Life Insurance Needs Analysis Example

Learn how you can maximize legacies with the tax benefits of life insurance.

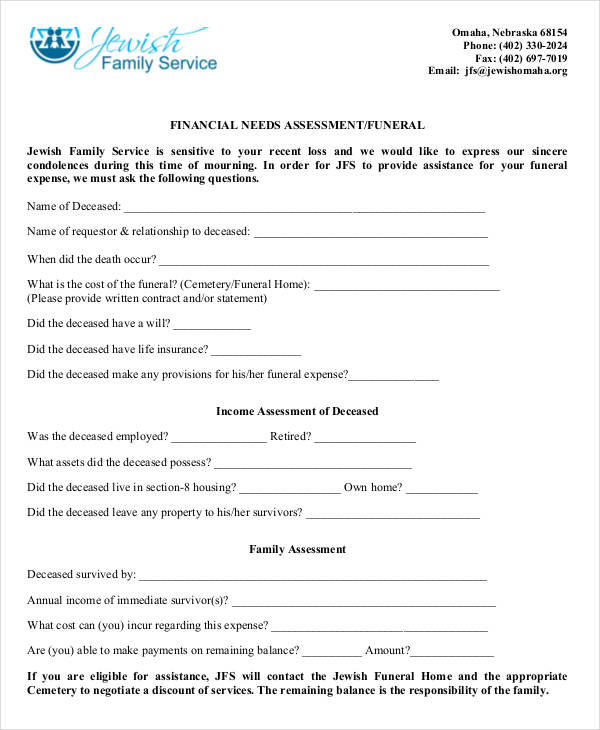

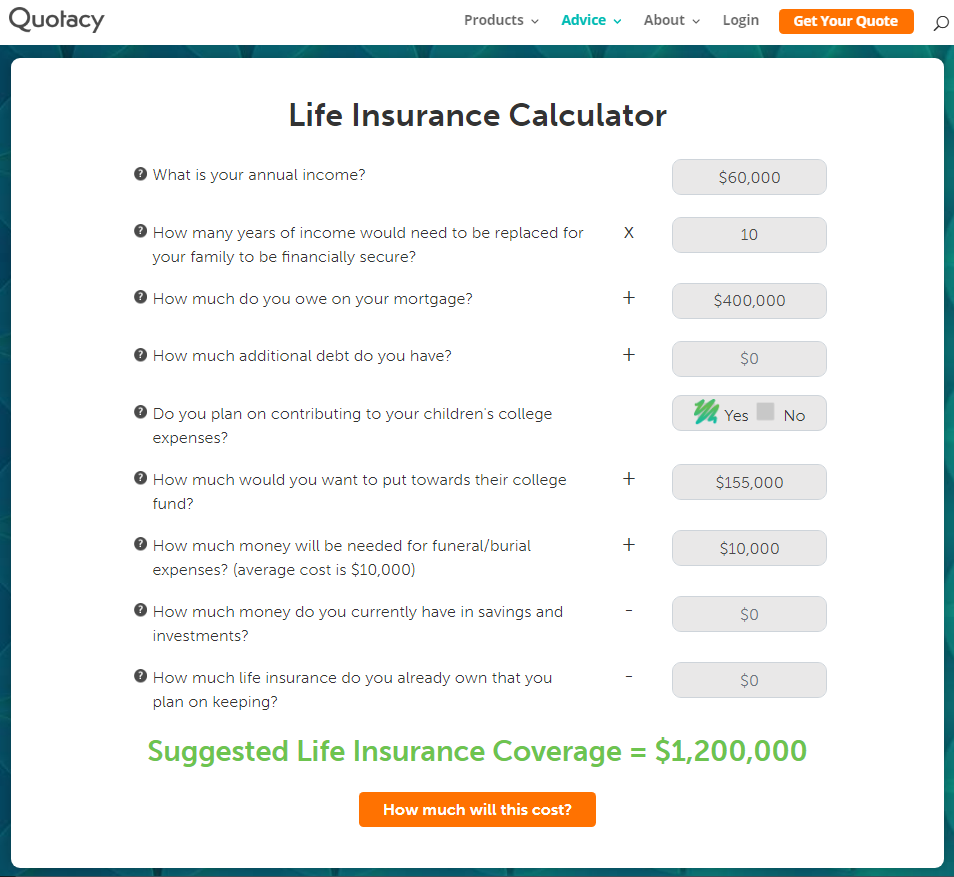

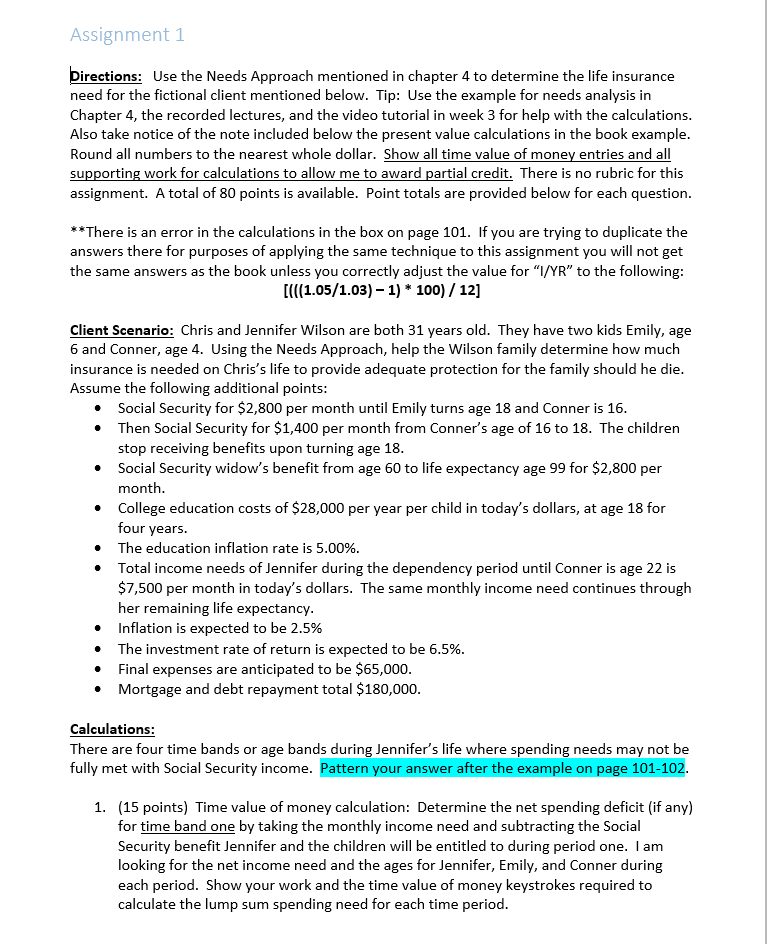

Life insurance needs analysis example - Life insurance need assessment form. Because the purchase of a life insurance policy is a contract that could very reasonable last the rest of your life making sure that it will provide financial assistance where and for as much as your family will need. Different from the one illustrated above.

