Car Insurance Additional Driver Cost

Open driving is an optional extra available at an additional cost that allows other qualified drivers to use your car as long as they re between the ages of 30 and 70 and they meet the same requirements as the main driver s with regard to licence accident record and convictions.

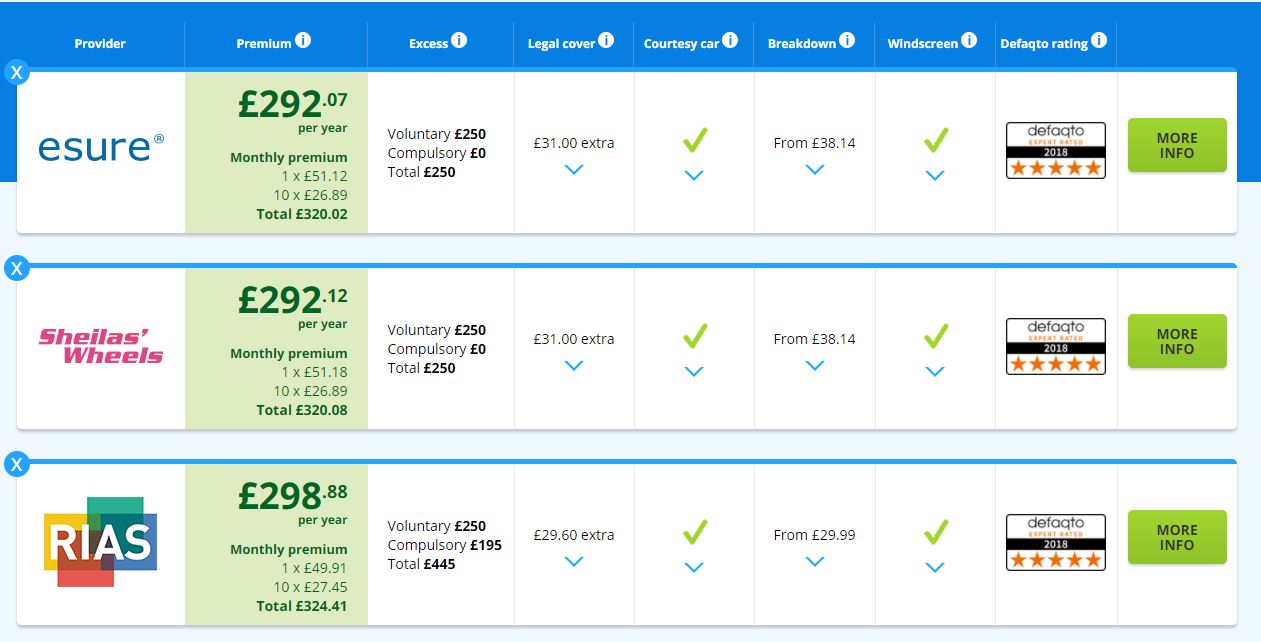

Car insurance additional driver cost - Lots of factors can affect the price of your insurance when adding a driver to your policy. Every car insurance company differs. We included adding a named driver to our list of 30 money saving motoring tips and noted it as a method of reducing the cost of insurance for new drivers.

It means the people you add can legally drive your car you don t have to be in it either. The age and marital status of the additional driver. Named drivers usually have the same level of cover as the policyholder.

Thankfully there is an easier most cost and time effective way of insuring a friend or family member to drive your car on a short term basis. Adding an experienced driver with a clean record to your car insurance policy typically will not cost you more money. Black box car insurance helps young and new drivers save money by rewarding safe driving.

Named driver insurance sometimes called additional driver insurance is cover for extra drivers added to your car insurance policy. The cost of adding an additional driver to your policy will vary. Their relationship to the policyholder.

The cost of insurance does rise if an adult driver who does not share living quarters is added to the policy. In some cases adding a named driver such as a family member who drives your vehicle regularly can prove expensive but this depends on the additional driver s risk profile. Some insurers may give a discount if the additional driver uses another car.

Different conditions and costs may apply to non family persons driving your car. However if you add a driver to your policy who has recent accidents or traffic violations the insurance company may charge you more. Adding a driver to your car insurance policy will have an impact on your rates.

For instance a car that is only driven 10 000 miles per year may have a much lower rate than one that is driven 20 000. If you want to add on a driver temporarily to your policy all it requires is a simple phone call or email. How much more will depend on how risky the insurance company considers the additional driver.

Adding experienced named drivers can discount your premium. Not only will it depend on the risk your additional driver poses but how expensive the fees are for adding someone since the rates at each insurance company are each a little different. However it isn t the case that adding another driver will always raise them in fact we found that depending on who the primary and secondary drivers are adding another driver can actually bring your car insurance costs down by a significant amount.

The cost of adding a driver to your car insurance.

/auto-and-car-insurance-policy-with-keys-1048031806-6dbe3526b6d84e14aa23d07fbe11c40e.jpg)