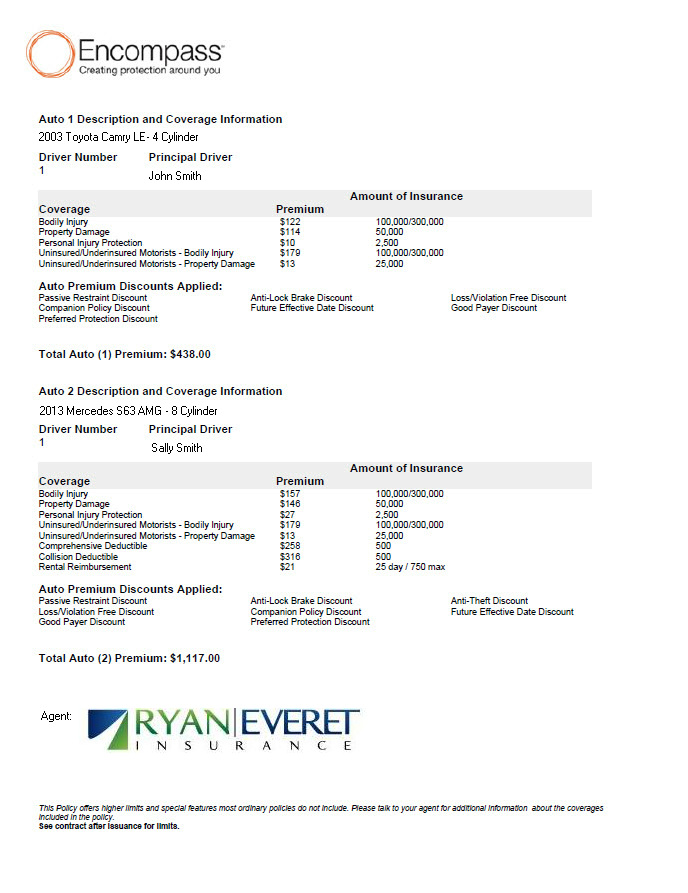

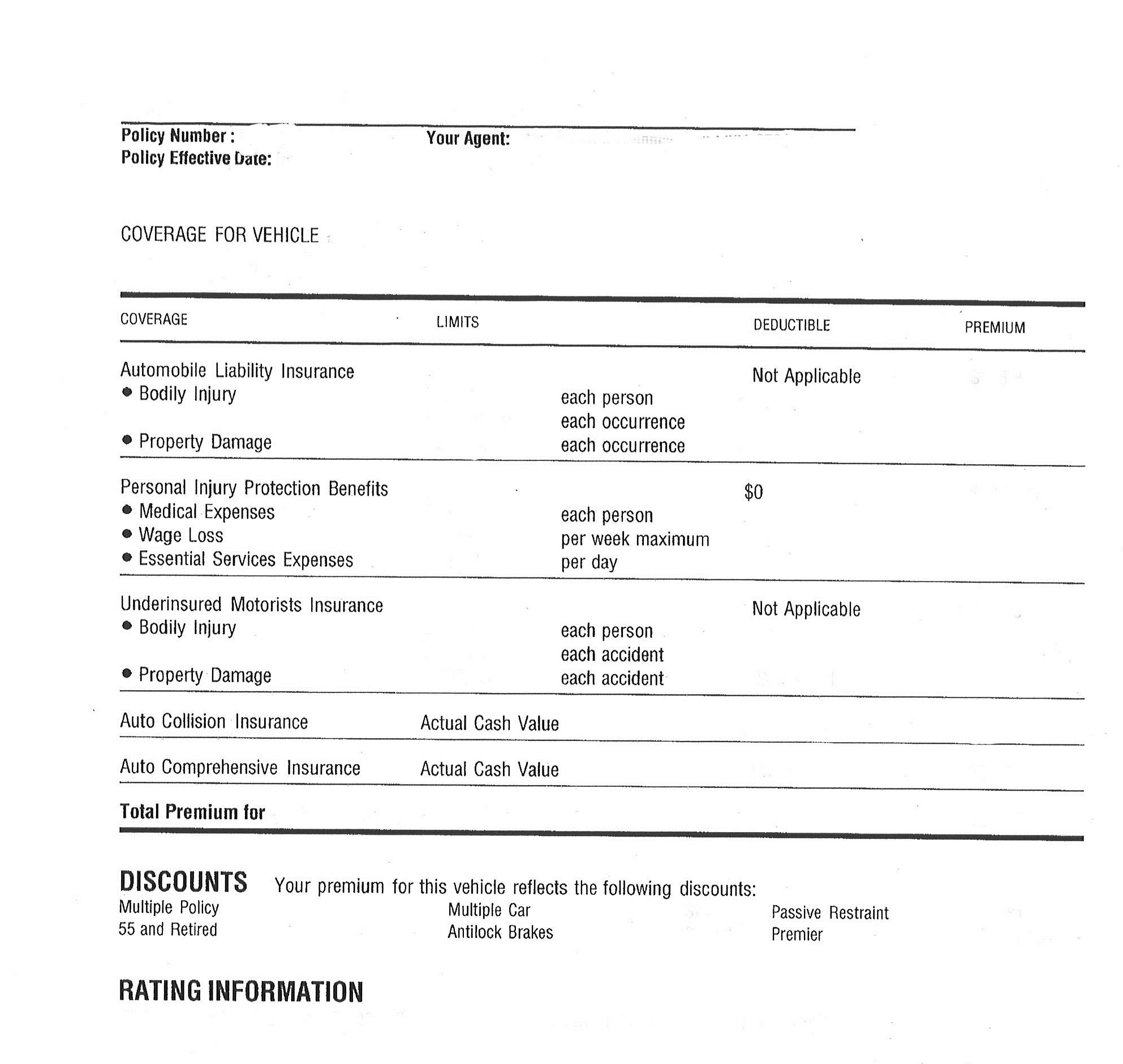

Sample Car Insurance Declaration Page

