Health Insurance Deductible

The health insurance deduction for self employed people is taken on schedule 1 of form 1040.

Health insurance deductible - With a 2 000 deductible for example you pay the first 2 000 of covered services yourself. The 2018 penalty isn t tax deductible but some taxpayers can deduct the cost of the health insurance premiums they pay. What is deductible in health insurance.

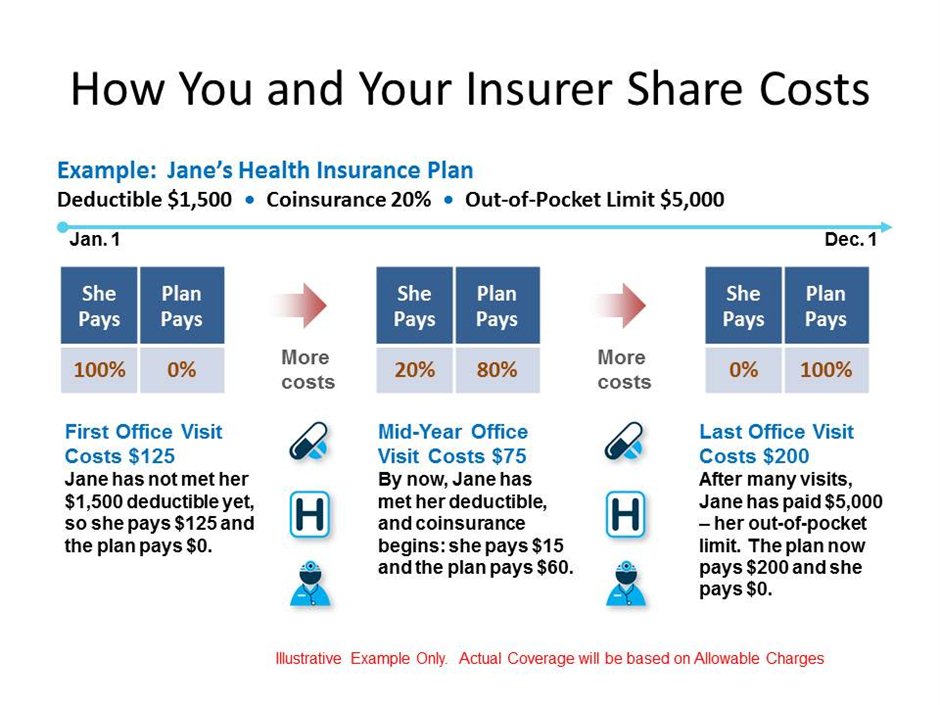

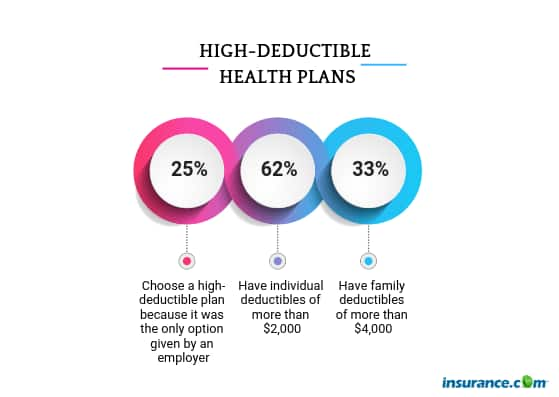

When deciding on a health plan comparing deductibles premiums copays coinsurance and out of pocket maximums should help with your decision. How it works if your plan s deductible amount is rs. High deductible health plans carry higher deductibles but they can offer access to health.

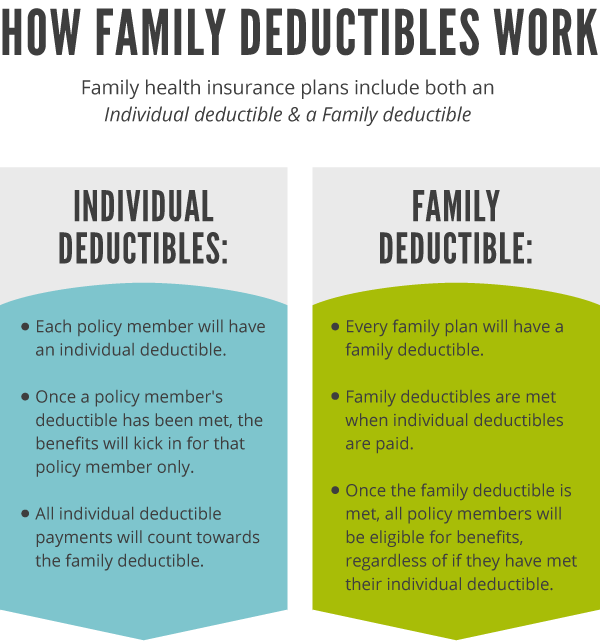

Your health insurance deductible is the amount you pay before your insurance plan s benefits begin. A deductible is a specific dollar amount your health insurance plan may require you to pay out of pocket toward covered medical care each year before your health plan begins to pay for covered medical expenses. All marketplace plans cover preventive care.

A health insurance deductible is different from other types of deductibles. Your annual deductible can vary significantly from one health insurance plan to another. Eligibility depends on whether you re an employee or self employed and whether you paid for your insurance using pre tax dollars or post tax dollars.

10 000 and the health care claim is of rs. Your insurance company pays the rest. Understanding your health insurance policy is crucial especially since you do not want to risk your health because you chose a health plan with too high of a deductible.

Just like with many other kinds of deductibles your health insurance deductible is the amount you pay before your insurance policy coverage kicks in. There are several advantages to the way the self employed health insurance deduction works. A deductible is an amount the insured has to pay as part of a claim whenever it arises and the rest of the amount is paid by the insurance company.

Screenings immunizations and. It can also depend on whether you take the standard deduction or itemize. 35 000 your insurance company will be liable to pay rs 35000 10000 rs 25 000.

A health insurance deductible is what you must pay for health care services before your health plan kicks in payments. After you pay your deductible you usually pay only a copayment or coinsurance for covered services. This makes it an above the line deduction which means it reduces your adjusted gross income.

Unlike auto renters or homeowners insurance where you don t get services until you pay your deductible many health insurance plans provide some benefits before you meet the deductible.