Life Insurance Underwriting

Life insurance companies use underwriters to look at the information gathered about you and then figure how much of a risk it would be to sell you.

Life insurance underwriting - The life insurance underwriting process has multiple steps and usually takes two to eight weeks to complete. Your application is the first step in actually getting life insurance so it s something you want to get right. An underwriter is a person employed by the life insurance company who is responsible for compiling all of the needed information about the applicant.

First an underwriter will need to determine the probability of an applicant s life lasting as long or even longer than the average life expectancy for an individual of that particular age and. Once the information is collected the underwriter then analyzes it to determine mortality risk and ultimately issues a decision on acceptance and a rating class. As a rule of thumb the healthier a person is the less risk he she poses and the lower rates he she will get.

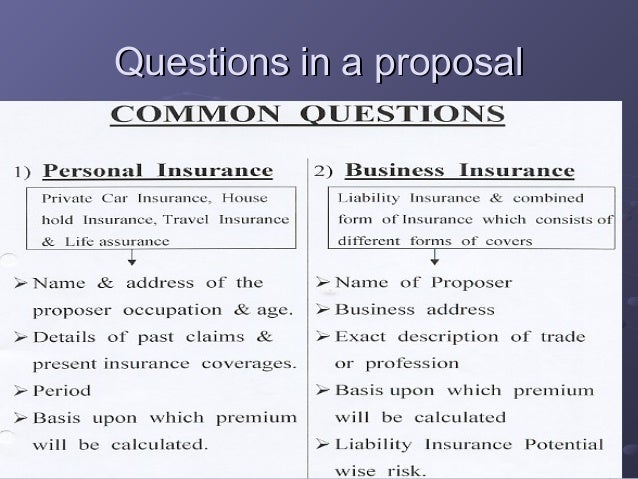

Insurance underwriting is the name given to the process of assessing your life insurance application. It determines whether it would be profitable for an insurance company to take a chance on providing insurance coverage to an individual or business. The process of integrating the complex insurance issues of estate planning taxation business insurance and employee benefit plans.

This involves finding out key details about you and is carried out by an insurance underwriter. In essence life insurance underwriting is the method through which insurers evaluate the risk a potential buyer poses in order to decide whether or not to approve deny or rate up a life insurance policy. All of the steps and information gathering ensure that happens in order to help you provide for your family.

Insurance underwriting is the process of evaluating a company s risk in insuring a home car driver or an individual s health or life. Before life insurance underwriting even begins the carrier will go through your application to make sure all of the correct information is there. What is life insurance underwriting.

There are numerous factors considered when underwriting a life insurance policy. The underwriting process is there to help ensure an appropriate amount of coverage for your family s financial situation. Advanced life underwriting can.

Factors considered when underwriting a life insurance policy. It s not uncommon for applications to be accidentally incomplete.

/what-is-insurance-underwriting-264577-FINAL-6fe41c1991cd4cd18460a0d211f490e0.jpg)

/insurance-underwriter-job-description-salary-and-skills-2061796-Final-99e6693dac354876a0e9eb470b469131.png)