Life Insurance Risk Management

Must have risk management certificate.

Life insurance risk management - Risk resource is a nationally recognized financial services company that specializes in risk management and succession planning we design and implement financial solutions to better prepare individuals and businesses for the future. Good knowledge of risks and controls. Bachelor s degree in economic or law or other related study.

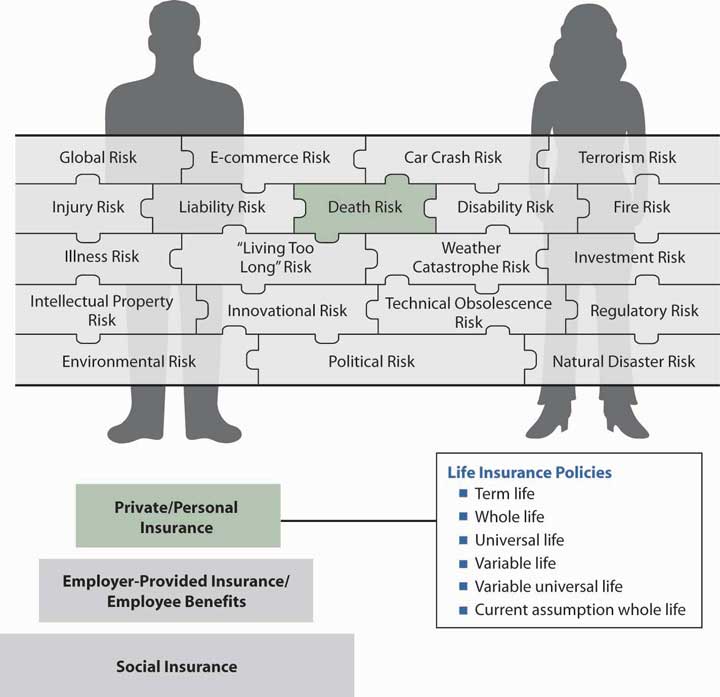

You buy insurance to mitigate the risk of major catastrophes. Risk management in life insurance part 1 sonjai kumar vice president business risk aviva india life insurance disclaimer. What is life insurance.

