Life Insurance Riders Types

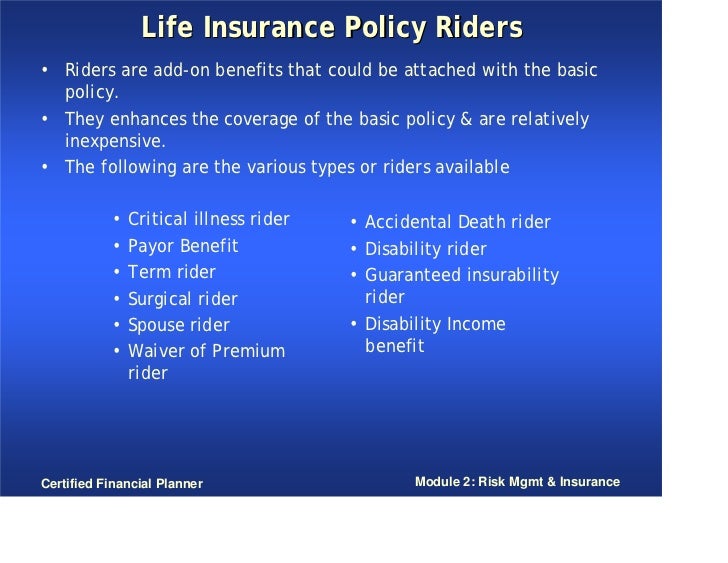

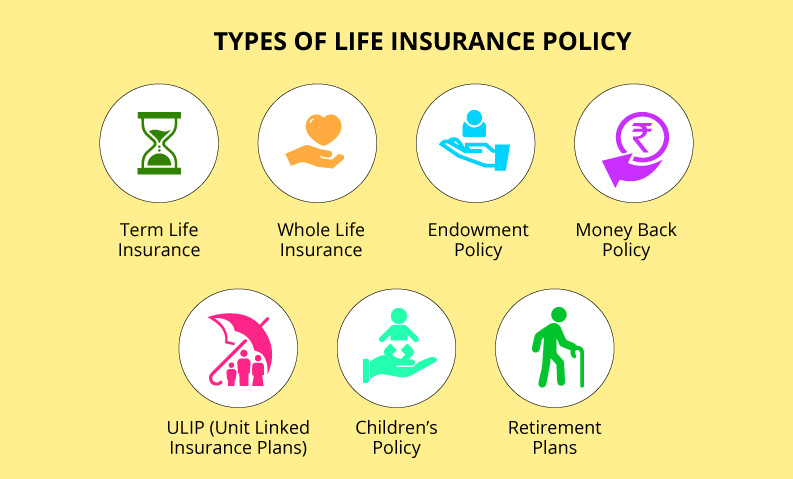

Life insurance is applicable to individuals and families in a wide range of financial situations because it refers to a group of several different products each of which can be customized with riders basically add ons to the policy.

Life insurance riders types - Because term conversion riders are so common and are usually automatically included for no charge the term policies that include these riders are just referred to as convertible term life insurance. When shopping for insurance it s important to discuss with your agent exactly what you want your policy to do. A term conversion rider allows you to convert your term life insurance policy into a permanent life insurance policy without having to go through underwriting again.

The spousal rider was once one of the most po pular life insurance riders. What s available to you depends on which company you purchase life insurance from so ask your insurance agent about riders you re interested in before purchasing a policy. It allows the policyholder to use their death benefits if they get diagnosed with a terminal illness that could.

