Zero Dep Car Insurance Price

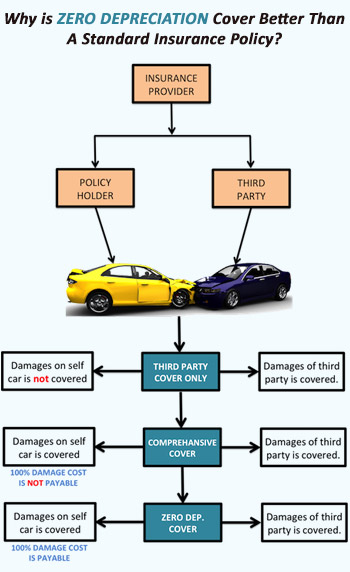

Is the all encompassing car insurance policy inclusive of add on covers and protection against financial liabilities arising from a number of common everyday scenarios.

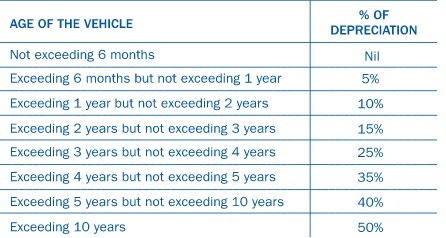

Zero dep car insurance price - Factors affecting car insurance zero depreciation. Also includes cover on emergency transport and hotel expenses key replacement. The depreciation value of the replaced or damaged parts is usually deducted at the time of claim but with zero dep policy one can claim the full amount.

In zero dep car policy all plastic fibre rubber and metal parts are covered at its 100 of the actual price without any depreciation cut. How a zero dep car insurance policy benefits you during claims. Zero dep insurance cover also known as zero dep policy is a type of insurance cover which offers complete coverage without factoring in depreciation value of the vehicle.

