Whole Life Insurance Cost

First of all if you are looking for a 10 000 quote ten you will only be able to get one type of policy.

Whole life insurance cost - The insurance providers will electronically review your records before approval. Several factors go into the cost of your life insurance rates. Whole life insurance rates chart.

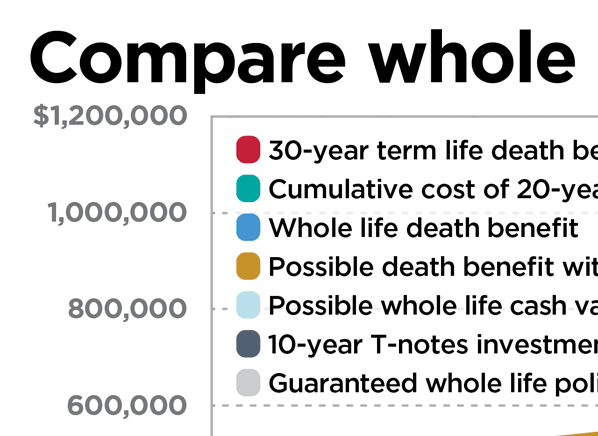

As a consumer you know that there is a lot that goes into comparing policies and companies. When you compare this to the annual cost of whole life insurance below you ll see that premium payments for a whole life policy are a lot higher. The whole life insurance rates by age charts below are examples of what you can expect to pay for a typical policy.

Keep in mind that when purchasing a whole life insurance policy the insurer will set up quotes based on paying your premiums until you re 65 99 and 121. These rates are available to qualifying applicants in average or better health and do not require a medical exam. Stranger originated life insurance or stoli is a life insurance policy plan that is held or funded by a person that has no connection to the insured person.

Most companies do not offer term policies for 10 000. Term life insurance is generally less expensive because of its length of coverage. Each employer has their standards for porting a policy.

The average life insurance rates including the average whole life insurance rates change drastically by age. You may think you can get a 10 000 term policy but in reality that will be very difficult. Term life lasts for a set amount of time whereas whole life is guaranteed for your entire life.

Cost of whole vs. The average person spends 169 month on a 500 000 term life insurance policy while the average cost of a 500 000 whole life insurance policy is 644 month. Whole life insurance rates.

The plan holder generally pays a costs either regularly or as one round figure. A younger applicant will have lower costs than an older applicant. Updated april 20th 2020.

The whole life insurance rates chart below provides pricing for males and females between the ages 35 and 75. Whole life insurance is more expensive than term life insurance because in addition to paying premiums for the death benefit policyholders also contribute to the cash value of their policy. If you want to get the best whole life insurance rates you are going to have to do the research the good news is we have done all the research for you.

Starting at around 30 years old you can expect to pay an average of 100 a month for 100 000 of whole life coverage. Whole life insurance rates comparison. Best term life insurance.