Life Insurance Offers Pure Insurance Protection For A Given Period Of Time

D 10 one disadvantage of term life insurance is that.

Life insurance offers pure insurance protection for a given period of time - Term life insurance b. Growth centered life insurance c. Consider buying a breakpoint level of insurance coverage better premium rates are given at coverage levels of 100 000 250 000 500 000 and.

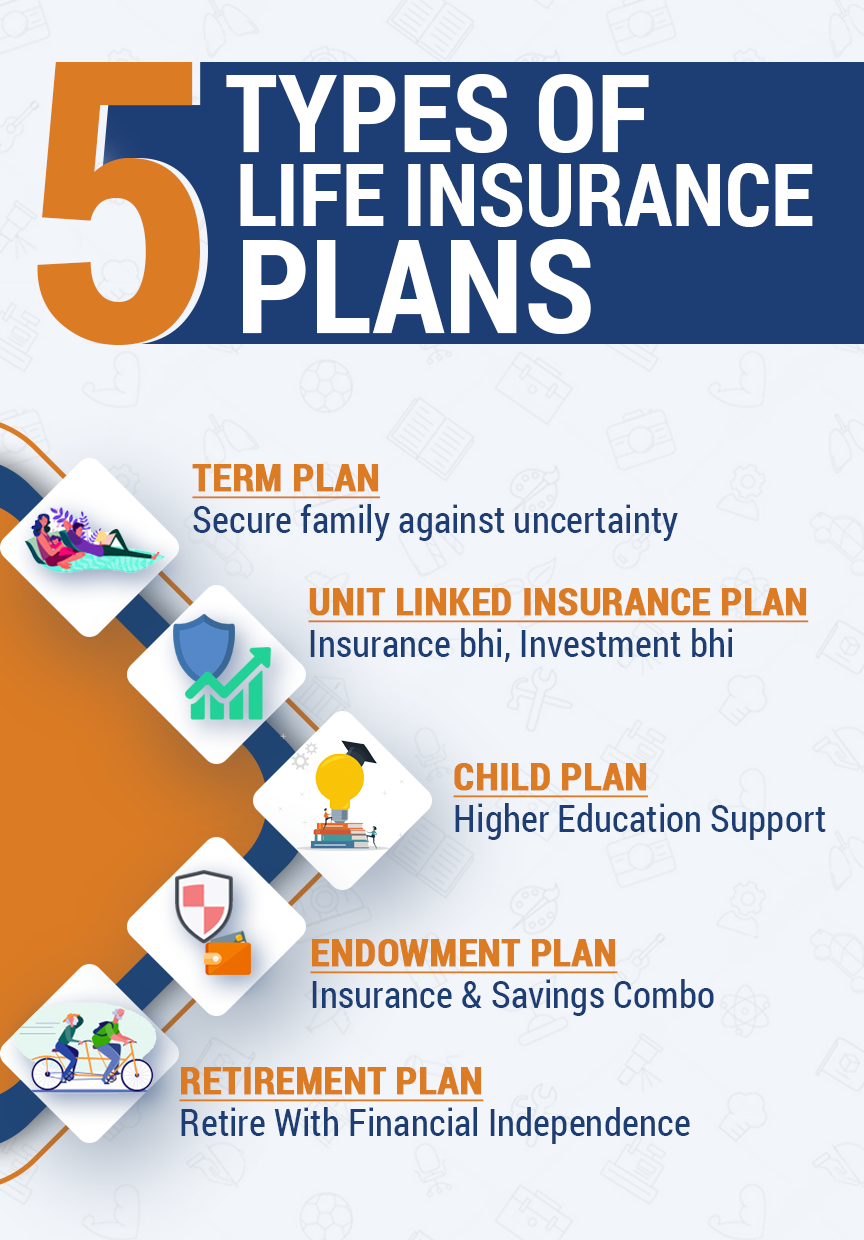

9 tips for those considering life insurance. Life insurance that permits changes in the face amount premium amount period of protection and change the duration of the premium payment period. A type of life insurance with a limited coverage period.

