Life Insurance Red Flags

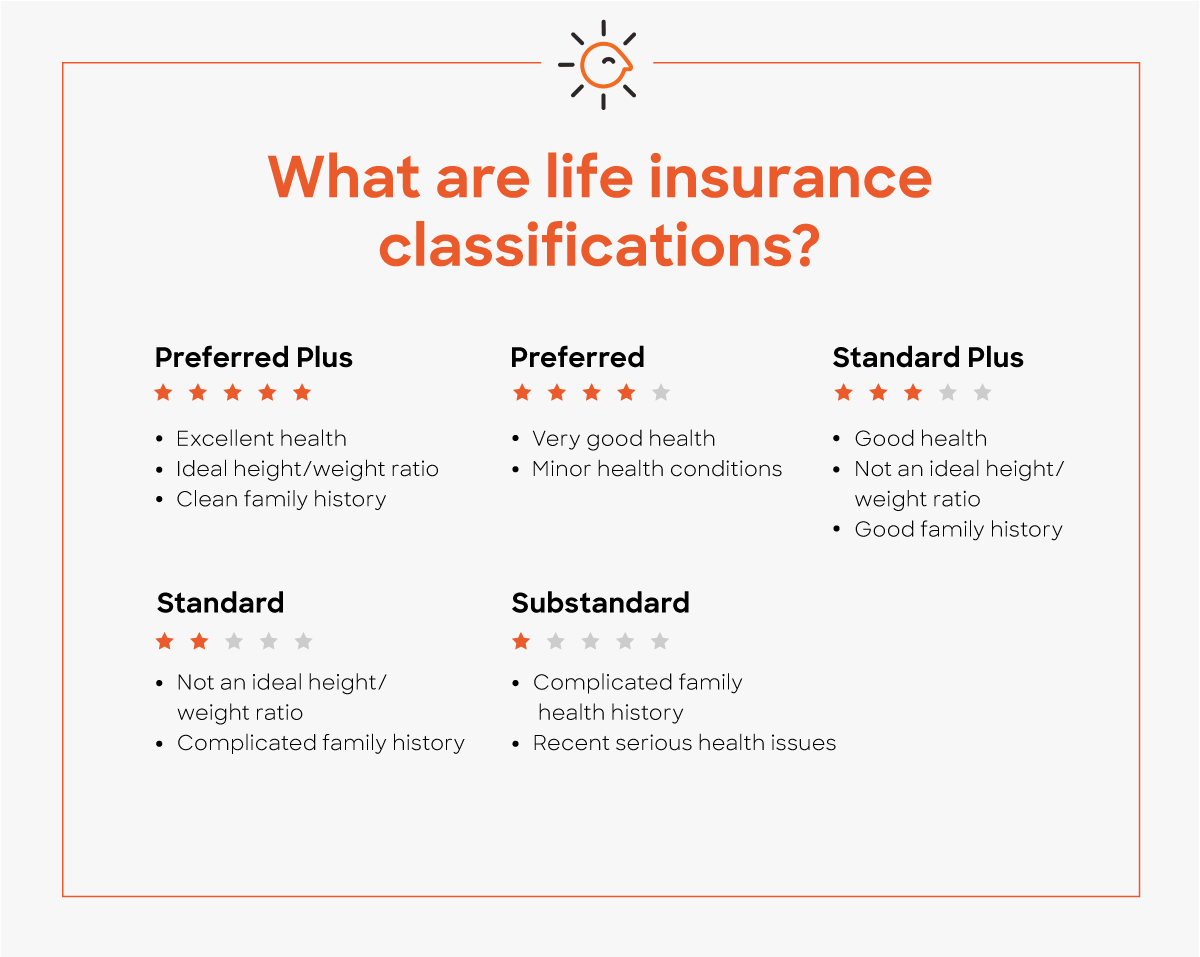

When an underwriter reviews your life insurance application they will be red flagging bits of your information where a possible problem might exist.

Life insurance red flags - Using life insurance for retirement or education savings. Delayed reporting of a claim or injury. However high blood pressure that is controlled with medication is considered.

