Sbi Life Insurance Term Plan

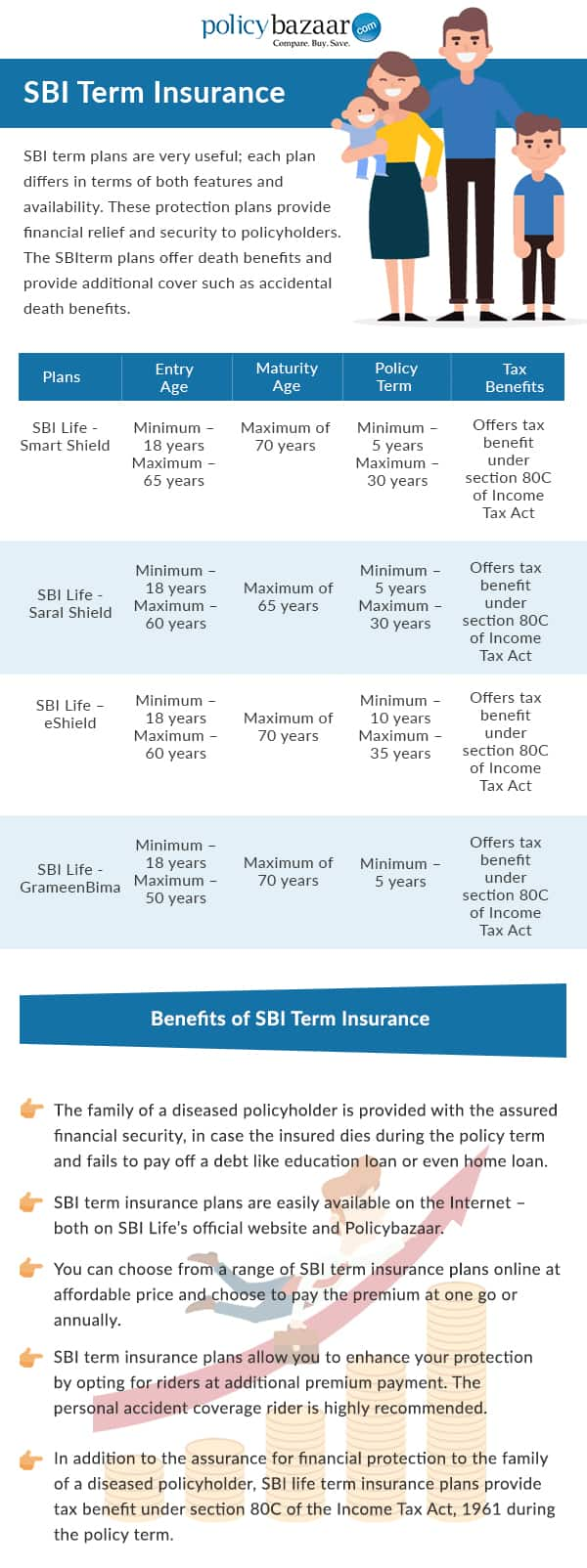

Sbi life insurance company offers a variety of term plans to individuals and each plan differs in terms of both features and availability.

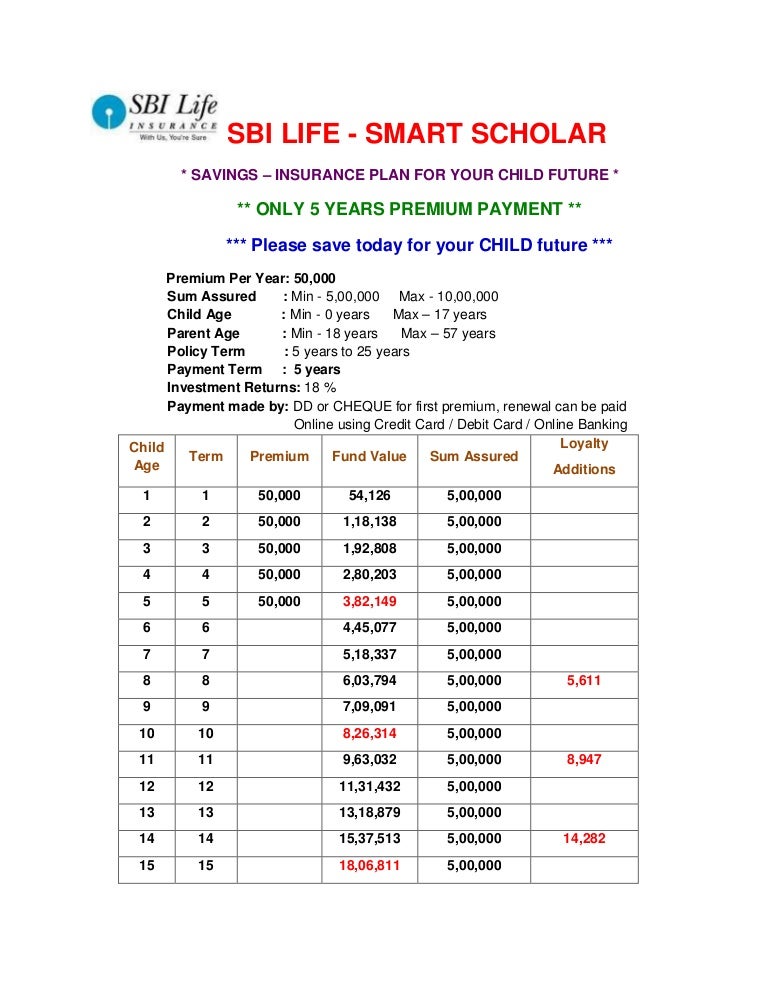

Sbi life insurance term plan - Sbi life insurance provides unit linked plans child education plans pension plans term insurance plans endowment plans and group plans. While some sbi term insurance plans can be bought online at a lower premium other sbi term insurance plans are available offline and can be easily availed from other marketing channels like agents brokers bancassurance channel etc. Let us see the key benefits.

The minimum entry age is 18 years and maximum maturity age 65 years to opt for. Sbi life smart swadhan plus plan. Sbi life eshield is a pure term policy with the best financial protection at an affordable cost.

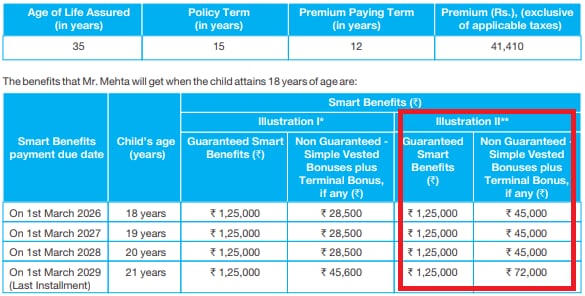

Compensation of 100 return of basic premium on maturity. The company offers customized plans for salaried self employed professional and business persons. Check key features review eligibility premium calculator benefits of online term plans from sbi life the term plans from sbi offer only death benefits but also provide riders that offer additional cover such as accidental death benefits.

Sbi life insurance policy term plans premiums reviews benefits in india. Buy online term insurance plan that offers comprehensive protection for your family. Online term plan affordable premiums protection benefit.

This term plan offers. This sbi life insurance term plan is a non linked and non participating term insurance plan with a guaranteed return of premium along with coverage for life. Free compare online and buy best sbi life policies from wishpolicy.

Sbi life insurance plans cater to individuals aged from 18 years up to 65 years. Sbi life smart shield is an individual non participating and non linked pure term insurance plan that provides financial security to your family in the case of death. Apply for sbi life smart shield an individual non linked non participating life insurance pure risk premium product and get peace of mind knowing that your family is financially secured.