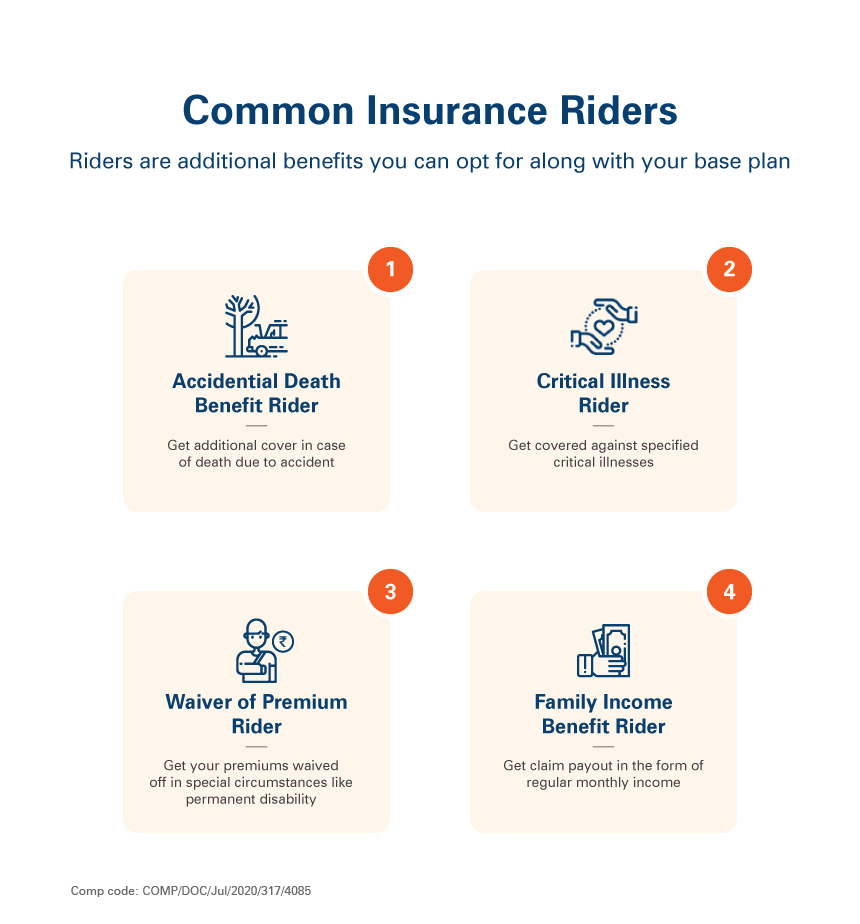

Know what a rider in life insurance is an insurance rider is a coverage enhancement or an add on to a policy that offers additional risk coverage. Here is when life insurance policy riders can help with the extra coverage you need. Common life insurance riders include.

Additional smaller policies can be purchased which will pre pay or provide a specific death benefit amount to pay for the cost of your funeral. A cornucopia of life insurance riders exists. Using life insurance riders to pay off debt.

Many people choose a spousal rider rather than getting a separate life insurance policy. Riders are additional benefits that can be bought and added to a basic life insurance policy. An accelerated death benefit rider is one of the most popular life insurance riders.

This type of rider allows you to add life insurance coverage for a spouse. Funeral and burial insurance rider. They allow you to customize a policy and can provide several kinds of protection if you meet their.

It tends to be more expensive than term life. But these higher premiums are paid in exchange for guaranteed lifetime coverage and an accumulating cash value you can borrow against. Permanent life insurance as the name implies offers coverage that does not expire it also combines a death benefit with a savings or investment account.

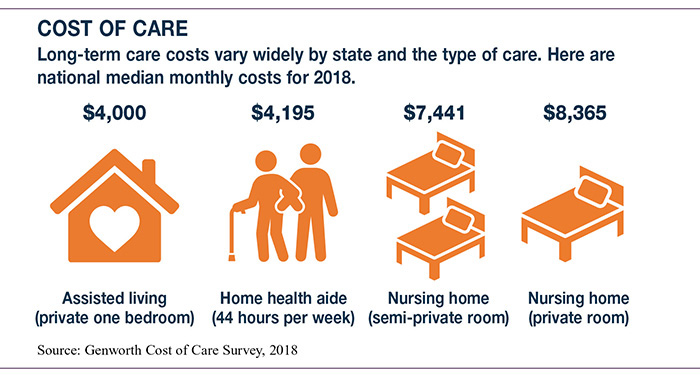

Long term care ltc beneficiaries receive a portion of the death benefit while the insured is still alive to cover. The type and cost of life insurance riders can vary widely from one company to another and from one policy to another.