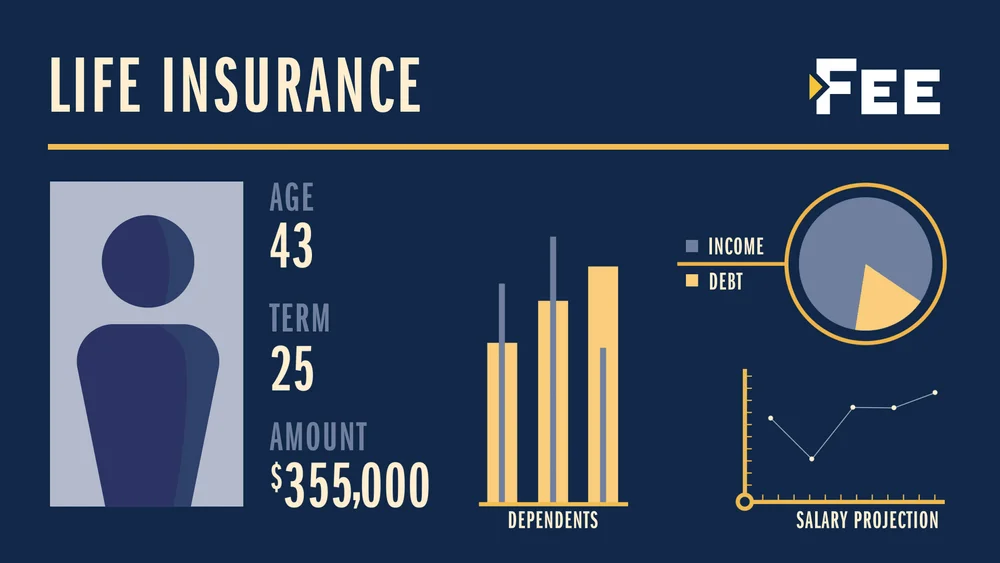

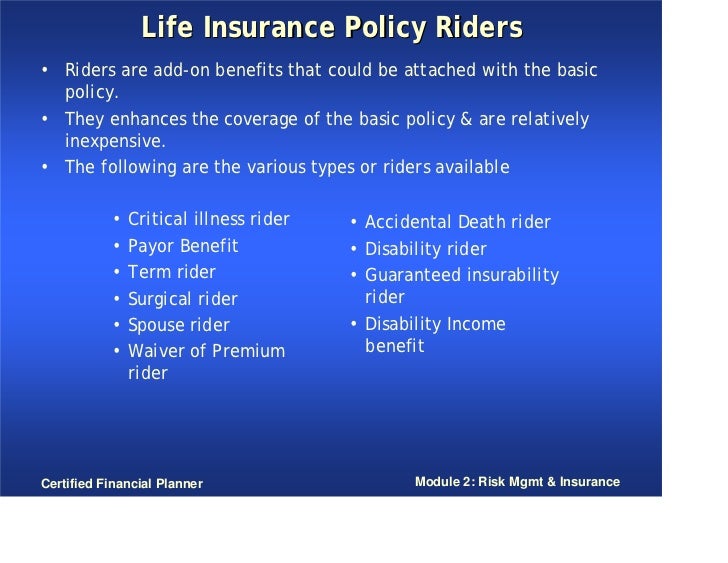

Risk management partners offers a complete line of individual life insurance products that are crafted to meet you and your family s specific needs. Worldwide these companies write policies that deal with specific risks and in many cases even underwrite exotic risks. These are the main types of life insurance.

Insurance industry by shriram gokte background insurance companies are in the business of taking risks. A systematic approach to risk management. Health insurance protects your finances in case you break an arm or get diagnosed with a serious illness.

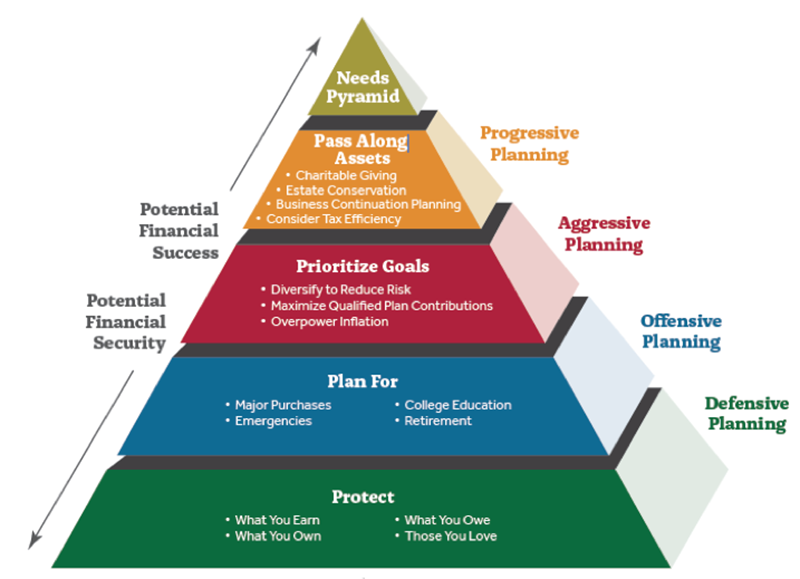

Life insurance can be a sensitive topic but it is a effective risk management tool that allows you to transfer risk to a third party. It should be an important part of your financial strategy as it can help you cover final expenses build a legacy protect your family leave an inheritance and much more. Identify stewardship governance strategy operational asset liabilities insurance and capital risk and develop risk scoring.

Risk management overview 11 49. Life insurance financial risk management inc. Based out of scottsdale arizona since 1983 risk resource is a third generation business.

Life insurance experience is an advantage. This module covers risk related topics related to insurance and introduces learners to the concept of personal risk tolerance and how it might impact individualized risk management strategies. Identifies potential areas of risk vulnerability.

Good understanding of corporate governance risk assessment methodology. Birla institute of management technology bimtech 2. Term life this is the standard and.

Minimum of 4 5 years in leading supervising risk audit compliance function for head level or minimum of 2 3 years in risk management with exposure to audit compliance for staff. We work with several different top rated insurance companies and we will place your account with the company that will provide you with the coverage and benefits you want. Good understanding of risk management standards regulatory requirements and guidelines.

Holding aaij certification is a plus. As a direct corollary therefore insurance companies should be good at managing. Conduct risk assessments and identifies controls in place to mitigate the identified risk.

/risk-management-2f0a910b44944108a7a0f4462db4175e.jpg)