Life Insurance Risk Ratings

Combined life insurance co.

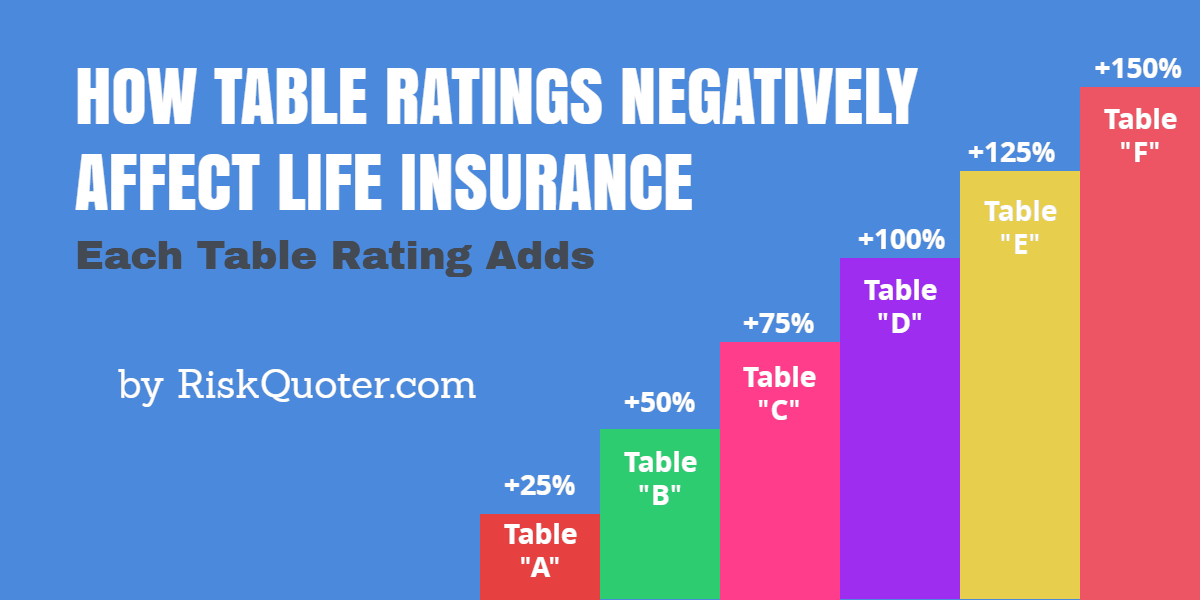

Life insurance risk ratings - Life insurance carriers want to offer coverage to anyone if it s possible so they are able to modify prices to match your risk. Most table rating systems take a normal risk class like standard and increase the regular premium payments by 25 for every step you go down the table. When you have a health issue adverse driving record drug and alcohol abuse history or occupation avocation that increases your risk a table rating may be required.

Insurance operations in latin america and the caribbean the majority of which have sovereign ratings that are lower than pan american s rating. Here s how your risk rating affects. Insurance that covers individuals that are not specifically named in an auto insurance policy.

Table ratings are numbered 1 16 or lettered a p with each grade adding 25 to a standard rate. And capitalize on innovative digital solutions to inform decision making will be most likely to thrive in the evolving life insurance marketplace. Chubb insurance company of canada.

Class 2 insurance also written as class ii insurance provides a narrower range. Rated aaa by value risk rating a colombian rating agency 8 rated locally by bank watch ratings a ecuadorian rating agency associated with fitch 9 outlook is under review for downgrade. What are life insurance table ratings and how do they work.

Experience ratings help determine the likelihood an insured will file a claim. See veralytic for more information. Life insurance ratings answer that and help set premiums.

Moody s creditview is our flagship solution for global capital markets that incorporates credit ratings research and data from moody s investors service plus research data and content from moody s analytics. Insurance experience ratings are losses an insured party has relative to similar insured parties. When you apply for life insurance an underwriter will determine if you re a good risk or a bad risk.

The ratings also consider pan american life insurance group s palig investment profile and the company s below investment grade exposure which is largely driven by the company s non u s.