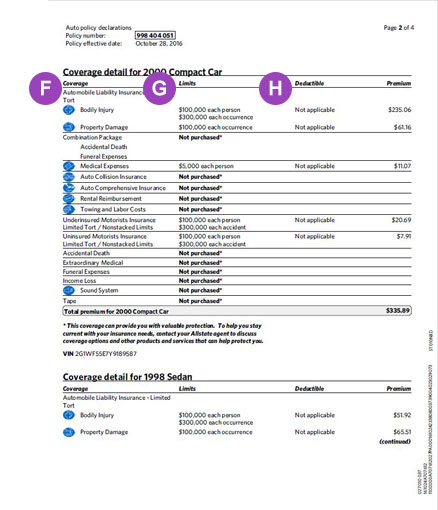

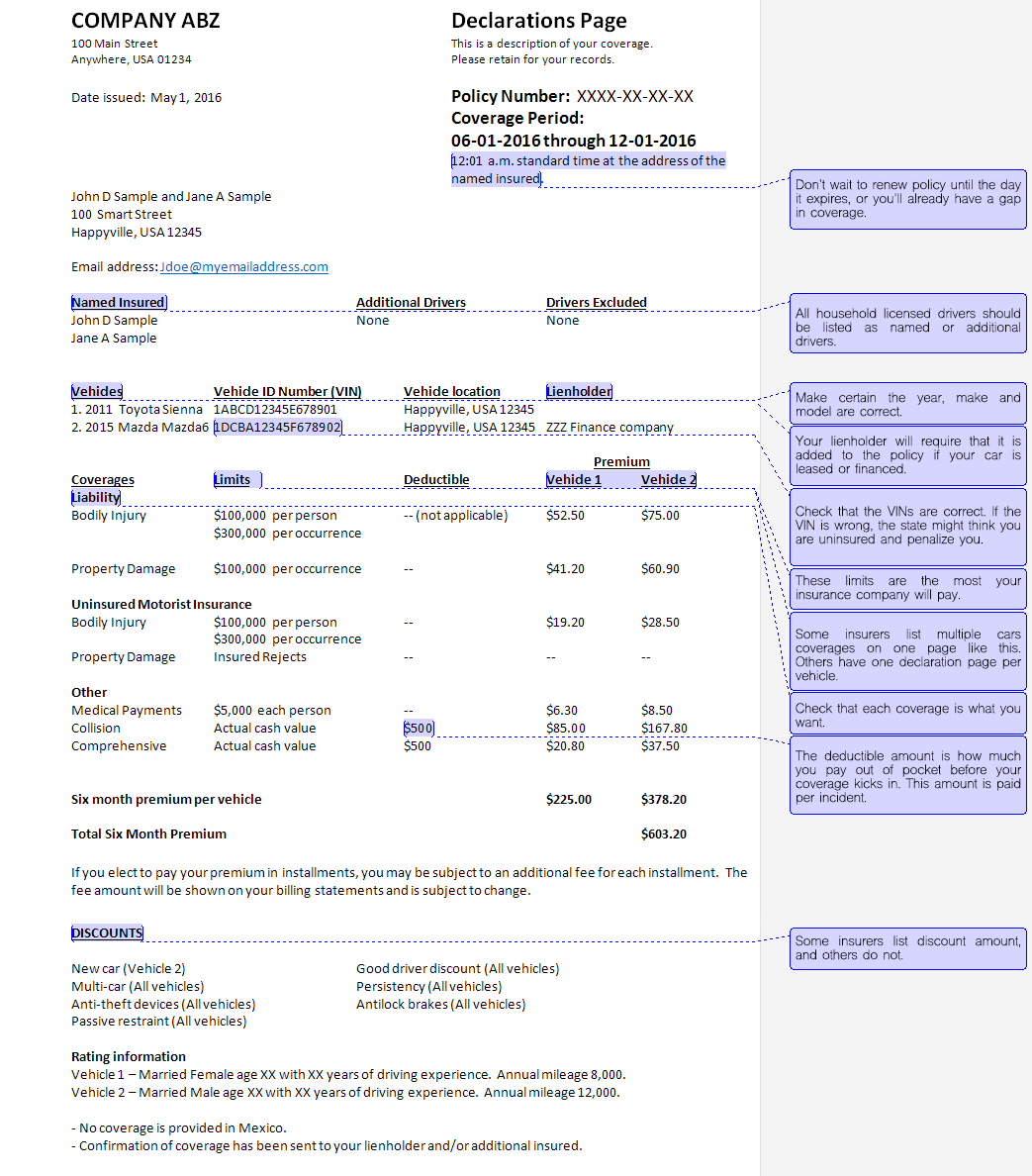

Section ii displays your liability coverage types.