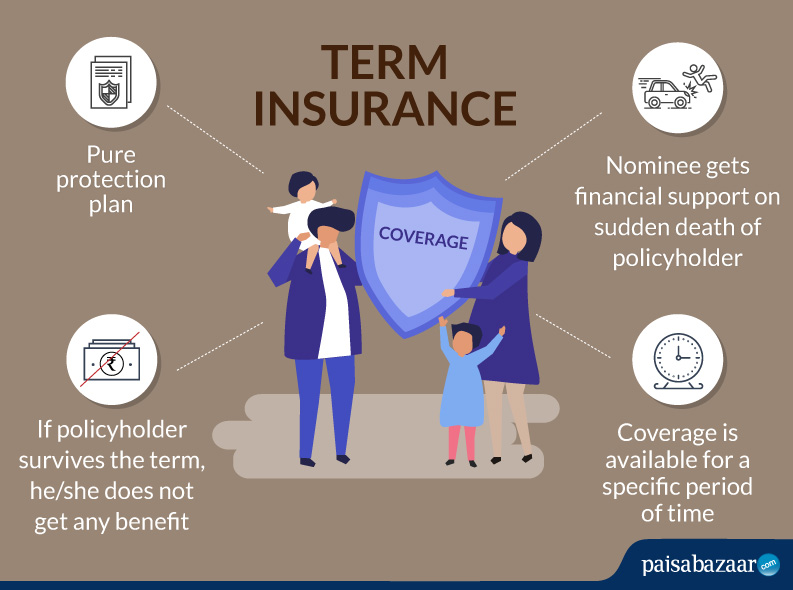

Term insurance therefore provides death protection only. More than half of the plans sold in q1 were from the protection category. Multiyear level premium insurance 205.

Cash value only develops when premium paid are more than the cost of the policy. However if the insured does not die during the term that the policy is in force the face value nor premium are refunded. Purchasing insurance is a relatively low cost way of protecting yourself form lost income due to an accident or prolonged illness.

Once that period or term is up it is up to the policy owner to decide whether to renew or to let the coverage end. Protecting your financial base 201. Is a form of life insurance that provides both a savings plan and pure insurance coverage.

