Zero Dep Car Insurance Cost

How is zero depreciation car insurance premium determined.

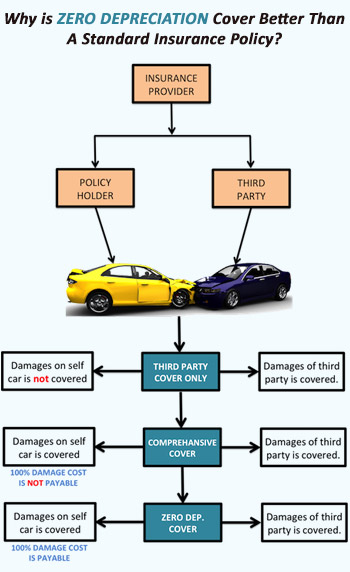

Zero dep car insurance cost - Hence zero depreciation is a good buy for any car owner provided the extra premium does not pinch. This means that if your car gets damaged in an accident you will receive the entire cost from the insurer. Policy hidden untold conditions explained.

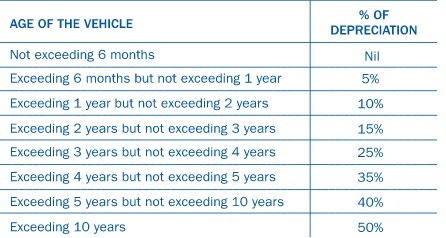

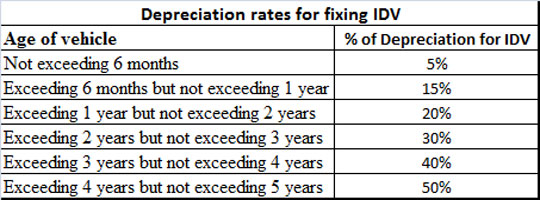

This cover is highly beneficial for car owners as it ensures no deduction on account of depreciation for replaced parts in case of an accident. Depreciation is deducted on these parts and even upto 50 in case of repainting cost. Plastic fibre rubber parts.

