Life Insurance Types Chart

This type of life insurance insures two lives usually those of spouses under one policy.

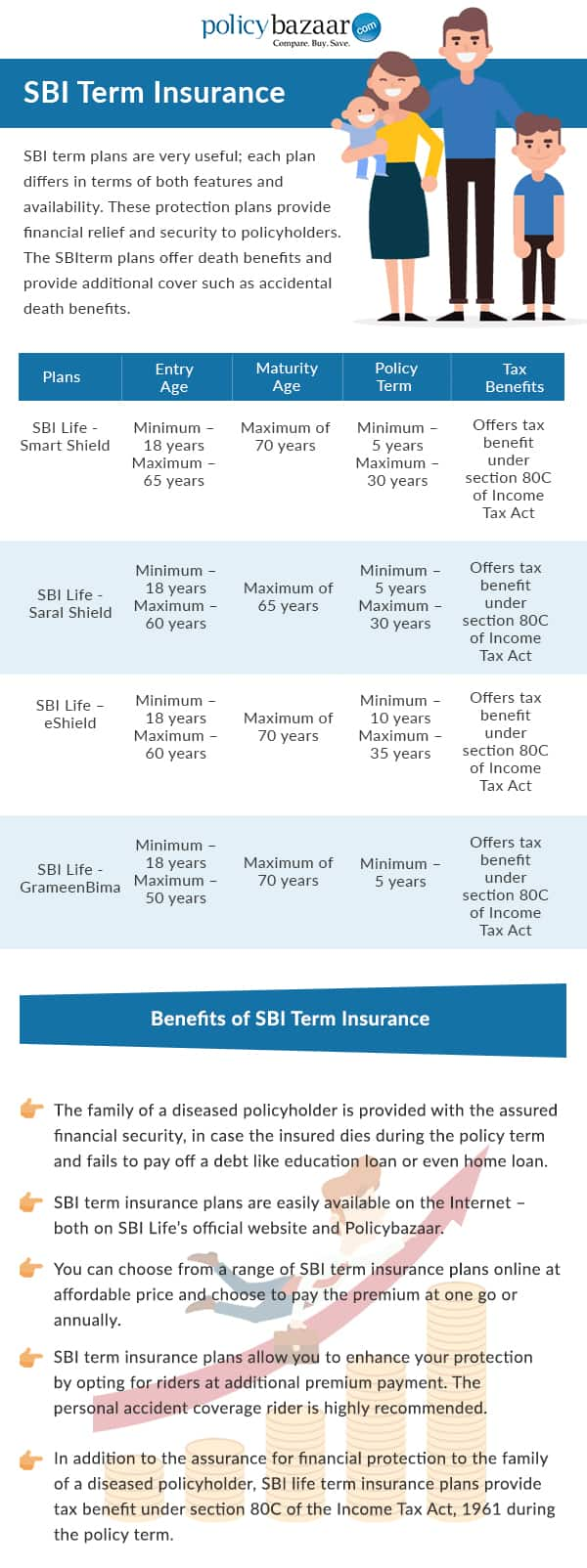

Life insurance types chart - Life insurance rates comparison chart our life insurance rates comparison charts cover several variables like the policy type age health and demographics. The policy expires at the end of the term which can last up to 30 years. Instead of just selecting a specific term and putting 100 percent of your premium toward the policy in this case part of your premium will actually go into a cash account within the policy.

There are two broad types of insurance. Pays out upon the death of the first person whichever one it is. There is also a 1 year renewable term life insurance option that is offered by many of the best life insurance carriers.

When you drive your car to work when you visit a new country when you ride your bike to a nearby shop when there s a new bug going around in town. Indexed universal life insurance is a type of universal life insurance policy that allows the policy owner to choose to invest the policy s cash value. All types of permanent or whole life insurance include a death benefit and a cash value but they differ in how the money is handled and invested.

Universal life insurance is a type of permanent insurance that covers you for your entire lifetime with a cash value component. Different types of whole life insurance. Take a look at our life insurance flow chart to help understand what type may be best for you.

Get 100 000 in coverage for as little as 6 92 month by using our free tool. No matter what type you. The life insurance company offers one or more investment options designed to match the growth rate of a well known index such as the s p 500 or nasdaq 100.

Choose protecting your family and loved ones is what life insurance is all about. And you need both in life. Understanding what type of life insurance to choose can be a difficult process.

Here are details on the most popular types of whole life insurance policies.