Life Insurance Explained Simply

Basically term life insurance is good to protect against temporary financial risks like a mortgage your kids college tuition etc.

Life insurance explained simply - Fortunately life insurance isn t quite as confusing as it seems on the surface. There are many different kinds of life insurance. Life insurance is an agreement between you and an insurance company that the company will pay your beneficiaries a tax free benefit if you die within the conditions of the policy.

Once you get older the need for life insurance changes. Term life whole life and universal life are just three of the most basic kinds. The policy expires at the end of the term which can last up to 30 years.

Hayley great yellow brick co. The transparency simplicity and competitive pricing of the simply products made it an easy choice for us in terms of who we went with for life disability and funeral cover for our people. Term life insurance policies are more affordable than other types of life insurance policies usually costing 30 40 a month for a 30 year 500 000 policy for healthy people in their 20s and 30s.

So if in 20 years your kids will be out of college and your mortgage will be paid off then a 20 year term policy for those amounts may be fitting. Life insurance explained simply taking out life insurance will be one of the best financial decisions you might make in your life. Check out life insurance.

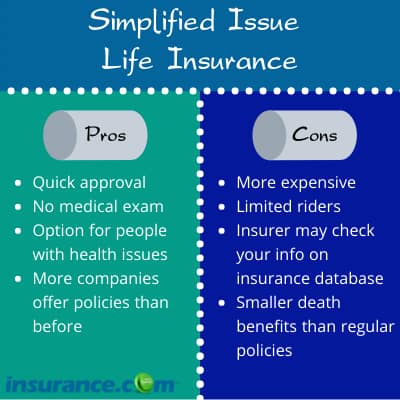

Life disability and funeral insurance. There is also a 1 year renewable term life insurance option that is offered by many of the best life insurance carriers. Choosing a life insurance policy can be somewhat daunting especially if you are new to it and don t know much about the coverage options.

Term life insurance is one of the primary forms of life insurance and is going to be what people think of as the most straightforward type of life policy. As you might expect life insurance generally becomes more expensive the older you get as your risk of passing away increases. The way term life insurance works is that you pay a set monthly premium like 30 00 per month for a specific amount of coverage like 100 000 for a set period or term length like 20 years.

On the most basic level it can be broken down into two main categories and from there into a few simple options. Selecting a policy is much easier when you know how each. However some providers offer specialised cover for people aged 50 or older so these groups can find affordable life insurance.