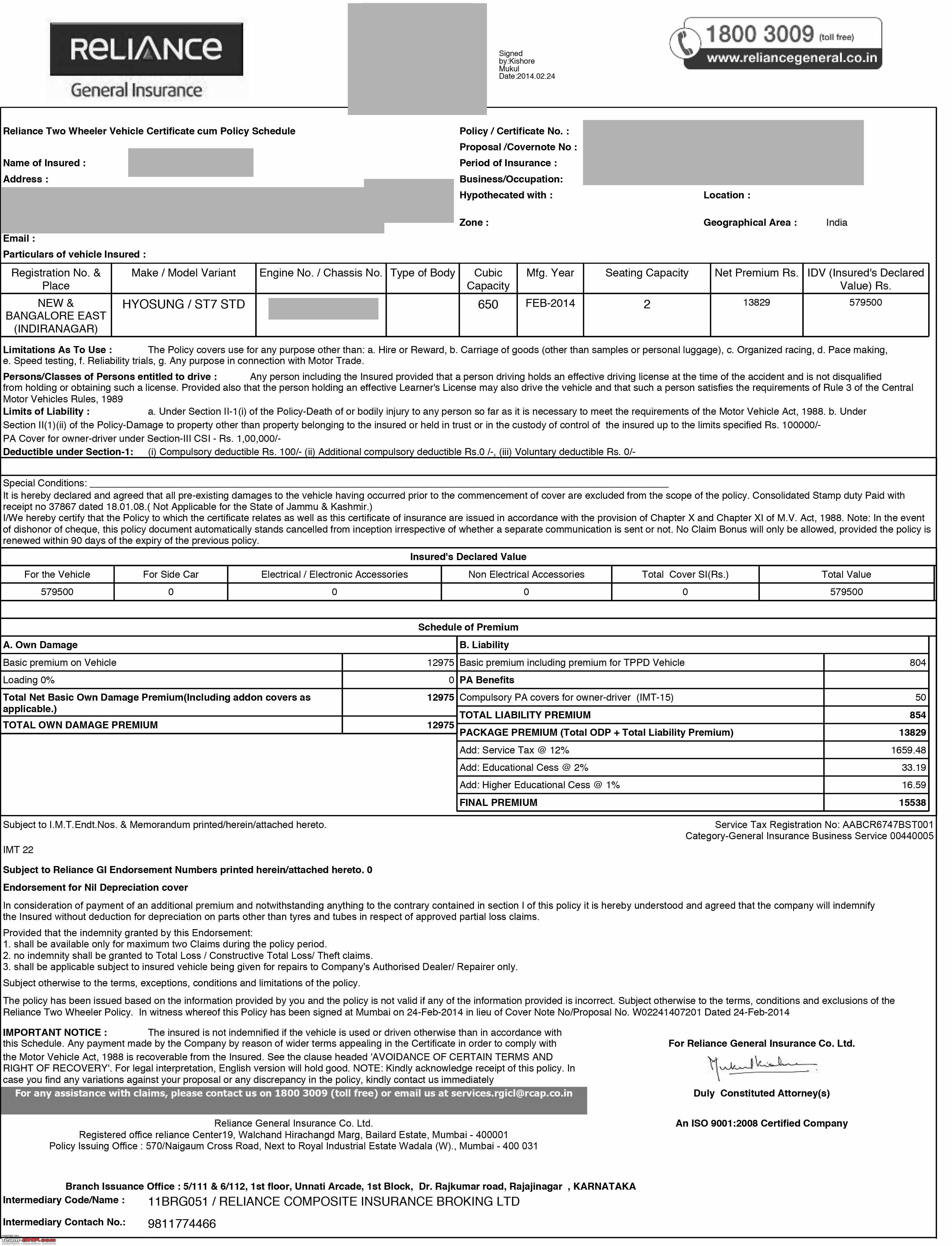

It shifts the liability of bearing the depreciation of your car and its parts from you to the insurance company. A zero depreciation add on cover also known as nil depreciation and bumper to bumper cover is a popular car insurance add on cover which is most commonly opted by car owners along with their comprehensive car insurance policy. In a zero depreciation policy the insured gets the total cost of the damage or loss that is caused to the insured car.

This is where zero dep car insurance comes into the picture. The main role of a zero depreciation cover during claims is to save the money you d be spending from your pocket. Zero depreciation car insurance.

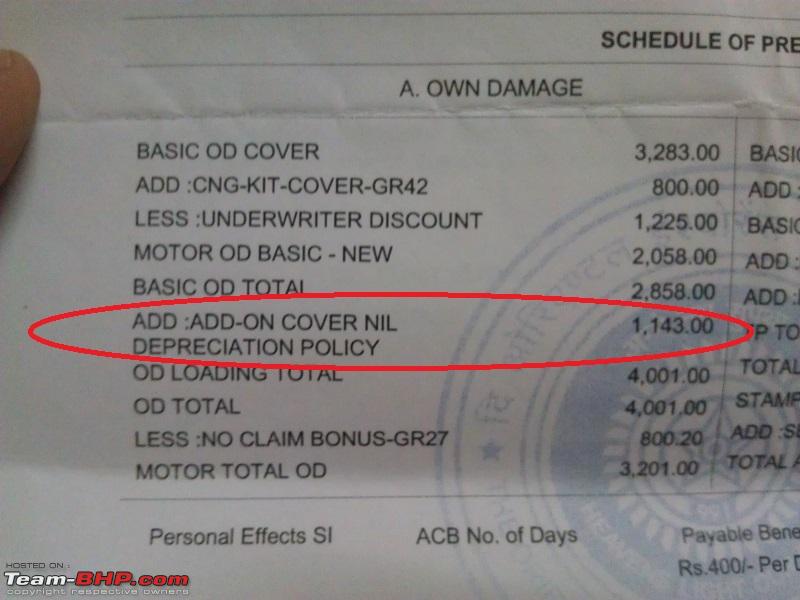

Zero depreciation cover is simply an add on cover which complements the basic car insurance policy. Zero depreciation car insurance. Contrary to its nomenclature comprehensive insurance coverage does not foot the entire bill of your car insurance claim.

