Life Insurance Options Explained

Life insurance options explained.

Life insurance options explained - A popular life insurance policy option. These are typically more expensive and complex but can satisfy specific needs like large estates or inheritances. They receive the death benefit upon the contract holder s death.

Agents say people sometimes avoid buying life insurance because learning the. If you retired before october 30 1998 your option a insurance may have been higher than. With term life insurance coverage is purchased for a certain length of time it could be as short as a 5 year policy a short term life insurance plan or longer terms such as for ten years 15 years 20 years 25 years 30 years and in some cases even longer.

Whole life insurance is a safer permanent life insurance choice than some others it can provide guaranteed interest premium and death benefit so you know what to expect. Many adult texans do not have life insurance even though just about everyone needs it to support their dependents and cover funeral costs. Universal life insurance often offers more flexibility than a whole life insurance policy.

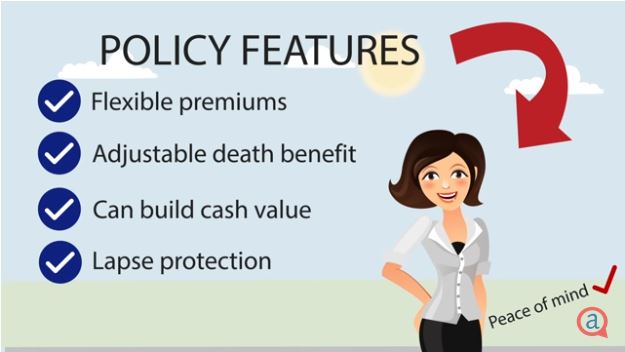

Universal life insurance options. The most obvious difference at least superficially is cost. For example if you re worried about your health or afraid that a family condition will appear in your check up one day a term conversion rider will allow you to switch to permanent long standing coverage within your insurance company without having to.

If you re confused about life insurance you re not alone. Viatical settlement is another option to sell the life insurance. There is also a 1 year renewable term life insurance option that is offered by many of the best life insurance carriers.

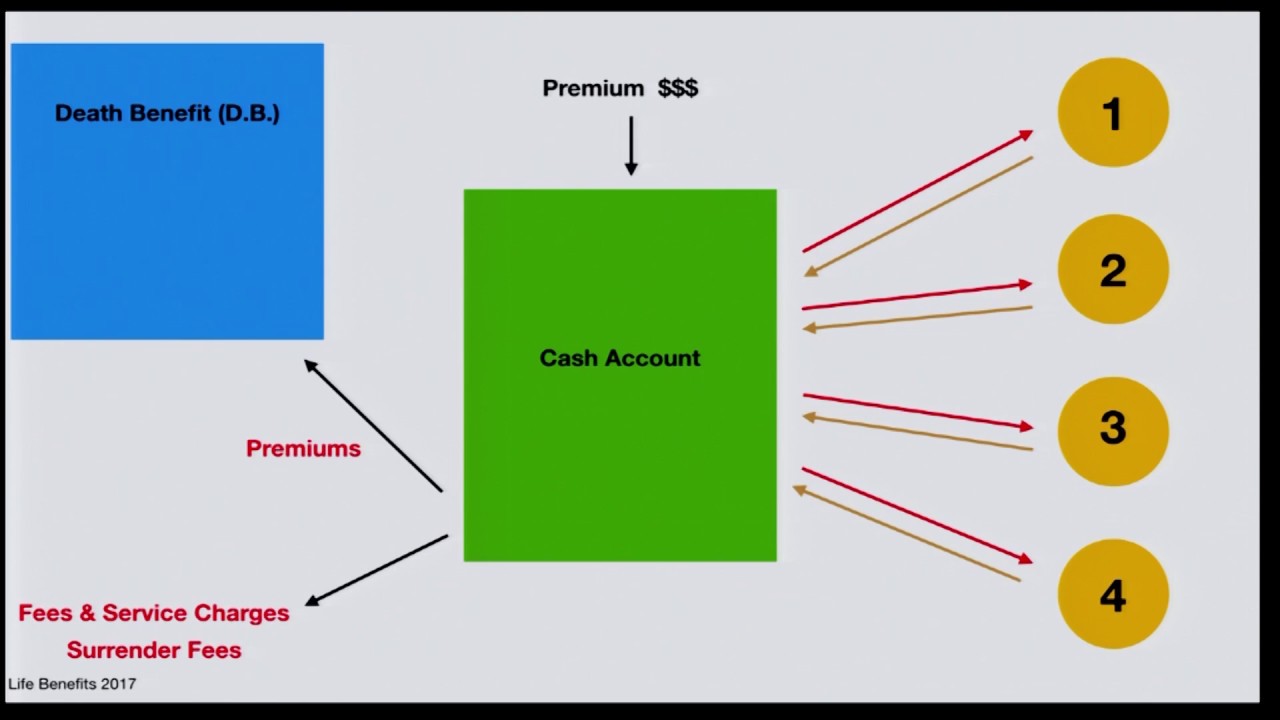

The amount of insurance formerly known as optional insurance is 10 000 at retirement. They can sell the insurance policy to a settlement company that will be the beneficiary and take over the premium payment. You may be able to alter your premium payments and death benefit within certain limits.

Indexed universal life insurance iul vs ul. In some cases whole life insurance premiums are three to five times as much as. Whole life insurance will provide a death benefit tax benefits and cash value but will cost you a lot more than the cheaper more straightforward term life insurance option.

By casey kelly barton 9 1 17. A form of permanent life insurance that has a premium and cash value. Similarities differences to term life insurance.

These have a set expiration date and are a cheaper more popular option. This is a good option for people with a life expectancy of 20 years or less. Just like term life insurance beneficiaries exist in a whole life insurance policy.

In past years there were concerns with the values in the investment portion of universal life insurance because of unstable markets.