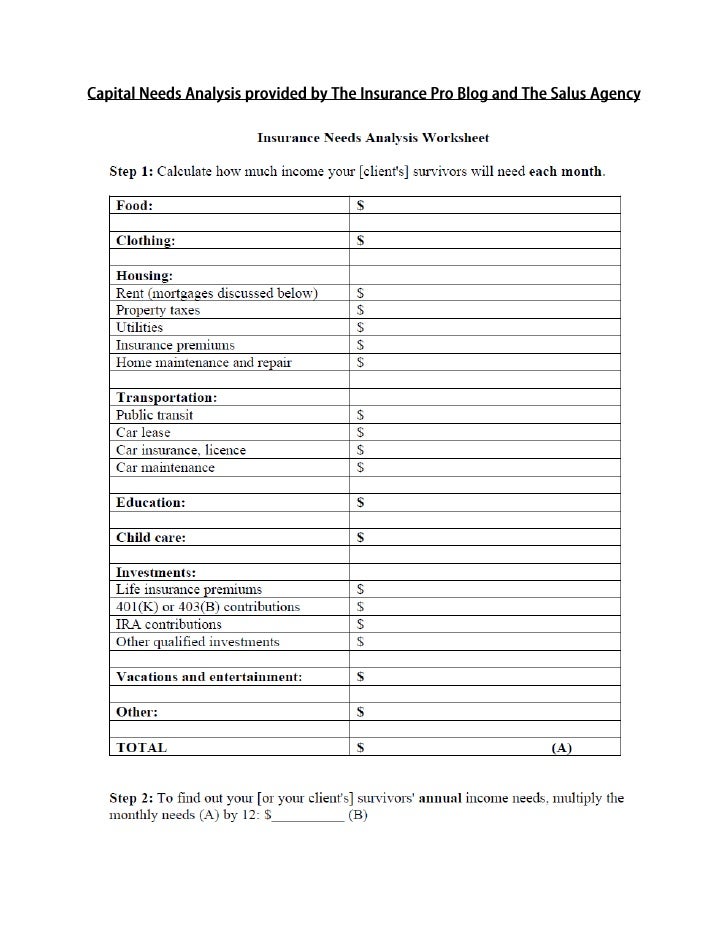

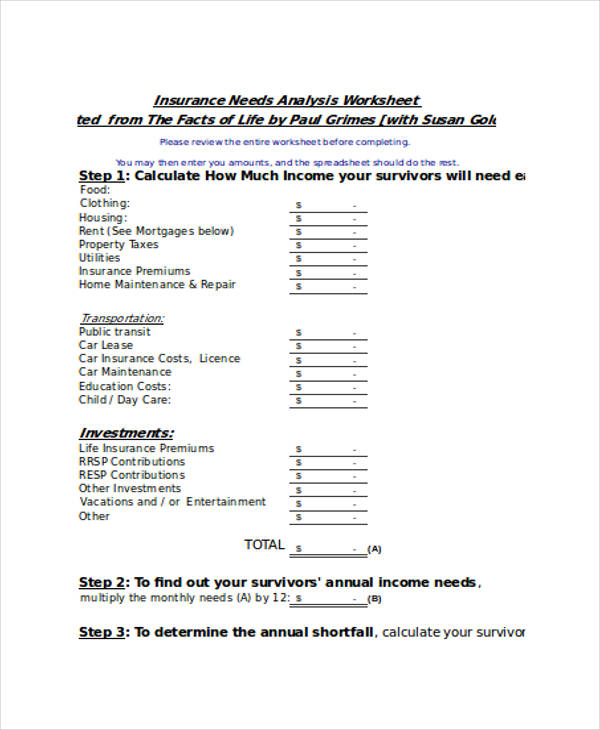

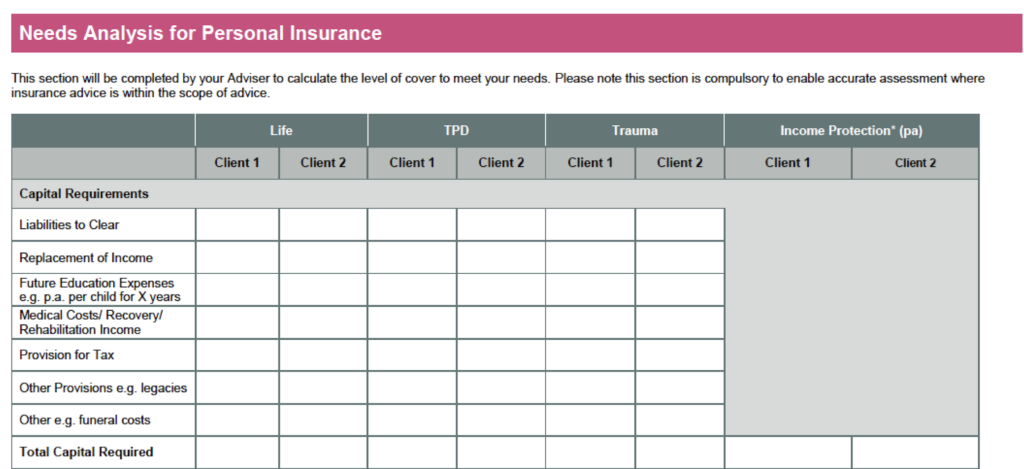

A needs analysis lets you put your insurance requirements in perspective. This worksheet may be used to collect information as part of a life insurance needs analysis for 1 or 2 individuals within the same family. A b c your life insurance needs and my understanding of my future financial needs in the event of my death.

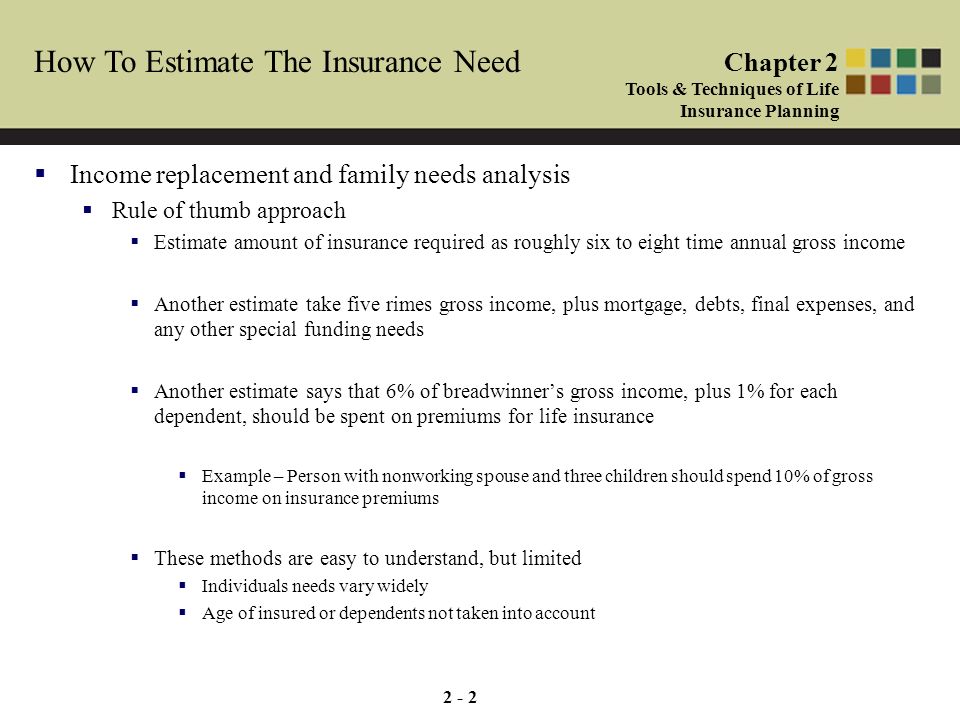