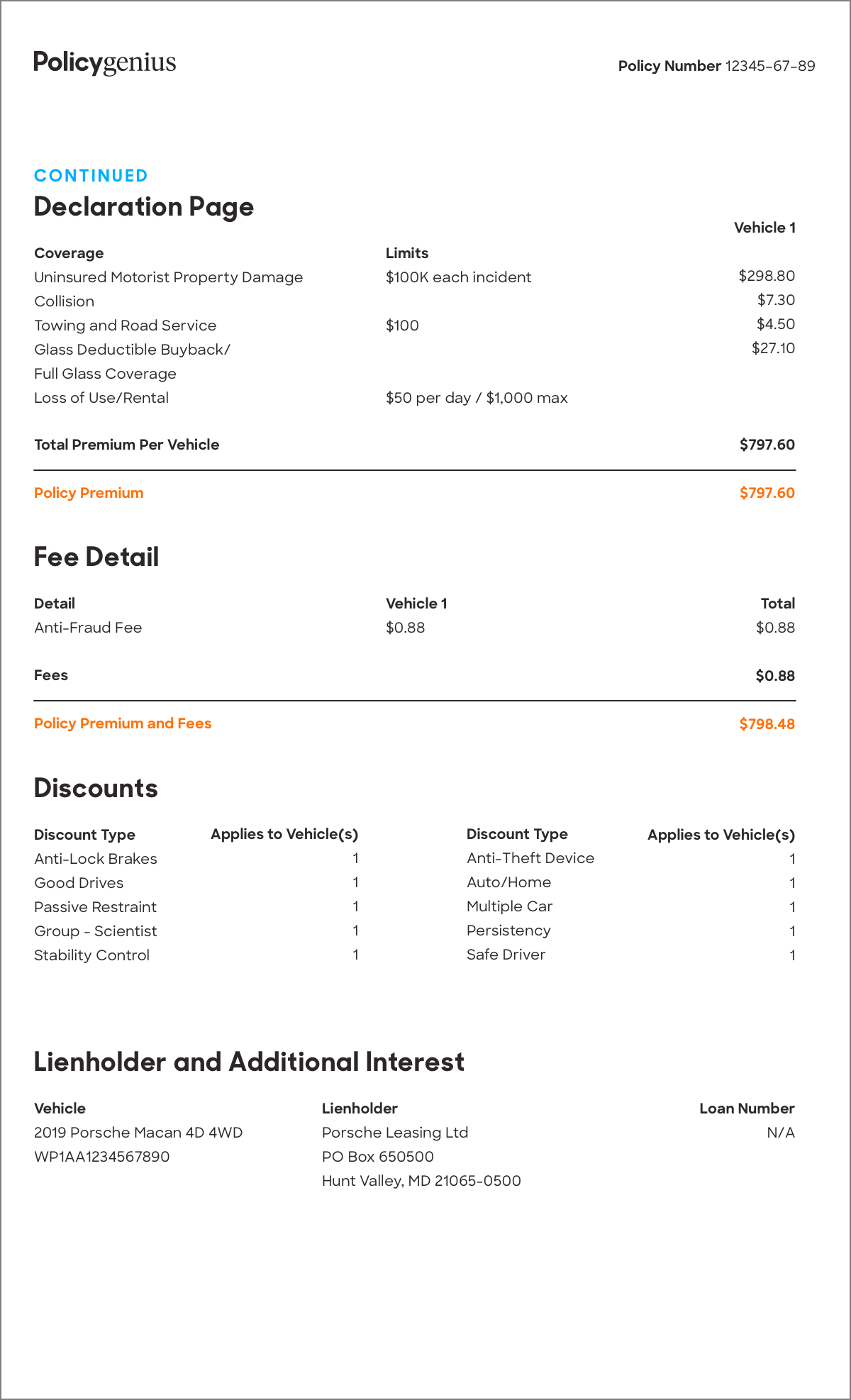

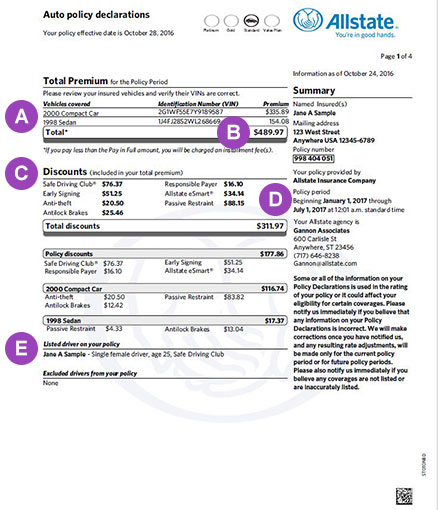

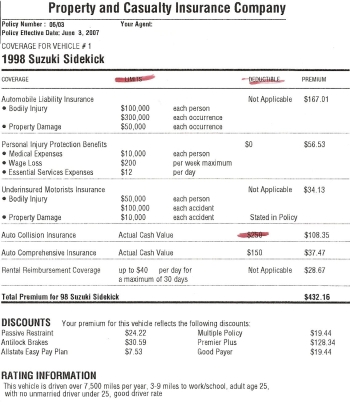

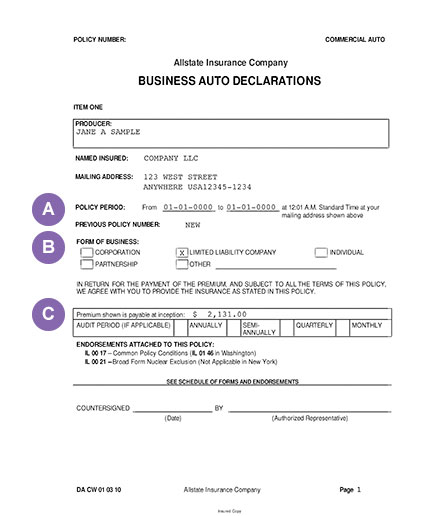

Sample car insurance declaration page - The declaration page also includes endorsements additions to the policy beyond the basic coverage already described. The binder of insurance is only a temporary document meant to outline the coverage that is confirmed when you receive your insurance declaration page and policy wording and can be shown as proof of insurance for a new car purchase for example. When you buy insurance coverage the insurance company gives you a document explaining exactly what you re paying for and how much it costs you this is your insurance policy and you can think of it as a glorified receipt.

Car insurance unlike your car itself is not a tangible object. It can also list the insured vehicles insured drivers and dates your policy is effective as well as any discounts you received. The only physical thing you get when you purchase car insurance is a whole lot of paperwork referred to as your policy within every insurance policy comes a declarations page or declaration page for short.

