Top Up Health Insurance India

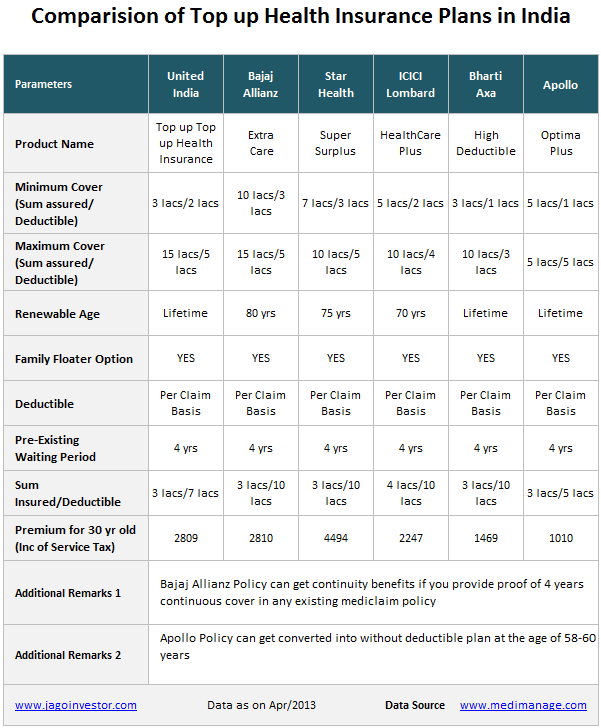

Which is the best super top up health insurance plans in india.

Top up health insurance india - Policybazaar does not endorse rate or recommend any particular insurer or insurance product offered by an insurer. Super top up insurance covers floater option cashless hospitalization etc. What s great about a super top up plan is that it covers claims for.

So if you want to buy a super top up plan you need to own a regular health plan. The second important aspect you have to choose is both the base plan and super top up plans commencement date should be as nearer as possible. A super top up health insurance plan is like an extension of a health insurance you can use when you ve already used the maximum claim amount during the year in your corporate insurance or are largely okay to pay some amount from your pocket but need a health insurer to cover for you when things get pricier.

Our extra care top up health insurance policy takes care of the expenses caused due to hospitalisation and medical treatments. Top up super top up of tata aig health insurance. Hence it is ideal to opt for a top up plan that comes in handy during medical emergencies and offers extra care and protection.

Best super top up health insurance plans in india. The best strategy while choosing the top 5 super top up health insurance plans in india 2020 is to have both the base plan and super top up plans within the same company. A complicated medical condition can consume your entire health insurance cover in one go.

This creates easy claim processing. All you have to do is present the religare health card at our network of more than 7800 leading hospitals pan india and avail cashless service. Top up plans are offered by several insurers and you can even buy from your existing health insurance provider.

However what may seem to be best for someone may not be the best choice for you. If you talk about premium only liberty health connect supra and max bupa health recharge seems to be the best. Top up super top up of oriental health insurance a super top up policy is an additional cover that a policyholder invests in to expand their health insurance coverage.

Buy top up health insurance plan with an additional sum insured to counter any medical emergency. Super top up health insurance comes to the rescue when a single claim does not cross the deductible limit of the top up policy but multiple claims do. Get a super top up health insurance plan to enhance coverage of your existing insurance policy.

And a top up medical policy is a feasible option for people who are covered under an individual health insurance policy or a group health insurance policy. Health top up plan. It increases the sum insured limit of your existing health policy so you can deal with an expensive medical emergency situation.

A super top up plan works as a supplement to your primary health insurance policy.