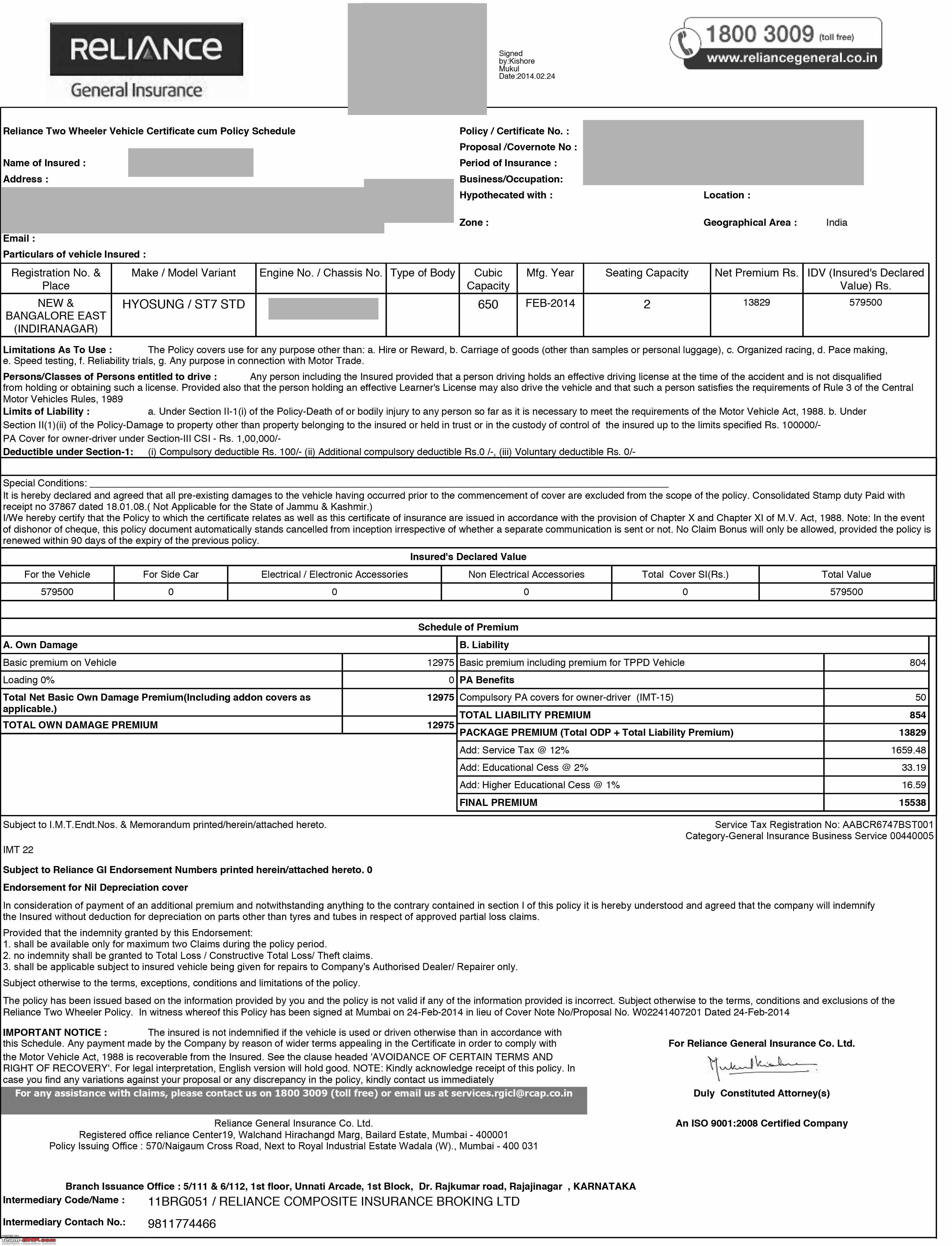

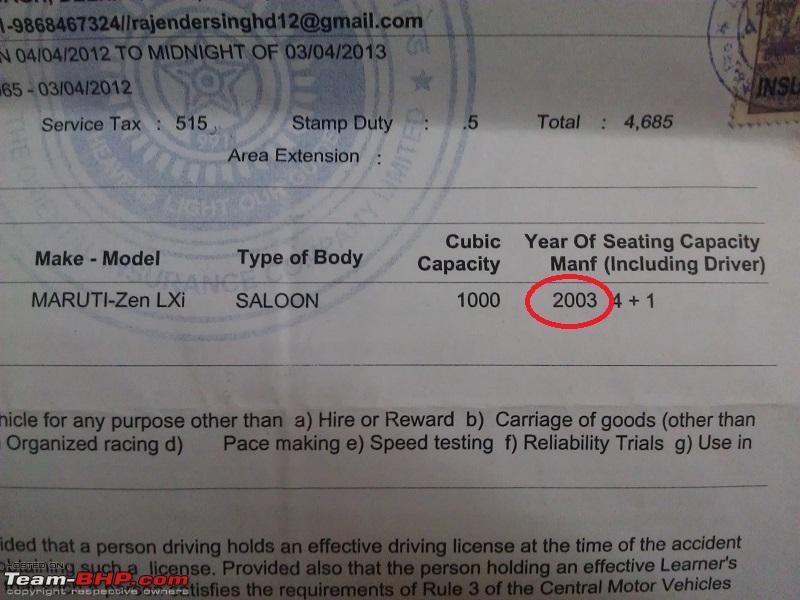

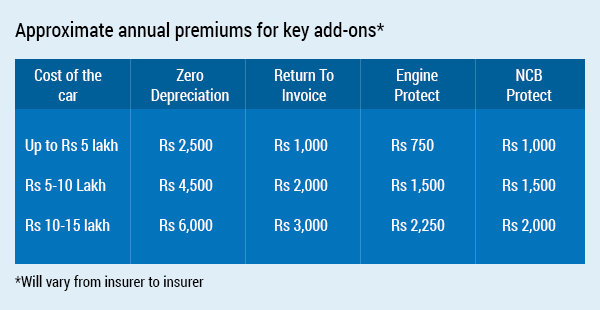

So in other words only new cars are eligible for 0 depreciation car insurance. While car insurance premium generally depends on the car s age model and location the additional premium for the zero depreciation cover could be up to 20 of a standard car insurance policy. There are certain things which you need to consider while buying a zero dep add on cover.

As compared to a regular car insurance policy zero depreciation car insurance will be slightly more expensive in terms of premium. Zero deprecation is an attractive prospect for customers who want a smooth claim settlement in the future along with peace of mind. Here are some of the tips to explore the benefits of zero dep car insurance policy.

Zero dep insurance also known as bumper to bumper car insurance a car is made up of several components. Plastic fibre rubber parts. With zero depreciation add on when you file an insurance claim due to damage loss to your car the insurer covers the entire cost without accounting for counting in the vehicle s depreciation.

Icici lombard car insurance policy offers zero depreciation cover that is it provides coverage on replaced parts with no deduction for depreciation for the first two claims in a policy year. Cost of policy. The car insurance zero depreciation policy is applicable to cars under the age limit of 3 years.

Factors that are taken into consideration while calculating zero dep car insurance premium place of registration the cost of the premium is higher in all the major cities like delhi bangalore mumbai chennai ahmedabad kolkata and pune as compared to other cities. Consider the age of your car.