Life Insurance Table D

The wisconsin state life fund is a state sponsored life insurance program.

Life insurance table d - Every company is different but life insurance agents may make 40 to 90 percent in commission of the first year premium on term life insurance. The state of. Example notation using the halo system can be seen below.

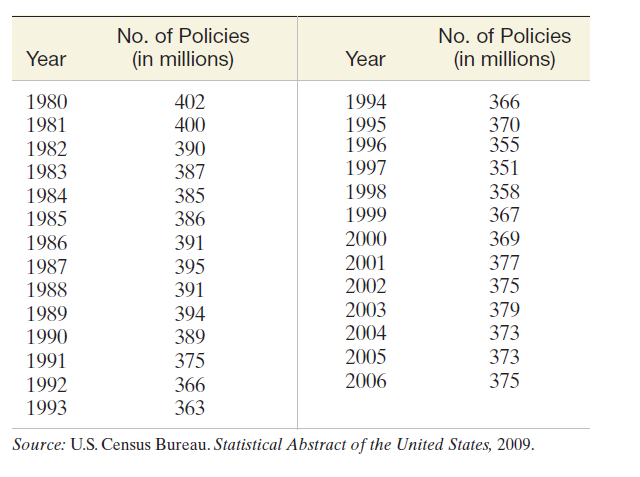

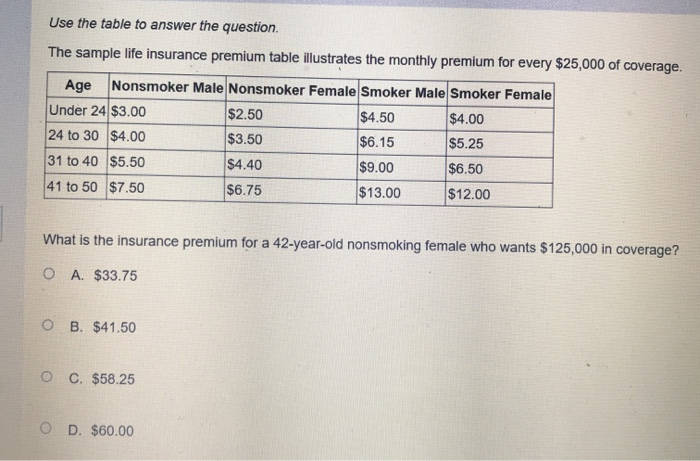

More voluntary life insurance. The first portion is. The million dollar round table mdrt is a trade association formed in 1927 to help insurance brokers and financial advisors establish best business practices and develop ethical and effective ways to increase client interest in financial products specifically risk based products like life insurance disability and long term care as of the end of 2008 the organization has more than 39 000.

Traditional notation uses a halo system where symbols are placed as superscript or subscript before or after the main letter. A special component of a universal life insurance policy is that the premium is split into two portions. In other words it represents the survivorship of people from a certain population.

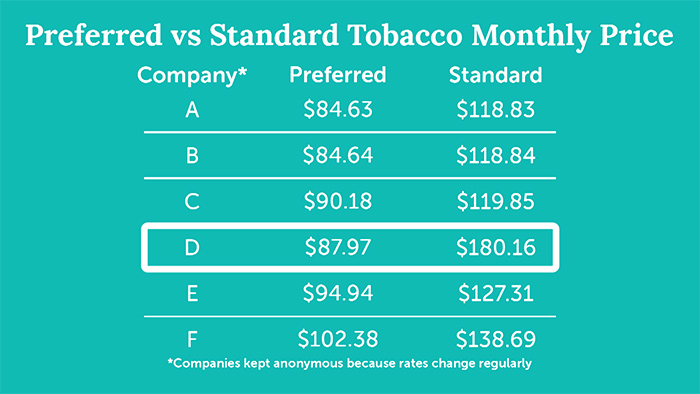

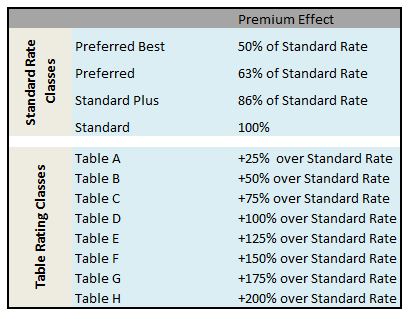

Top ranking producers may even get 100 of the full premium in the first year as commission and often 2 to 5 commission from the second to the fourth year. As an example if the standard rates were 1 000 per year the table d or table 4 rates would be approximately 2 000. A table d or table 4 rate for life insurance quotes is generally equal to the standard rating plus an additional 100 premium effectively doubling the cost versus a standard rate.

