Application For Car Insurance Claim

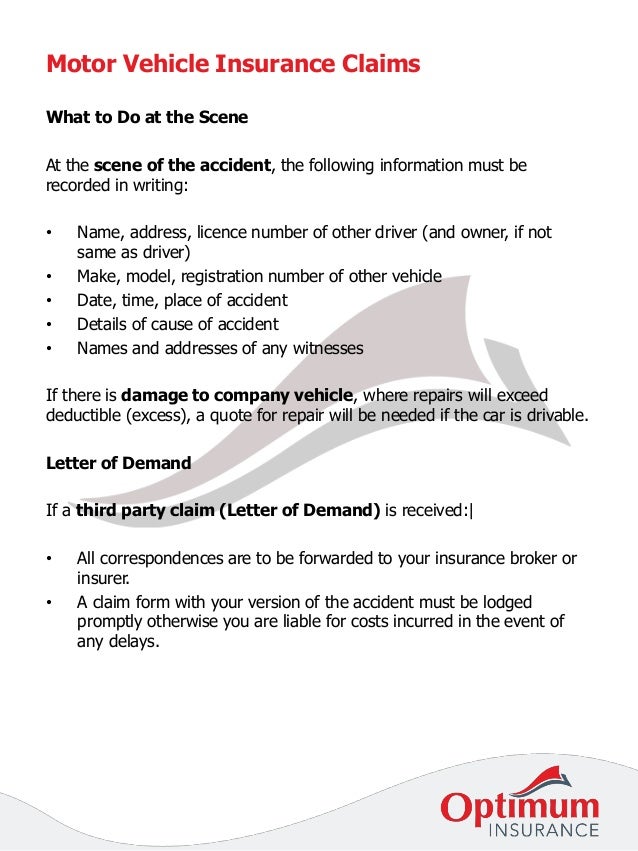

Take note of all the details of the driver involved such as name phone number and address.

Application for car insurance claim - Below is a sample insurance claim letter for a car accident. Keep in mind that state laws vary so some claims or expenses may not be eligible for subrogation. Insurance claims cover damages sustained after a car accident or for representation or intervention on the insured s behalf when they are liable for damages.

It should be a formal business letter and may be sent by certified mail to the claims adjuster. Check your proof of insurance most proofs come with a phone number for both your insurance agent and a 24 7 customer service representative. An auto insurance claim is a request made to an insurance company for compensation.

Car repairs can be expensive so if you are involved in an accident you will want to know how to file. Car insurance cashless claims. The amount of time necessary for the premium on an insurance policy to cover the commissions the cost of investigation medical exams and other expenses associated with the.

In any bodily injuries immediately arrange for medical aid. Firstly inform the police and lodge an fir. It is the car insurance provider who settles the claims with the workshop on behalf of the policyholder.

Know your insurance coverage. As part of the car insurance claims process your insurer will tell you if it will file a subrogation claim. If you do not already know the best place to check is your car insurance agent or customer service representative.

Claims range from minor incidents such as a broken wing mirror to more serious events including written off vehicles or fatalities. This doesn t mean your insurance company will do this for every not at fault claim. Sample insurance claim letter for a car accident name of claimant address of claimant city state zip code date.

Certainly car insurance is expensive and in one survey almost two thirds of the drivers who submitted false information to insurers said they did so to save money the average cost of car. A car insurance claim is when someone contacts an insurance provider for compensation after a road accident. Typically this claim would be for damage caused to a car or injury to a person or both.

In cashless car insurance claims an insured does not have to pay upfront for the repairs at the network car garages of the insurance provider. Below are following points to remember when you apply for a car insurance claim settlement in case of car accidents.