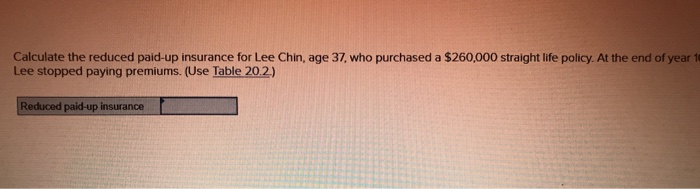

Life Insurance Reduced Paid Up

Reduced paid up insurance cash surrender and extended term.

Life insurance reduced paid up - Paid up life insurance allows you to benefit from the continued growth of the policy without needing to pay into the policy to keep it active. Reduced paid up insurance allows you to stop paying life insurance premiums. With term life insurance if you stop making premium payments the policy will quickly lapse and leave you without protection.

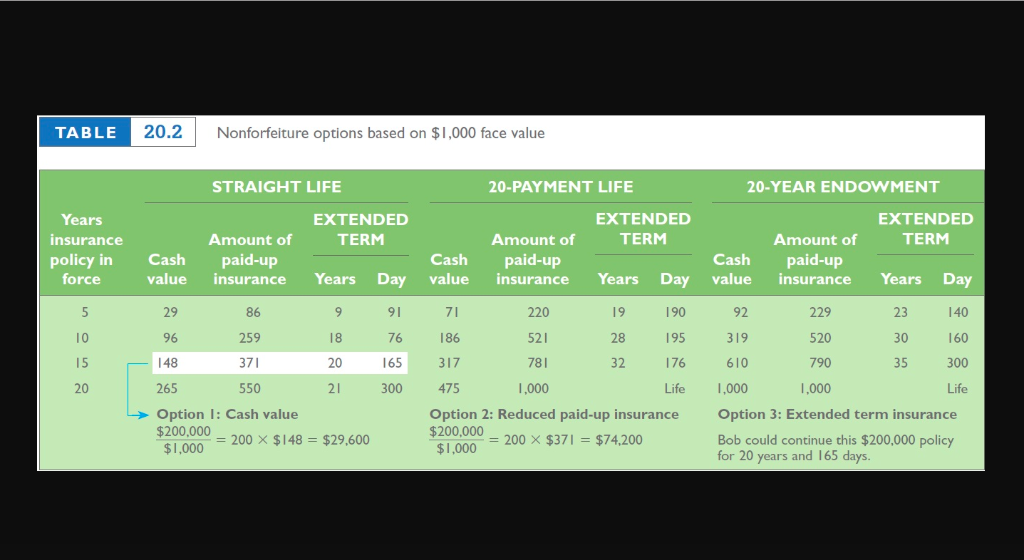

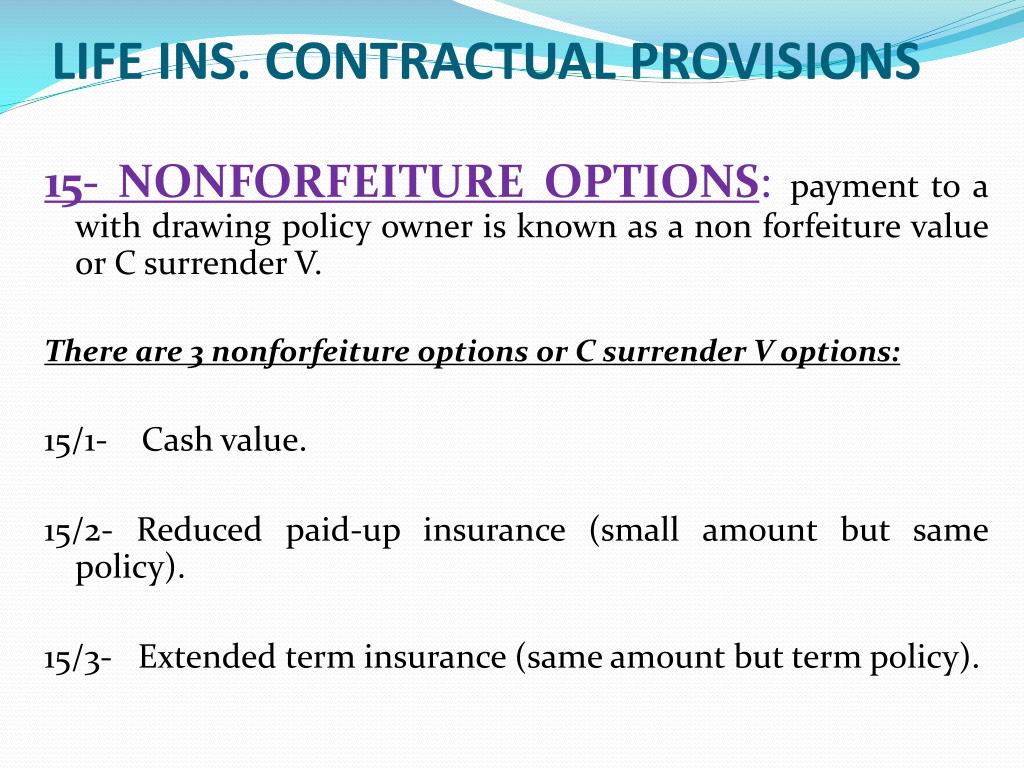

Reduced paid up insurance is a nonforfeiture option that allows the policy owner to receive a lower amount of fully paid whole life insurance excluding commissions and expenses. The attained age. With a permanent insurance policy you can convert it to a reduced amount of paid up coverage.

A whole life insurance policy is paid up when no further premium payments are needed to keep the policy in force. Reduced paid up whole life insurance is a policy for which the policy owner no longer wanted to pay premiums but did not want to lose the death benefit. Rather than surrender the policy or take the cash value the policy owner decided to turn the policy into a reduced paid up whole life insurance policy.