Before tax income by 10 to 15. It is strictly for reference and i may decide to take out a life insurance policy with a coverage. Get this insurance risk assessment form downloaded for your insurance company and carry out a kind of thorough survey on your customer s insurance needs.

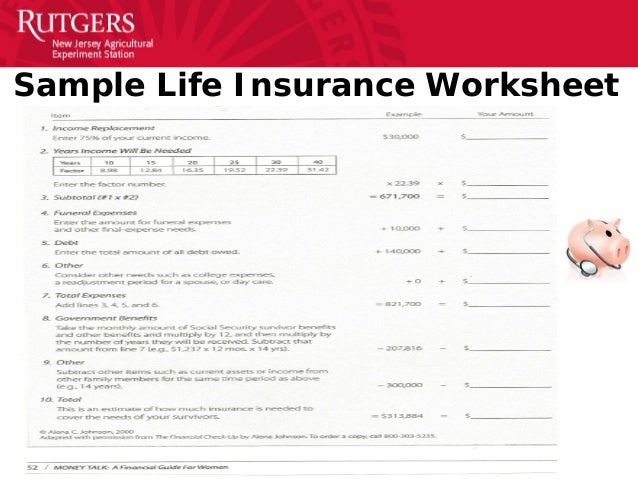

Life insurance needs analysis worksheet date. My insurance coverage has to be rev. With this formula you begin with the amount of income you would like to give to your family for a certain number of years.