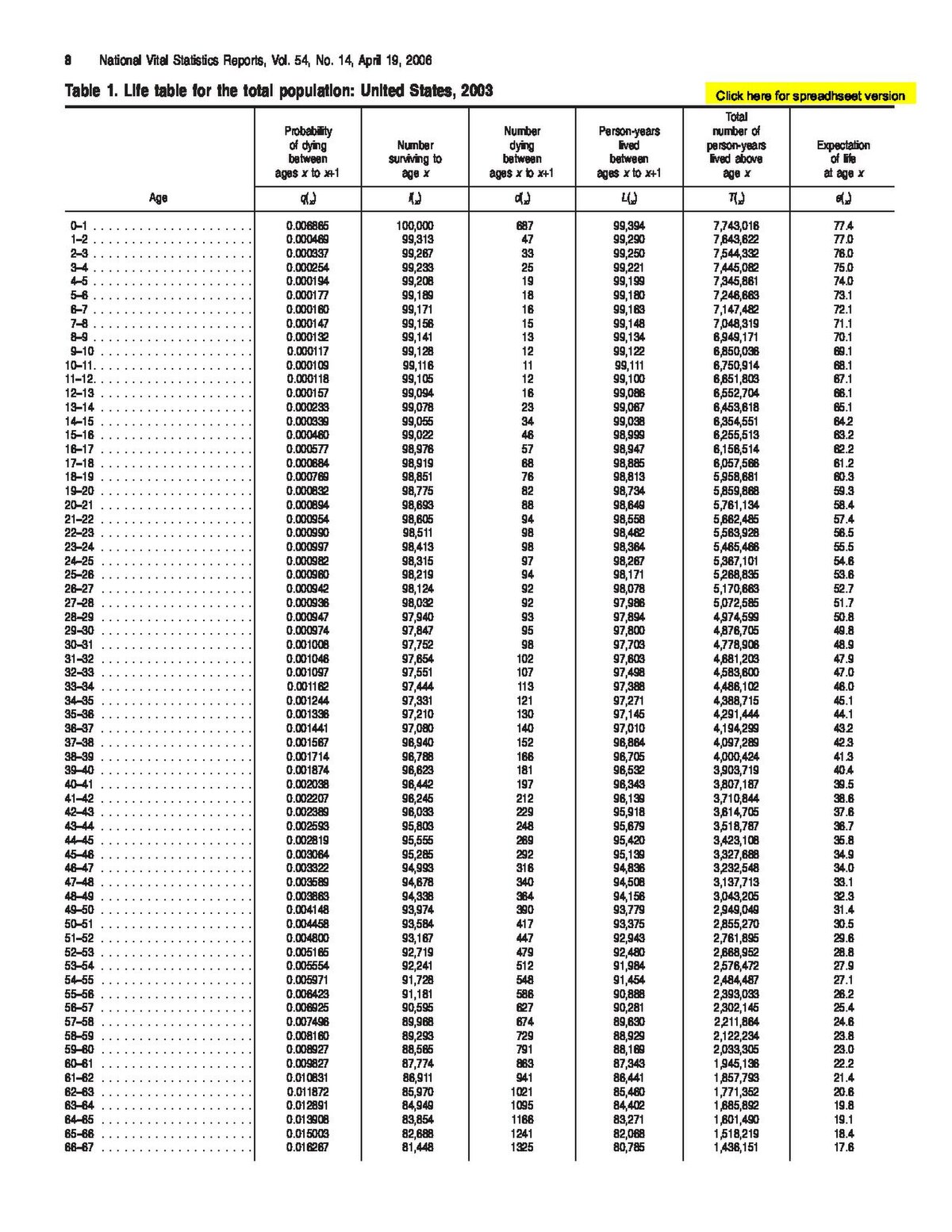

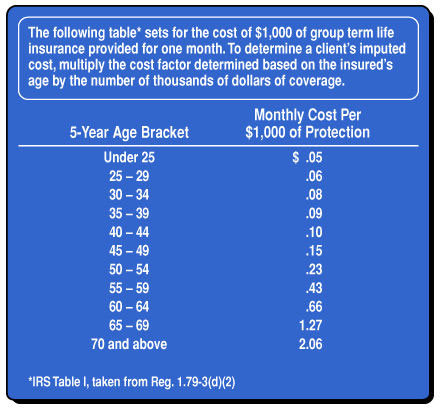

Actuarial notation is a shorthand method to allow actuaries to record mathematical formulas that deal with interest rates and life tables. Life insurance policies come in many different shapes and sizes. In actuarial science and demography a life table also called a mortality table or actuarial table is a table which shows for each age what the probability is that a person of that age will die before his or her next birthday probability of death.

A life insurance distribution system available to residents of wisconsin. Life insurance companies use mortality tables to help determine premiums and to make sure the insurance company remains solvent. Various proposals have been made to adopt a linear system where all the.

Mortality tables typically cover from birth through age 100 in one. Group life insurance is offered by an employer or other large scale entity such as an association or labor organization to its workers or members.