Life Insurance Value Chain

Responding to the economic and business impacts belt and road cyber entrepreneurial and private business greater bay area outbound investment.

Life insurance value chain - The typical life cycle of an insurance product consists of the following. In fact blockchain s potential role in insurance is wide and deep. The life insurance industry is stagnant.

Product design and marketing. The good news is that both life and p c carriers have increased labor productivity in all areas of the value chain through investments in automation and improved sourcing exhibit 2. Life insurer reaches out to millennials with product testing challenge.

How to build analytics into the insurance value chain undiscovered opportunities insurance analytics 2. Insurance value chain 1. 6 modernizing the insurance value chain.

As the insurance industry continues to consolidate and restructure achieving profitable growth is key to long term survival. Insurance life sciences and healthcare private equity technology media and telecommunications services audit and assurance consulting deals new ventures risk assurance tax issue based services covid 19. Google launched its google compare aggregation tool in uk and us markets in 2012 and 2015 respectively.

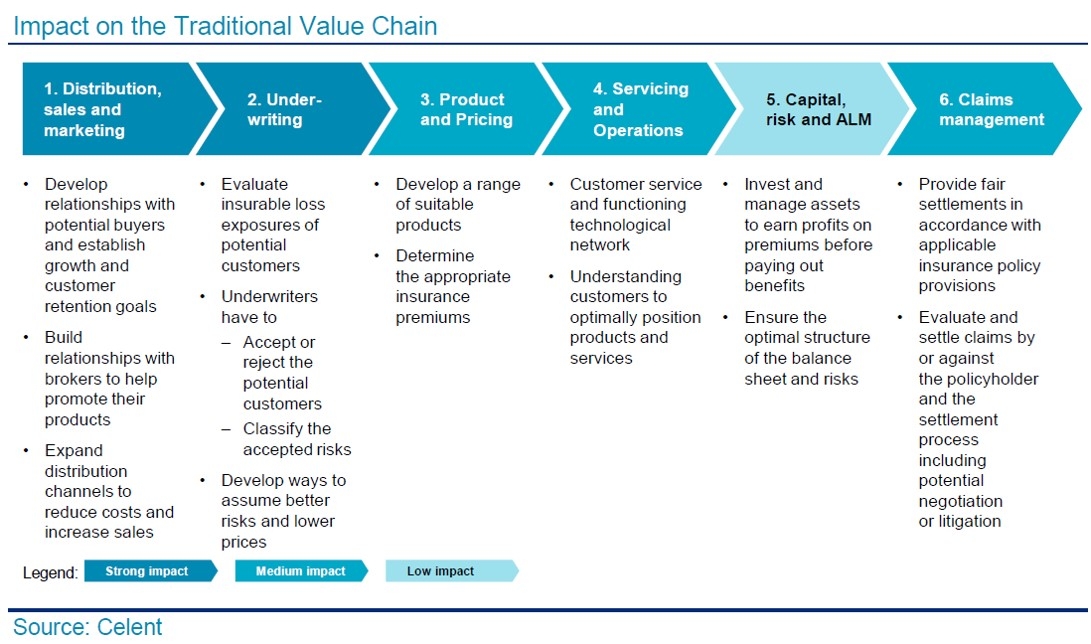

To highlight where opportunities lie we performed a detailed analysis of the costs and full time employees ftes along the industry value chain isolating the. By using value chain analysis china life insurance company limited can select and source premium quality raw material and develop customer loyalty on the basis of it. In life insurance 2020.

It can be leveraged across the insurance value chain due to its ability to reduce duplication of processes and counterparty risks as well as enhance process automation and provide secure and decentralized transactions. The industry faces product commoditization and a lack of relevance with younger customers. Ecosystem players such as amazon and google are well positioned to permeate the distribution part of the insurance value chain.

Closing the loop of the life insurance value chain. Competing for a future we examine the developments that are set to have the most decisive impact over the next five years and the main opportunities for innovation. Oliver wyman combines strategic analysis tools with extensive information on different businesses markets and value chain activities to help insurers design strategies that give them a competitive edge.

And they have shown intent. To explain how we have delivered value in the underwriting process we first take a step back to describe how we view the insurance value chain within life insurance firms. Top three digital imperatives digital business real world engagement.

:max_bytes(150000):strip_icc()/Portervaluechainoutline-446e5e48a68b402e8c5e042f21350993.jpg)

/Clipboard01-8f23b0bd8fbb4aef80fb84caa8fdbea2.jpg)