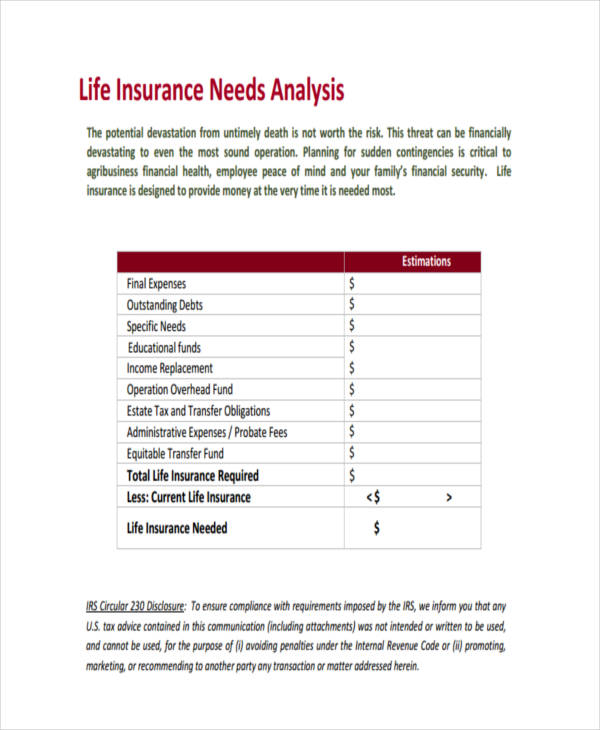

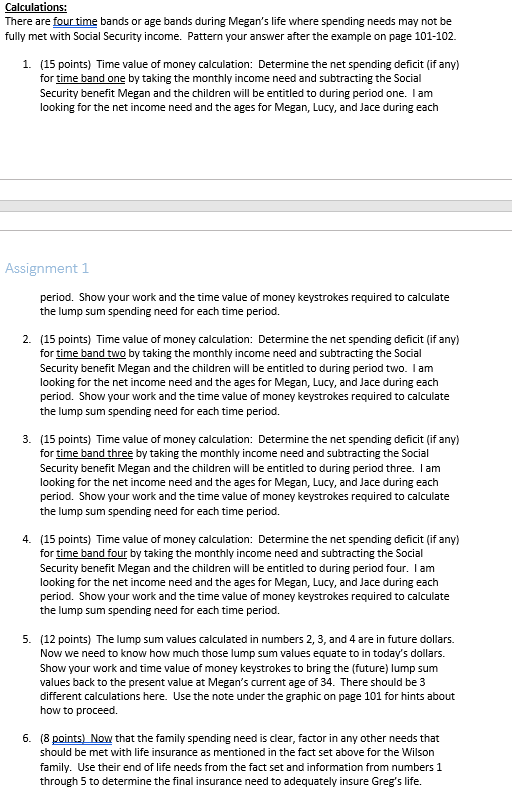

The second way to calculate insurance needs is through a shortfall calculation. The type and amount of information required to be collected will vary depending on each client s particular circumstances. This risk assessment form will enable you to explore complete information about associated risk with the client or his her property.

The best way to determine how much life insurance if any you should buy is with a needs analysis. A new study by the international insurance consulting group limra finds that people are 1 5 times more likely to buy life insurance if they first do a needs analysis. The capital needs analysis is the most widely used approach for estimating life insurance coverage.

Keep in mind that experts recommend erring on the side of caution and buying a little more life insurance than you think you may need calculation 1.