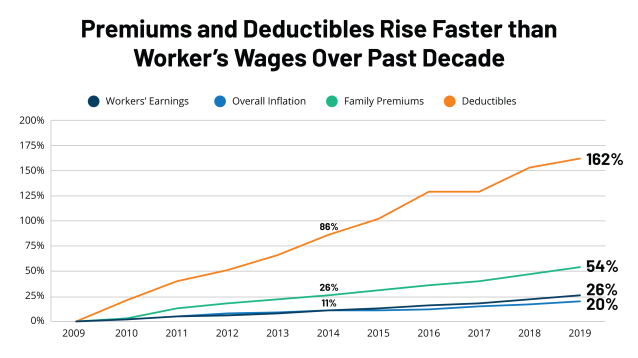

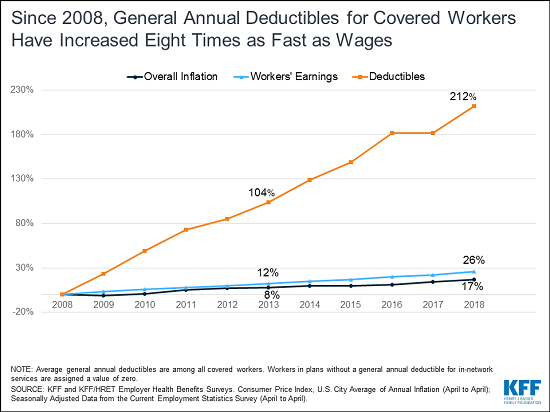

Here is what each one means so that you are sure to be able to understand how the deductible will impact you on different coverages. Deductibles in health insurance come into two types namely compulsory deductibles and voluntary deductibles. As a general rule the higher your premium the lower.

Insurers offer different types of top up health insurance with specific terms and conditions for deductibles. Hmos generally come with lower deductibles which is nice. Health insurance deductible types.

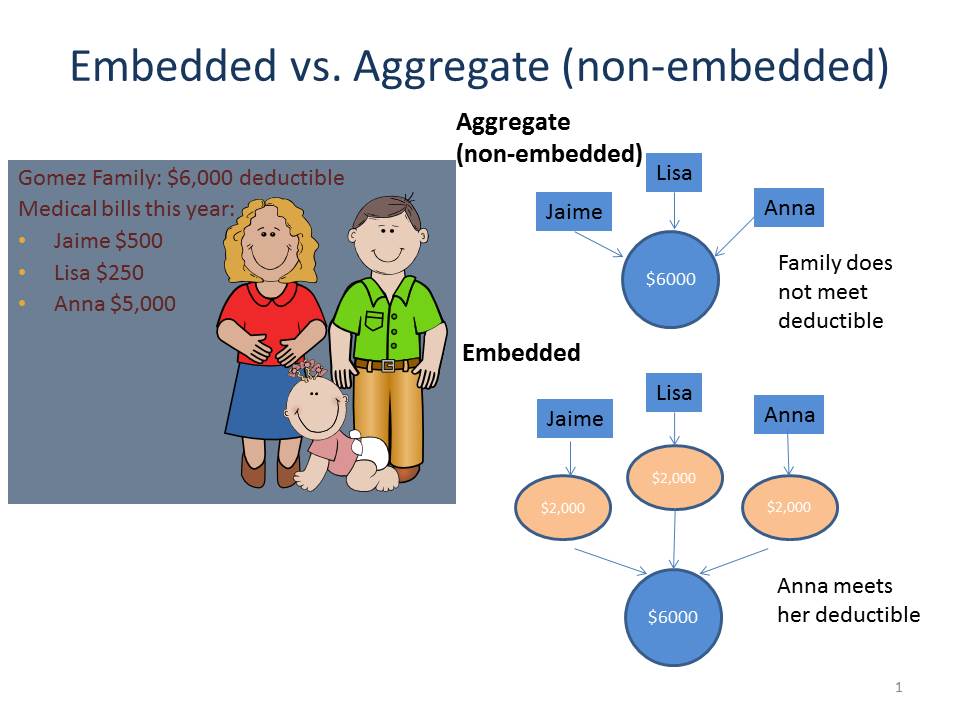

A health maintenance organization hmo policy is a type of group insurance usually offered through an employer. The amount you pay for a health insurance deductible is determined by the type of health insurance plan you have and your coverage benefits. With an embedded deductible your health plan will keep track of two different types of health insurance deductibles for each family member.

If you are an employee seeking insurance coverage there are the five major types of plans you will encounter employee seeking insurance coverage there are the five major types of plans you will encounter. If you are on a family two or more members. After you reach.

However these plans are notorious for how restrictive they are. When a family member has a healthcare expense the money they pay towards their individual deductible is also credited toward the family deductible. Deductibles apply each calendar year and are reset every january 1st.

Deductibles and coinsurance are clauses that are mostly implemented together under one single insurance plan. First let us review the embedded deductible. When it comes to insurance there is a mountain of options out there.

:max_bytes(150000):strip_icc():saturation(0.2):brightness(10):contrast(5)/GettyImages-490636933-2--575b268c3df78c98dc3dba01.jpg)