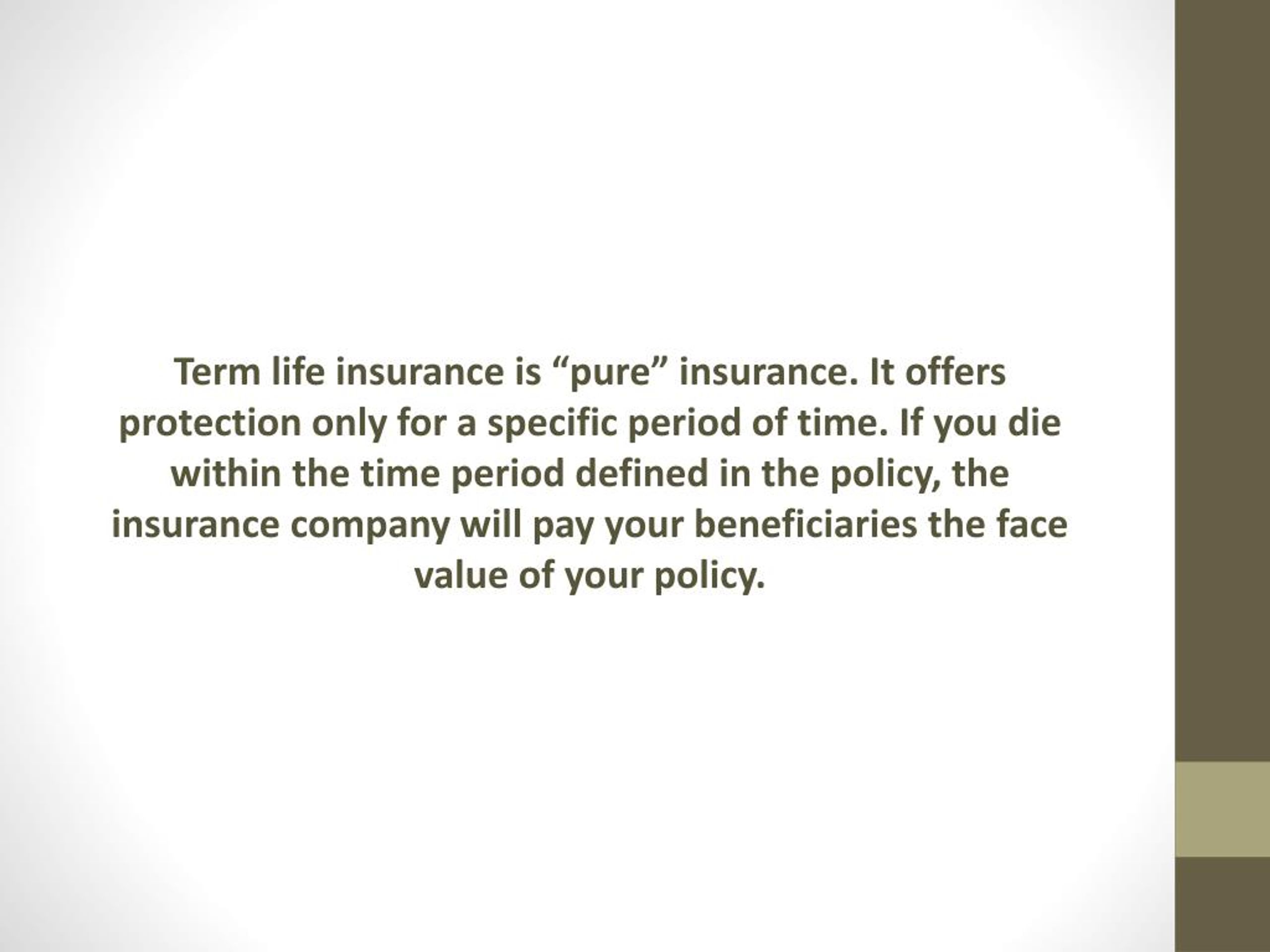

This includes insurance for homes motor vehicle travel private medical insurance pets extended warranties mobile phones and weddings. Term life insurance is designed to provide protection for a limited period of time which is the term of the policy. Whole life insurance d.

D 3 level of learning 1. It also covers protection insurance which includes life critical illness cover for particular conditions income protection where there is accident or sickness and redundancy cover. It offers no living benefits such as the guaranteed cash value of whole life insurance.

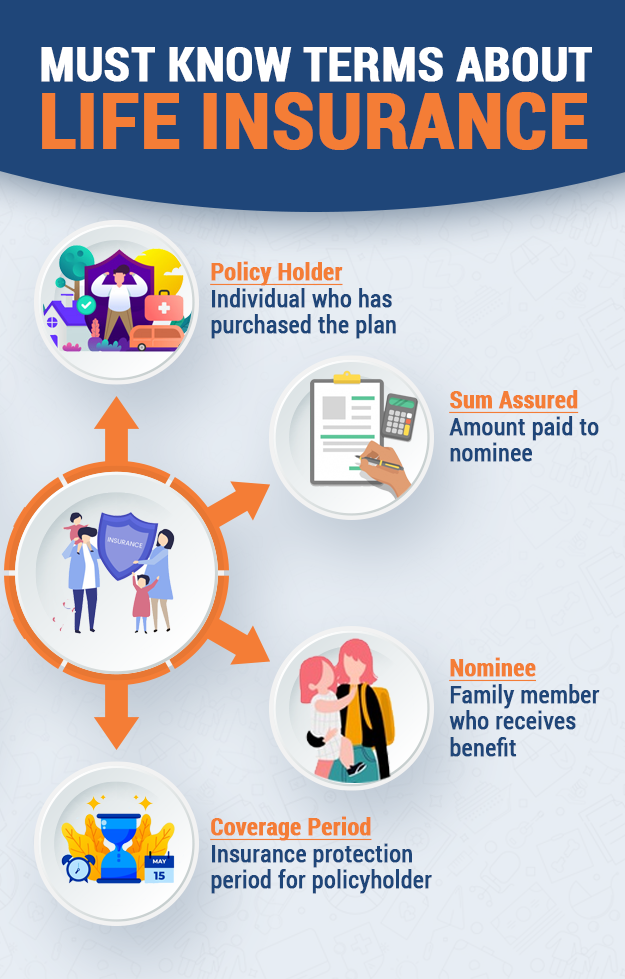

D 10 life insurance offers pure insurance protection for a given period of time. Aalok bhan the chief marketing officer of max life insurance has seen the demand for pure protection plans increase. Life insurance is a contract between an insurance policyholder and an insurance company where the insurer promises to pay a sum of money in exchange for a premium after a set period or upon the death of an insured person.

Life insurance offers pure insurance protection for a given period of time.

.png)

.png)