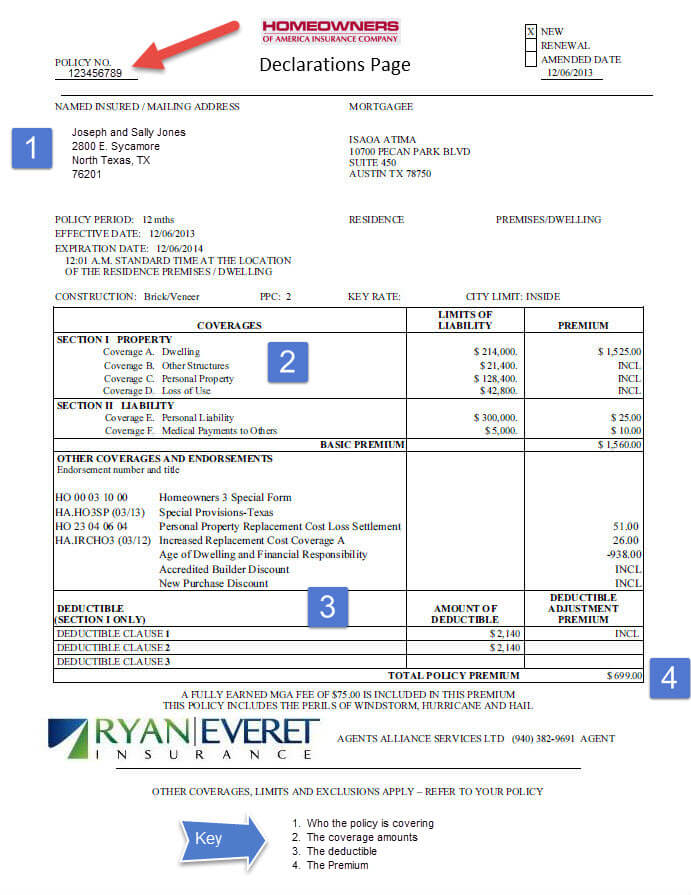

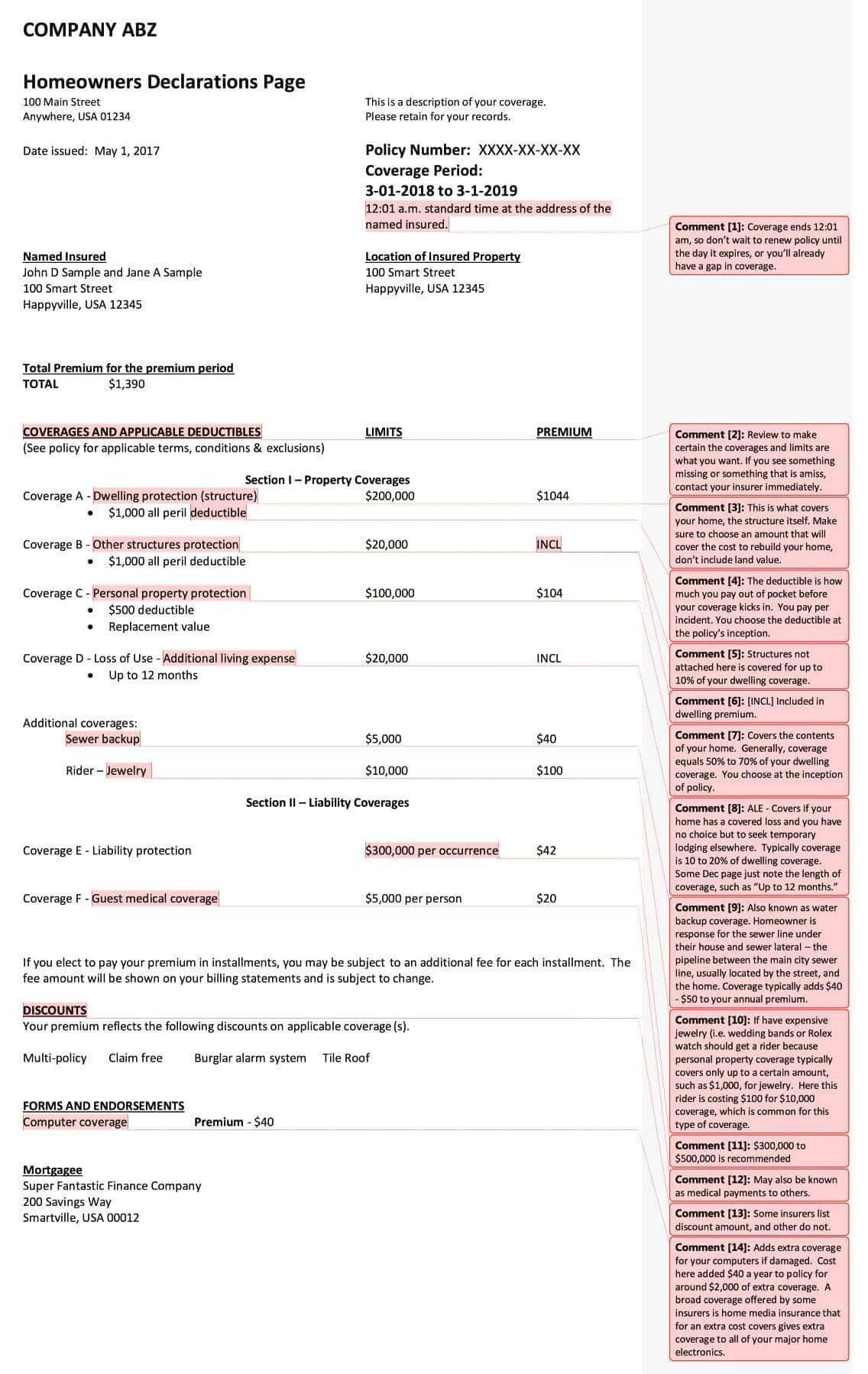

While important insurance policies are confusing and intimidating to read. In the sample homeowners declaration page the insurance company will cover living expenses under loss of use coverage for up to 12 months with limits up to 40 000. They are filled with unfamiliar legal and financial jargon and are written in as specific a manner as possible.

To use the example of car insurance again the insurance policy could state that the car also has an auto glass endorsement specifically covering damage to the windows and a towing package which will cover towing of the vehicle in the event that it is disabled. Understanding the layout of the declaration page can make it much easier for you to find the information you need on your policy if you need to file a claim. A car insurance declarations page explains how much your car insurance costs and how much you re getting for what you pay.

When it comes to having proof of homeowners coverage and understanding your policy specifics there is nothing better than a homeowners insurance declaration page. An auto insurance policy declarations summarizes your policy and the coverages limits and deductibles you ve chosen to purchase. Your insurance declaration page.

It has the amount of car insurance coverage you purchased in each component liability personal injury collision and comprehensive and uninsured underinsured motorist coverage any optional coverage and any discounts you get. The car insurance declaration page is arguably the most important part of your auto insurance policy as it summarizes the coverage available to you. You can see that the premium for this uninsured motorist coverage represents only 11 of the total premium.

250 000 per person 500 000 per accident. It spells out the agreement you ve struck with your insurer in black and white.