That reduced amount is based on the cash value at the time you stop the policy. This means that your family will receive a portion of your death benefits if you die but you will not have to continue to pay the premiums. Another common use of reduced paid up insurance is as a nonforfeiture option.

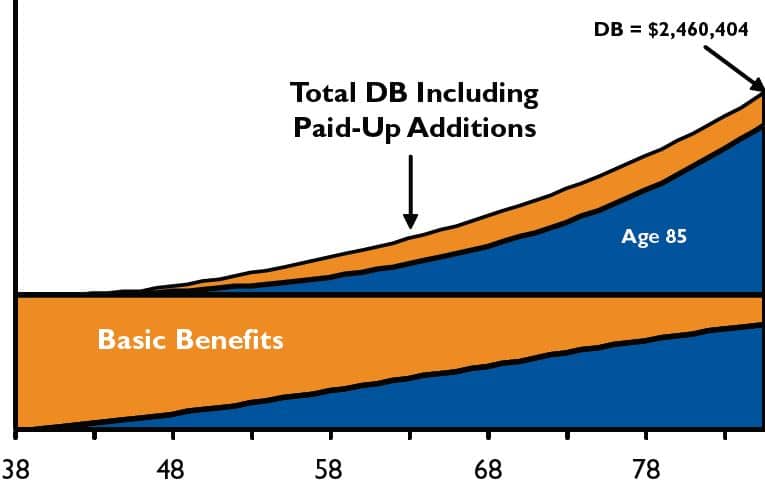

This option is sometimes used when people no longer want to pay the premiums noted in the life insurance contract but do not want to surrender the policy and lose all their coverage. In exchange for no longer having to pay premiums the life insurance gives you a reduced amount of life insurance. A paid up addition is a small chunk of whole life that is added to a base whole life policy often through extra premium payments whereas the reduced paid up insurance option is chosen when someone no longer wants to pay premiums and henceforth reduces their base policy.

The reduced paid up nonforfeiture option is one of several ways in which whole life policyholders can adapt policies to ever changing life circumstances financial situations and market conditions. Paid up status you are able to convert a whole life insurance policy to a paid up policy in which this will allow you to keep the policy in force without continuing to pay the premiums. Though the option is required in many states the precise terms and requirements vary among insurance companies and between policies.

Insurers that offer whole life insurance usually provide three nonforfeiture options.