Health Insurance Marketplace Statement Tax Return

Choose your 2019 health coverage status for step by step directions tax forms.

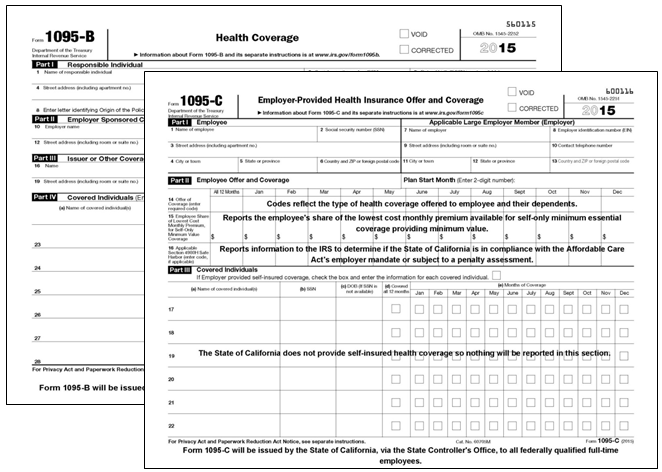

Health insurance marketplace statement tax return - If anyone in your household had a marketplace plan in 2019 you should get form 1095 a health insurance marketplace statement by mail no later than mid february. Basic information about form 1095 a. Form 1095 c employer provided health insurance offer and coverage.

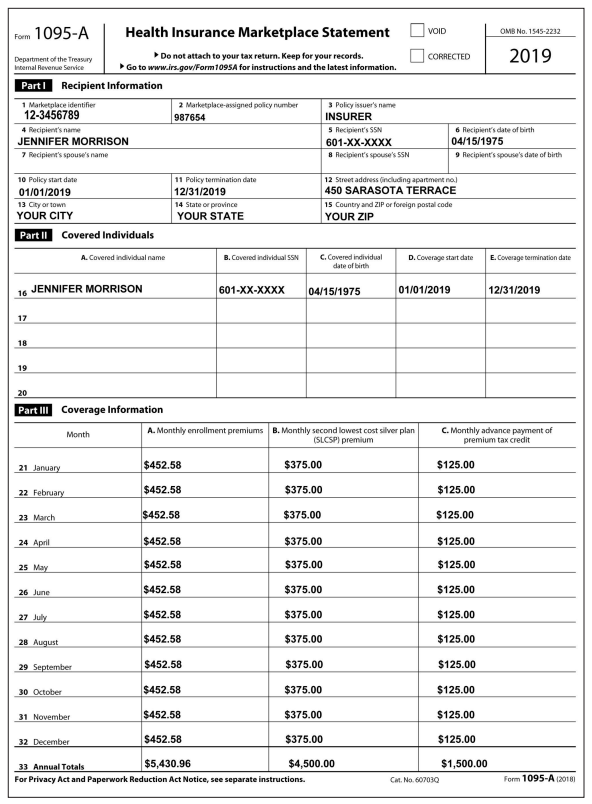

If you purchased health care insurance through the marketplace you should receive a form 1095 a health insurance marketplace statement at the beginning of the tax filing season. This form should have arrived in your mailbox by jan. It may be available in your healthcare gov account as soon as mid january.

If you or anyone in your household enrolled in a health plan through the health insurance marketplace in 2017 you ll get form 1095 a health insurance marketplace statement you will get this form from the marketplace not the irs. You might not receive a form 1095 b or form 1095 c from your coverage providers or employer by the time you are ready to file your tax return. You will receive form 1095 a health insurance marketplace statement which provides you with.

If form 1095 a shows coverage for you and everyone in your family. Check the full year coverage box on your tax return if the form shows coverage for you and everyone in your family for the entire year. If you are expecting to receive a form 1095 a health insurance marketplace statement you should wait to file your income tax return until you receive that form.

If form 1095 a shows coverage for you and everyone in your family for the entire year check the full year coverage box on. Received a form 1095 a health insurance marketplace statement and did not receive advance payments of the credit. Don t file your taxes until you have an accurate.

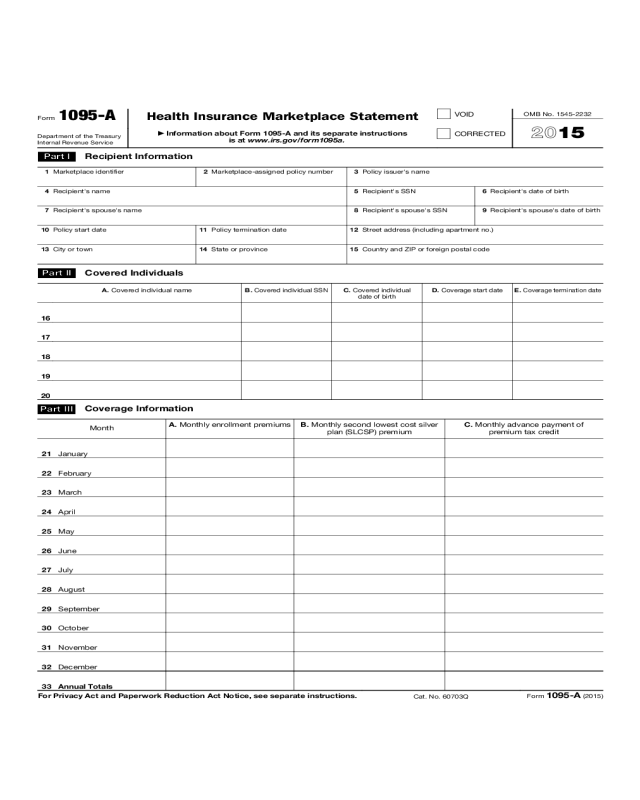

A 1095 a health insurance marketplace statement is a form you receive from the health insurance marketplace or health insurance exchange at healthcare gov if you and your family member s purchased health insurance through the marketplace for some or all of the year. Form 1095 a how to reconcile find and use form 1095 a. Form 1095 a is used to report certain information to the irs about individuals who enroll in a qualified health plan through the marketplace.

Information about form 1095 a health insurance marketplace statement including recent updates related forms and instructions on how to file. You must have your 1095 a before you file. Form 1095 a is the health insurance marketplace statement which comes in the mail and you need to include it in your tax return.

The information shown on form 1095 a helps you complete your federal individual income tax return. If you or your family received advance payments of the premium tax credit through the health insurance marketplace you must complete form 8962 premium tax credit with your return.

:max_bytes(150000):strip_icc()/1095-BHealthCoverage-1-c2b35a65cb7046028b47940d68f4260c.png)

/irs-form-8962.resized-4c525af04e6347f296d912d00785f2f2.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-02-03at2.02.31PM-9dcbc3a8b1604721b8586a24d7c7ffb7.png)

:max_bytes(150000):strip_icc()/99542520-5bfc2dc746e0fb00260b8e2b.jpg)