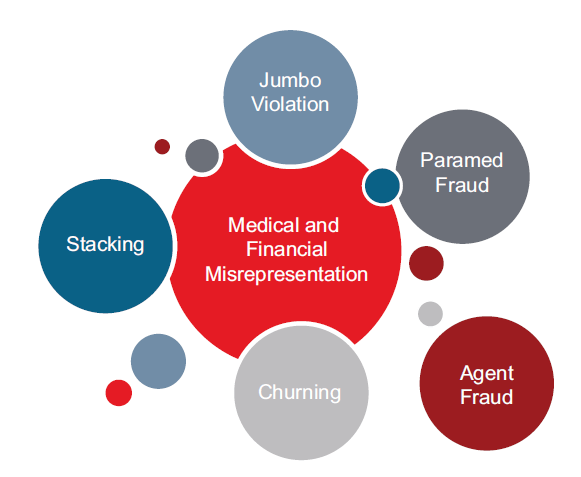

A history of filing claims. Perhaps they are suggesting a whole life universal life or variable universal life policy to accomplish this. Insurance fraud alerting factors.

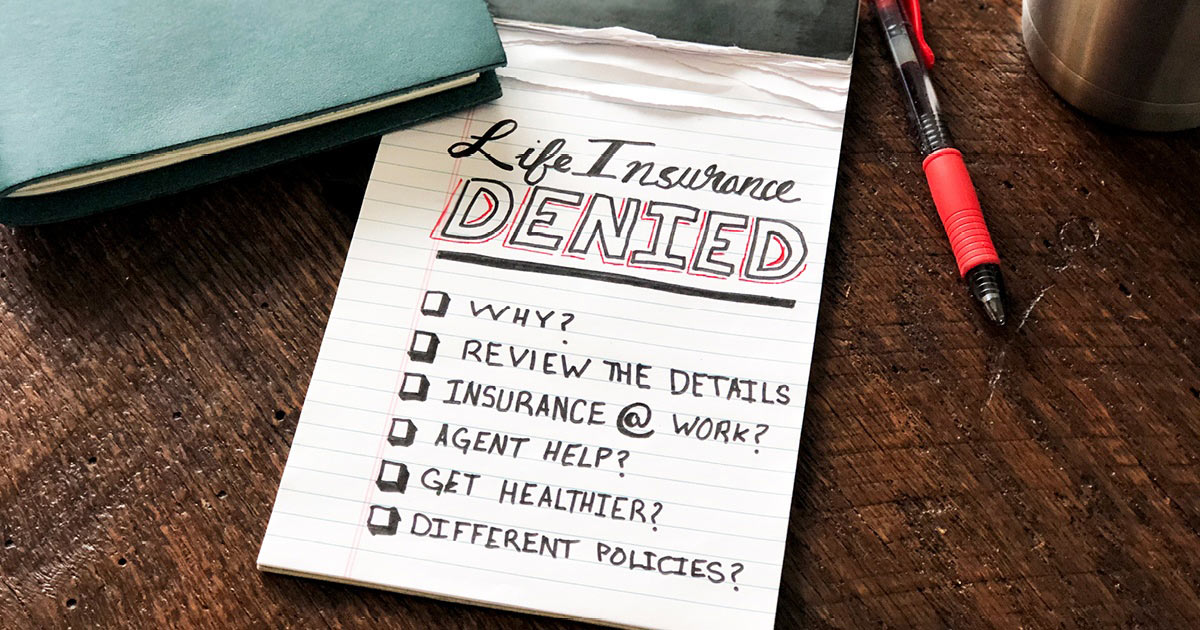

10 must know red flags your insurer looks for when you apply for life insurance posted on june 26 2019 and updated june 26 2019 in life insurance canada news 7 min read this publication is based on a past chantal marr s interview with sheryl smolkin for toronto star. Erratic blood pressure uncontrolled blood pressure is a very common red flag for life insurance companies. To help you spot and deter fraud this holiday season and throughout the year here s a list of just nine of the many fraud red flags that life insurance underwriters watch for.

Here are five life insurance red flags. Tue april 29 2014 timer 3 min. Insurance fraud red flags when investigating a suspected insurance fraud case investigators and lawyers look for red flags or indicators of insurance fraud.

Whether you re a tribal business owner an insured or a tribal insurance producer here are a few red flags you probably know to look for. By sheryl smolkin at work. Red flag medications for sleep apnea.

A problem to an underwriter could be anything from an addiction prone medication to a disease. 10 life insurance fraud lack of identification on person for application or exam unable to answer personal questions or avoidance of detail not actively at work address not verifiable. Therefore the bottom line is this.

If an insurance agency regularly extends credit to customers it will probably be considered a creditor and will have to develop a red flags program. A salesperson may tell you that a great way to save for your retirement or children s education is through a life insurance policy. The main way an insurance agency or company would come under this definition is if they allow insureds to pay for coverage at the end of a coverage period.

Eight red flags when you apply for life insurance. They are often contradictory and are never standing alone evidence of insurance fraud.