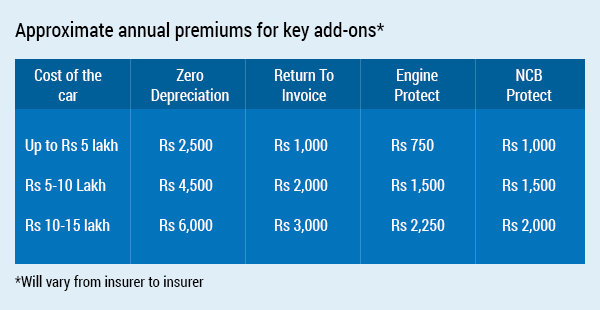

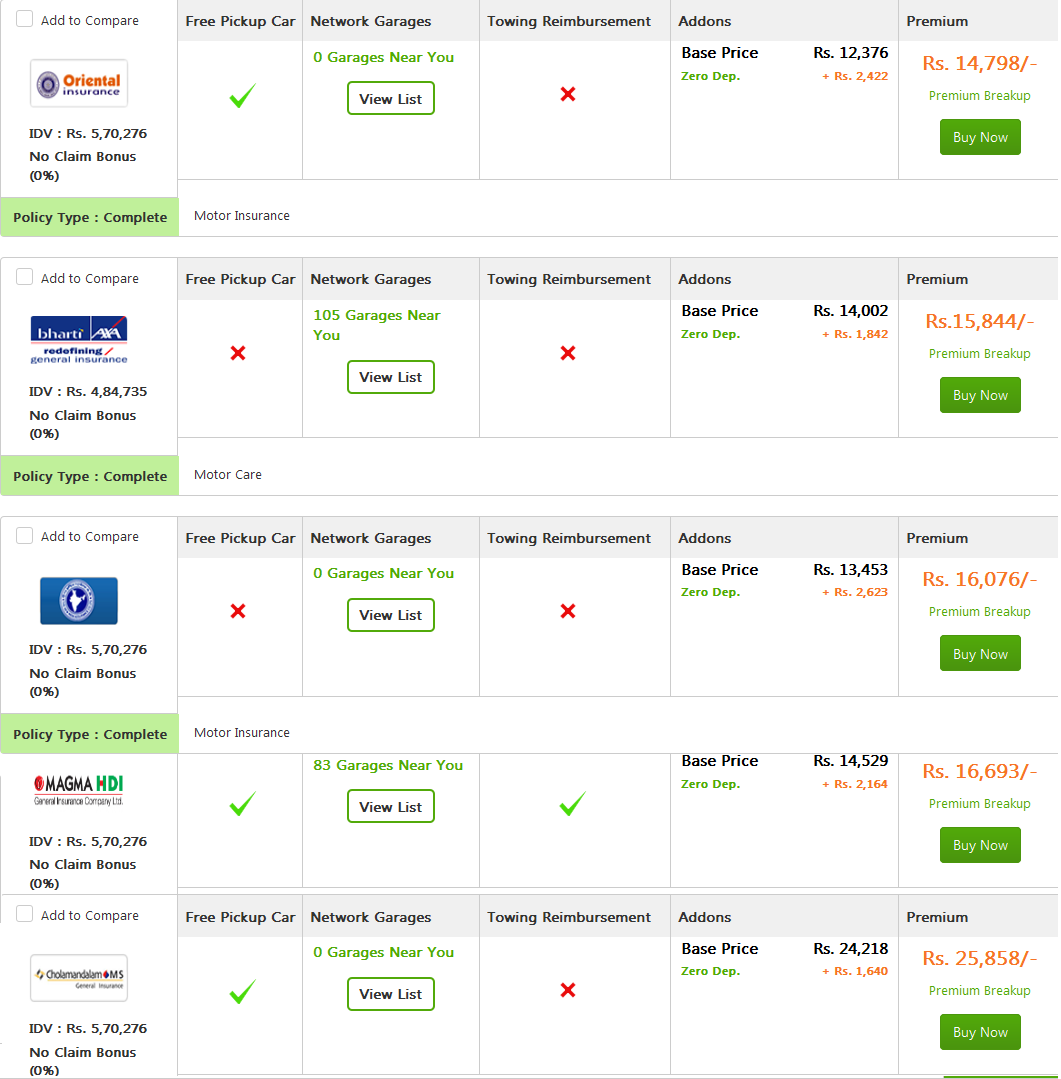

As this is an add on cover that has to be purchased over and above the comprehensive car insurance cover the premium to be paid is slightly higher than a normal policy. Zero dep car insurance. Comprehensive car insurance policy.

The premium for a comprehensive car insurance is slightly less as compared to a policy with zero dep cover. A zero dep policy would cost you additional premium compared to a comprehensive policy although the benefits justify the additional cost. If your total claim amount payable is rs 20 000 and the total cost of your car s part depreciation is rs 6 000 then without having a zero depreciation cover your insurer will account for this cost and only pay you rs 14 000.

Which means that out of an x amount of repairs you will need to pay a percentage of the same. Acko general insurance offers zero depreciation add on cover only for cars not older than 5 years.